Google Glossier Advertising Strategy (Case Study)

Glossier is a brand from nothing to nothing, and it's more than just hard work and blood behind it. It is no exaggeration to say:Starting a business itself is already a risky businessNot to mention competing with countless well-known brands in the industry. However, there is a brand that not only survives firmly under such conditions, but is also knownThe most popular brand among American millennialsIt was founded by Emily WeissBeauty brand Glossier. Emily Weiss started the blog in 2010 while working at Vogue. The site's rapid growth (10 million pages per month) has allowed Weiss to surpass direct advertising opportunities. At the crossroads of the actual consumer and industry contacts of a large audience, she has a good sense of opportunity in this market. So in 2014, she managed to raise $2 million in venture capital and founded Glossier. The company's first version was a small catalog with only four SKUs. Its biggest selling point is beautiful vision, which resonates with many (young) women. Make women feel good. It's not enough to tell them. They do this by staying in close contact with their core audience to help them develop products and get feedback. The company has been growing since then.

Glosser business: Glossier has so far raised a total of $186m to fund its expansion, valuing the company at $1.2bn. considerable number. In that number, the company's revenue for 2018 is $100 million. The investment has been used to expand its product line, develop its platform, expand internationally and open two brick-and-mortar retail stores. Cloud Paint, one of Glossier's most popular products, should not be underestimated in its development. In some interviews, glossier's team claims to have spent two years making sunscreen products. The reason to focus on this is to get the parts of the product right. They are using the millennial version of the Amazon press release process:

"If this were an Instagram post, what would it be like to comment?"

Since its launch, their catalog has expanded to include 54 products, some of which are called Glossier Play under the brand extension.

Glossier.com traffic analysis

Glossier doesn't sell on other platforms, so most of the $100 million in revenue comes from its own website.

So, with sameweb, we can get a closer look at where they get traffic.

Traffic overview for glossier.com – source: Similarweb

In May 2020, they visited about 2.8 million times.

Most of the traffic comes from direct traffic (47.98%and search traffic (37.14).%)。

The brand is very powerful on Instagram, but only 7.14% of traffic is attributed to socializing.

This percentage may be a bit poor, but a lot of Instagram traffic is classified as direct traffic. This may also be the case with many of the campaigns they run.

Search traffic is broken down into63.86%natural search and36.14%Paid search, with referrals accounting for 4% of traffic. The company is mainly from the original blog inthegloss.com. The site is visited 32,000 times a month, so this is a critical part of its content strategy.

Another 15 per cent of revenue comes from Buzzfeed, which boosts Glossier through associated deals.

Then there's email and display ads, which each attract 1.12% of the traffic.

In this way and the extent of Glossier's PR efforts, sales seem to have been smooth sailing.

Don't get any credit for the great brands and communities they build, but Glossier still spends a lot on advertising. It's mainly Instagram and Facebook ads, and I've found some of their test ads on Reddit.

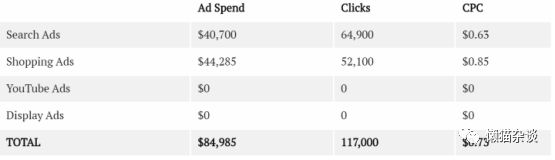

So in the next section, I'll analyze how they get the exact cost of 117,000 visits through paid searches!

A more glossy Google Ads campaign

Here's an overview of Glossier's spending on Google Ads during April 2020:

The sources of these numbers are Semrush, Spyfu, Similarweb and my own collection of e-commerce benchmarks.

Let's take a closer look at the different parts of their strategy.

Google search ads

Externally, Google Ads is usually a black box.

However, with some spy tools, we can learn about the structure of the Glossier Google Ads account

The look of the search ad is as follows:

Glossy Google Ads search campaign structure

At the highest level, each brand has campaigns: Glossier and Glossier Play.

Campaigns go deeper and are divided into branded and non-branded introductory campaigns.

These groups are then divided into ACQ and CRM. This may sound mysterious, but it means:

ACQ: Get-focused campaigns. These targets are people who have never interacted with the site before.

CRM: These activities are targeted at users who have visited the site. This is the RLSA (search ad's remarketing list) feature in Google Ads. CrM's name may mean that they have a large number of different audiences in this campaign. One will be different types of site visitors (product visitors, cart abandoners, etc.). But they can also sync their email lists (website registrations, past customers, high-value customers) with Google Ads. In this way, they can increase their bids for their most valuable people.

Therefore, ACQ and CRM campaigns are accurate copies, except for the audience they target.

Glossier also advertises outside the U.S.: in the U.S., Canada and France.

