Google will adjust its advertising bidding model by the end of 2019, and Baidu will be able to follow suit

On March 6, 2019, Google announced on its blog that it would adopt first-price auctions (broadly bidding model) in its advertising management system, publisher trading platform and advertising server by the end of 2019. By then, Google's advertising bids will be single and consistent, and the original "binary bidding" will gradually change.

Link to original text:

https://www.blog.google/products/admanager/simplifying-programmatic-first-price-auctions-google-ad-manager/

It takes about a minute to read the full article

Google says bidding is a one-off in the early days of search ads, but as the complexity of the program market grows, the development of ad serving from a single bid to a single ad may follow different rules, with more than a dozen bids to determine the final price and run the ad, and often the final price is the second-highest bid plus a few more fees. Google believes this approach reduces transparency because the complexity of the program is a challenge for strategic planning for all departments. The First-Price Audition mechanism can monetize display and video advertising stocks through an advertising trading platform, bringing more revenue to Google.

We understand that advertising has evolved from an open market from the beginning to a concentration of good resources to the private market (Private Market, PMP), and the media has begun to protect bidders' chances of winning through mechanisms such as Last Look, driven by the motivation of private models to preempt traffic. Last Look means that assuming you bid X for a CPM, the media will give you a chance to keep an X-plus 0.01 priority deal. But the more small innovations that increase turnover, the more trade-offs and balances need to be made, so Google simply returns to a bargain.

According to Google's announcement, the product currently preparing to launch its initial bid is Google Ad Manager. Google Ad Manager was obtained from Google's July 2018 merger of doubleClick's two product lines. That means ads on Google Ad Manager aren't Google's own search ads, nor do they include YouTube, which Google acquired, but alliances and program-based display ads on Google's co-ed media.

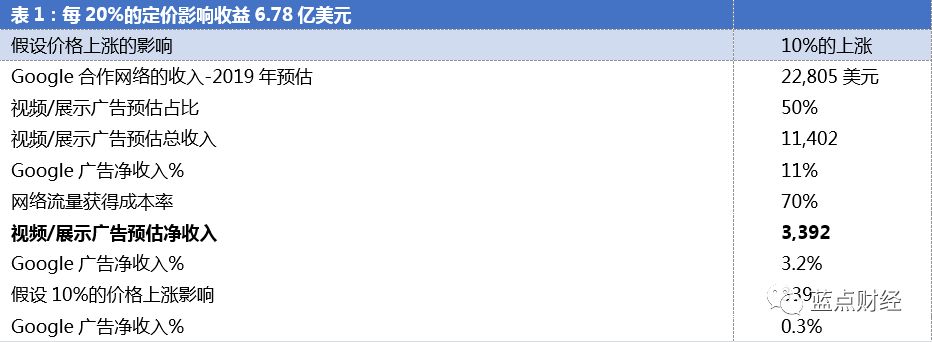

In 2018, Google Alliance's advertising revenue is about $20 billion, or 17% of Google's total advertising revenue. Assuming Google Alliance's ad revenue grows 14 percent to $22.8 billion in 2019, about half of which will be display ads, it will be $11.4 billion. Google's traffic share (TAC) is 70%, which means that Google's own revenue is 30%, or about $3.4 billion. Google's revenue could grow by $340 million if the initial bid results in a 10 percent increase.About 0.3% of Google's total ad revenue in 2019。

There is no doubt that this figure is small, but only if the project does not expand. If the move were to expand to Youtube, Youtube's revenue would be $14.3 billion in 2018, and assuming Youtube grows 20 percent to $17.2 billion in 2019, the revenue from the initial auction would be significant because Youtube is Google's own media and doesn't have to pay TTC. The impact on Google's revenue could reach 1.5%.

So will the initial bid lead to a higher bid? From Google's past history of changing bidding patterns, it can be assumed that it will. Because SEO and SEMs are not familiar with the new bidding model, they will overbidding in the short term until they are finally familiar with the new bidding system, and the bid will fall back. This phenomenon also appeared in the early days of Baidu's phoenix nest.

According to our understanding, because AdExchange has not been up, Baidu's bid is not as complex as Google's dozen bids, but Baidu is also a binary bid, that is to say, Baidu's winning bid is currently a reference to the next bid. So Google this time into the first bid initiative, Baidu can also follow. And as far as we know, search can also use the first bid, which is Baidu's profit growth will be relatively large. Of course, Google's application of the initial bid to search will also significantly boost short-term earnings.

See Tencent's abacus, see the fate of tiger teeth and fighting fish

The spring of A-shares is coming, it's time for higher education stocks to enter midsummer

Xiaomi and Samsung release summary: Lei Jun's Jedi counterattack, and Samsung's continued death

The economic downs are hitting Macau's gaming industry

Tencent Music: See what foreign investment banks say

Booming: Global CRO Industry Analysis and Outlook 2018 (2018)

Understand the logic of dodos and funny headlines, and their endless potential for the future

Booming: Global CRO Industry Analysis and Outlook 2018 (China)

Booming: Global CRO Industry Analysis and Outlook 2018 (above)

Who will benefit from 5G smartphones? This article tells you (2)

Is it time to buy Momentum Blizzard?

Who will benefit from 5G smartphones? This article tells you (above)

◆Learn how Vietnam has benefited from the Sino-US trade war (multiple images)

On the trade war ceasefire, listen to what foreign investment banks have to say

What did global tourism great V say at the Annual Photowright Summit?

The U.S. economy's lighthouse: What is the Fed thinking about raising interest rates or not?

Will the slowdown in consumption affect China's sporting goods market?

What does it mean to legalize marijuana in Canada?

·END·

Go to "Discovery" - "Take a look" browse "Friends are watching"