The campaign structures of these countries appear to be a copy of the United States. Here's what the ACQ campaign looks like in the UK:

UK_Google_Brand_ACQ_P_Main_General

UK_Google_Brand_ACQ_P_Skincare_Product

UK_Google_Brand_ACQ_P_Makeup_Product

UK_Google_Brand_ACQ_P_Body_Product

Brand paid search

Looking closely at these brand campaigns, we can see campaigns for core brand keywords ("Glossier"), as well as several other keywords by category (skincare, body and makeup).

This is very similar to a site structure and is usually a good approach:

Glossyier.com website navigation

Brand paid search accounts for 80 per cent, while non-brand traffic brings in 20 per cent.

Top 10 Brand Keywords

Source: SEMrush

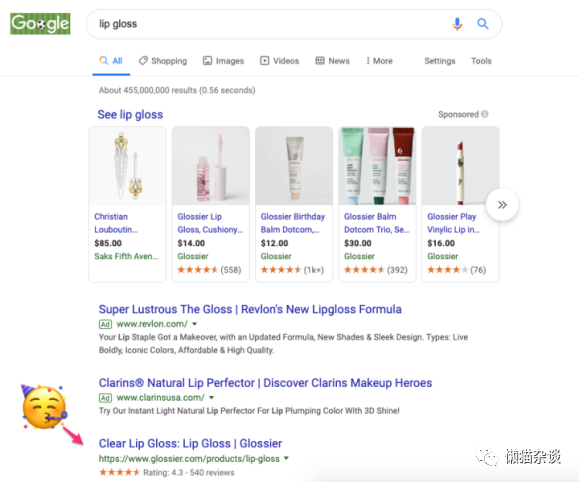

The core brand names in this list are the most searched. There are also plenty of promotional discount code searches that they try to capture by offering a 10% discount on the target page. And the other big parts of the top 10 are product and sub-brand search queries, boy eyebrows, lip gloss, solutions, games, cloud paint. This list also shows the possible impact of the product name on cost-per-click:

"Glossier lip brow" - excluding generic category description (blush) - CPC: $0.31

"glossier lip gloss" - including generic category description - cost-per-click: $1.87

6x difference in cost per click!

However, this is not the most important reason to propose a unique product name. Having an SEO-friendly product name (which means it contains queries that people are looking for) can help you rank naturally:

Glossier's Lip Glossier was number one

Search for ads

Glossier text ads are straightforward:

Example of promotional additional information

They focus on the brand's main selling points: first, skin, second, makeup, real-life beauty and so on.

Their ad extensions are also very reliable.

In the additional promotional message, they mentioned other benefits: free shipping for up to $30, free returns, etc.

One of the more skillful things they did was use their sitelinks to push a new product: Brow Flick.

The second add-on: "Buying the iconic Eyebrow Duet" actually points people to the new product portfolio.

This speed and control is an advantage over the organic sitelinks that sometimes occur.

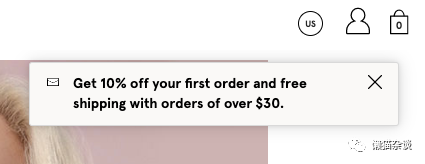

They will also offer a 10% discount on "first order" in the links to their websites. This will point people to the regular product category page, but there will be some kind of notification in the upper right corner of the page, which you really have to admire.

There is a 10% discount on notifications on Glossier.com

Glossier also uses promotional extensions to promote its products. This is a very clever way to discount.

Glossier also advertises in France. It looks like this:

The first thing to say is the language, the advertisement is English, if your browser settings are in French.

One of the texts of the title states that they are now "now being shipped to France".

This is a small adjustment compared to translating and managing campaigns in other languages.

However, this is only valid in rare cases until you are eager to copy this content. Different languages alienate most people who see ads. I usually see these ads with very low click-through rates, resulting in quality scores being punished.

But in the case of Glossier, their advertising seems limited to brand and product name searches. As a result, consumers have no choice because they can only get -Glossier products from lossier.com.

Landing page

Most of the paid traffic falls on the home page or on a specific product page.

Obviously they invest a lot of money on the site from a traffic perspective because the overall experience is very good. Its appearance and feel is also great value for money, and there are plenty of real reviews on the essential product information (what's inside, how to use it, etc.).

I can see that people spend a lot of time on the site and the conversion works very well.

Non-brand paid search

The structure of non-brand campaigns is much simpler. There are no specific RLSA advertising campaigns. Only campaigns for skincare-related non-brand queries, and Dynamic Search Ads (DSA) campaigns that cover the rest of the catalog.

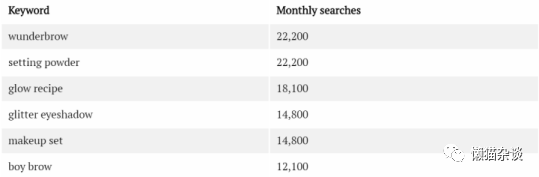

Top 10 unmarked keywords (sorted by the number of clicks they bring to lossier.com)

Source: SEMrush

By looking at the top 10, the first thing that comes to mind is that these popular search queries bring few clicks.

This is in consistent with the total number of non-brand paid search traffic, which is approximately 12,000 visitors per month. This is common. These clicks cost about $2, making it difficult to make a profit on a $35 order. In the dismantling of Away Travel, we said they had the ability to do that. But that's because they have a much stronger market share and a 10-fold AOV.

The second comment on the top 10 is the advantages of product names such as "Boy Eyebrow" and "Cloud Paint". This indicates that these Glossier products have a high brand awareness.

Finally, there are some search queries in this list that may not be ideal: kat von d and anastasia liquid lipstick.

Both are search queries for competing products. Sometimes it's fun to keep them in your campaigns and even target them to specific competitors. But to see how much money they spend on non-brand searches, I'm not sure it was intentional.

I suggest they browse their search terms report, look for search queries to add as negative keywords, and check the matching type of their current keywords.

Search for ads

Non-brand search ads are an interesting example of how to link a regular search query to your product name.

Here's an ad pop-up search for "eyeliner":

They used title 1 to introduce their "makeup" brand, Glossier Play. They then refer only to the eyeliner search query in title 2 and link it to the actual product name", Colorslide.

The ad itself is written specifically for this product and contains some additional features and benefits.

Also note that the display URL is "minimum" without defining any paths. (Another way is www.glossier.com/Makeup/Eye-Pencil)

The same thing happened when searching for "perfume":

Your perfume is the product name of their perfume. The rest of the ad is very generic, which indicates that the ad is running through all DSA campaigns.

This all-in-one campaign is great for launching, and it doesn't take much time to quickly run ads for all your products.

However, as we covered in the course, revisiting the campaign and rewriting ads for these search queries can further improve results. Click-through rates go up, and quality scores usually go up.

Like brand search campaigns, ad extensions are well utilized.

Glossy shopping ads

Before we go into more detail about Glossier's shopping ad features, I want to show you what they didn't do.

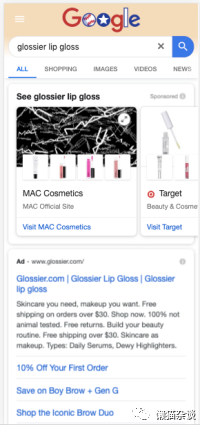

The screenshot above shows the search results for Glossy Lip Gloss, but as you can see, Glossier won't appear on the top ad rotation. That's because they didn't run Showcase shopping ads.

Therefore, MAC Cosmetics is the first result/advertisement that searchers encounter. This increases Glossier's clicks and sales costs.

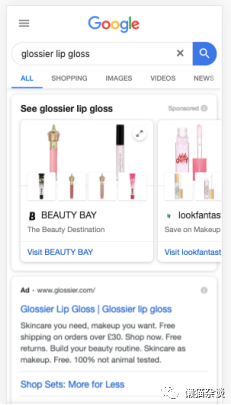

The same thing happened in the UK:

Glossier isn't the only top e-commerce brand missing from Showcase ads, and I mentioned exactly the same thing in dismantlingAway Travel.

Glossy shopping activity structure

Here's the structure of the Google Shopping campaign:

Google Shopping Campaign Structure

The structure of a brand search campaign is much simpler than that of a brand search campaign.

Two campaigns, one for Glossier and the other for Glossier Play. These are further segmented to separate brand and non-brand (NB) search queries.

Each country then has its own specific campaign: the United States, the United Kingdom, and Canada.

Many countries

It's easy to extend Google Shopping to other countries that use the same language. This is especially because Glossier actually has local currency on its website (and its product Feed).

The make-up kit costs $50 or about $40.

But as Glossier began selling in different languages, new problems ad emerg emerged.

By searching for campaigns, they (and you) can show English ads to a French-speaking audience.

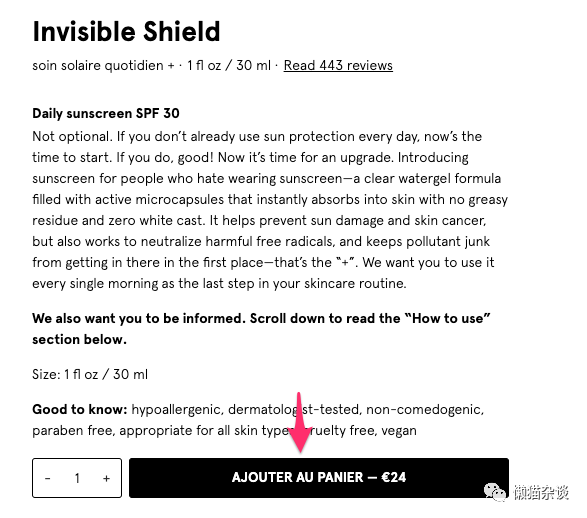

But Google Shopping requires the target page to use the language in which your ads are targeted.

As a result, shopping campaigns for French-speaking users need to create ads and landing pages in French.

They have translated some parts of the site, mainly related to checkout, but the content of the product is still in English.

The add to cart button is translated into French

From.

In Europe, I have a lot of experience with the complexity of multiple languages. Fast translation sites increase dependency and often pose technical challenges.

RLSA campaigns are missing

The biggest difference with search campaigns is that there are no dedicated campaigns for a real-world audience. They may have added these audiences to their actual campaigns, so they can target these visitors or customers like this.

But shopping traffic brings almost the same number of clicks as search campaigns, so I'd love to hear why they divide search campaigns into RLSA and non-RLSA, but they don't.

Campaign naming conventions

Also note how THEFEs in campaign names represent shopping campaigns, which is useful when filtering campaigns in Google Ads or Analytics. (If you want to know whether PLA represents a product information ad or the old name of a shopping ad)

Ad group structure

If I speculate on a deeper account structure, I'd say they'll break these campaigns down further into ad groups based on different product types:

Lip gloss

Cloud paint

Eyebrow Boy

Wait a minute.

·

Popular shopping keywords

Source: SEMrush

From this (short) list, we can already see many differences in search ads.

First, despite 365,000 searches a month, the brand did not appear. Perhaps the simplest reason is that shopping ads rarely appear in that search query.

When search ads are displayed for products such as highlighters, lip gloss and light perfumes. The products displayed in the shopping are very different: stying powder, glow, flash, makeup suit.

The only consistent is Boy Eyebrow, which is also one of the most popular search queries for search ads.

The top search query in the list is a competitor's product, wunderbrow. Interestingly, they gained such high visibility through "shopping" that they didn't show up at all in search campaigns.

This may indicate that they are too widely targeted and may miss some keywords.

Another thing I found in my research was that search queries such as "niteshine" and "vinylic lip" came from "non-brand" campaigns.

These two findings show me that they can further optimize their campaigns and move from 2 to 3 floors.

Existing structures:

US_Google_Play_B_PLA: Position the search query as smoother.

US_Google_Play_NB_PLA: All other

New structure:

US_Google_Play_B_PLA: Locate the search query to get gloss and product name.

US_Google_Play_COMP_PLA: Targeting competitors' brands/products

US_Google_Play_NB_PLA: All other queries

This helps them adjust their bid strategy to the actual value derived from these search queries.

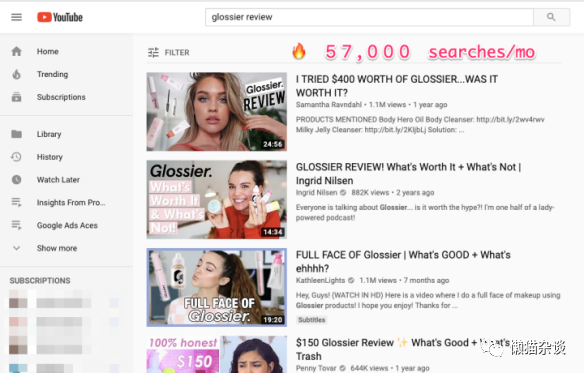

YouTube movie ads

With a few exceptions, videos on its YouTube channels have very low viewing rates.

Often, this is a good indication that they don't do much on YouTube ads.

At least there's nothing public, probably because they've tried campaigns in the past. But today, their video revenue may be best spent on Instagram.

Some of their social traffic does show YouTube's referrals, but it's more because they get a lot of reviews from others.

Search on YouTube for smoother reviews

Google Display Ads

In general, it's easy to find your company's display ads, especially if they're running a talk campaign.

But I can't find any current banners on the Google Display Network. But they've done things in the past. Here's one of the slogans I found:

So I have to let you down in terms of my current display strategy. But I did find some older campaigns that might provide some clues about what they're doing

Here are some of the campaign names I found:

·

US_Google_Display_ACQ_RTG_Generation

US_Google_Display_ACQ_P_Geng_Customintent

·

Based on what we've learned from the Search campaign, ACQ indicates that these target groups are people who haven't visited the site yet.

Both campaigns are aimed at specific Glossier lipsticks, known as Gen G. It's back in late 2018, so I think they're using display ads to support that release.

Customintent at the end of the second campaign says it's using Custom Intent, one of the targeting options on the Google Display Network:

Unlike prefabribribrio audiences provided by Google Ads, you can build your own custom target audience based on specific keywords or target pages. This allows Glossier to cultivate an audience interested in lipstick, not just makeup.

Save time!

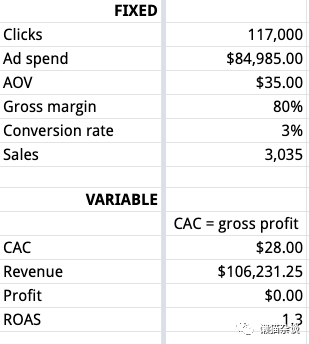

The scoreboard is the part where we put all our research together and see how much Glossier has made (or lost) through its Google Ads campaign.

One thing I don't usually mention is the rate of return. This is mainly because the information is not often made public. But in an interview, CEO Weiss revealed that their return was only 1%. This is very low for companies that offer free returns.

Gross margin.

Euromonitor, a research firm, says premium cosmetics brands have a profit margin of 75 per cent. Profit margins for other brands are between 60 and 80 per cent.

Like most of the brands we've covered in this series, Glossier sells directly to consumers, which often results in additional profits for them.

So I don't think it's an exaggeration to estimate that Glossier's gross margin is also 80%.

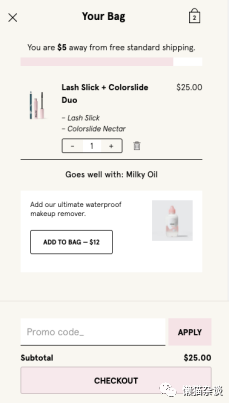

Average order value

Glossier does not appear to be promoting prices. Compared with other beauty and cosmetic brands, their products are relatively cheap. Prices range from $12- $35, while perfumes range from $60.

During checkout, they also sell a large number of hits and add-ons, all of which help to increase the average order value.

In other words, they offer free shipping for orders over $30. This makes me guess that their average order value is a little higher, about $35.

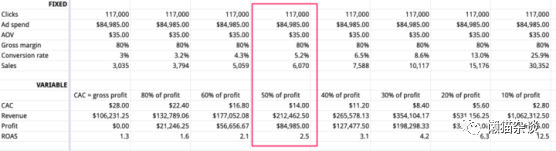

As usual, we start the scoreboard by filling in all the numbers and assume that the company is spending all its profits on getting new customers:

At $28 in Customer Acquisition Costs (CAC), the company earns $106,231.5 a month and earns $0. That's not very realistic, so let's see what happens if we reduce the CAC.

Now, I'm cutting the price of the CAC from $28 to $2.80. Next, I choose a CAC somewhere in the middle, which accounts for 50% of my gross profit.

Repeat purchase rate

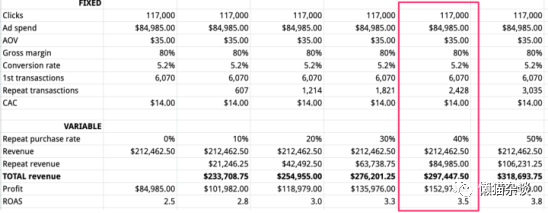

For top e-commerce companies, repeat customers earn more than new customers.

It takes some time to establish this dynamic process, but it seems exactly the same as what's happening with Glossier right now.

Because in a 2018 interview, glossier's chief executive said 50 percent of his revenue came from repeat purchases.

This is huge and the main driver of profitability.

Here's the impact on the profitability of google Ads campaigns:

Repeat purchases are moved from 0% on the left (only one sale per customer) to 50% on the right (again half for all customers).

The actual dynamics of repeated purchases are more complex, but this provides a good understanding of profitability.

In the pink box, I chose the most likely scenario. $85,000 in advertising spending turned into nearly $300,000 in revenue, with ROAS at 3.5. Moreover, this brings Glossier's total monthly profit to $156k/mo!

That's my Google Ads campaign for Glossier!

Go to "Discovery" - "Take a look" browse "Friends are watching"