2019 Q1 Entertainment App Mobile Advertising Intelligence Insights

The following article comes from App Growing , author of App Growing

App Growing is a professional mobile marketing data analysis platform, real-time tracking of the network's mainstream mobile advertising intelligence, to achieve the network's advertising materials, paper, landing page one-click query, to help you make better delivery decisions! Website: https://appgrowing.cn/

/Start.

With the rapid decline of the global population dividend wave, the mobile market channel purchase expansion path gradually returned to rationality, in the context of mobile application manufacturers in the soaring cost of customers, return to product iterative innovation, continue to explore diversified cashing model, deep-ploughed user preferences and user-accompanied growth, but also in the long-term economic buffer recovery cycle, solid and steady to enhance market share, create sustainable value of products. The more the economic trend cushions, the more the entertainment industry grows against the trend.

According to the data reported by the Chinese cultural industry, the output value of China's cultural and entertainment industry will exceed 2 trillion yuan by 2021, and the accumulation and development trend of China's economy will jointly start the accelerated process of the era of Chinese cultural spiritual consumption, and the future of the mobile entertainment industry can be expected.

App Growing 以201January 1, 1999-On March 31st, the entertainment app tracked was released on the basis of intelligenceQ1 Entertainment App Mobile Advertising Intelligence Insights 2019, summarized below:

Description:

(1) App Growing has not tracked the advertising information of Tencent's QQ browser, WeChat Friends Circle, App Bao and other media, and the above-mentioned Tencent ads do not include the advertising data of these media.

(2) This report to the number of ads as a measure of the intensity of advertising, the number of ads is not exactly equal to its actual advertising consumption, for reference only. The amount of ad serving mentioned in this report is estimated by App Growing based on a combination of factors such as large-cap data and ad delivery time.

First, entertainment app advertising overview

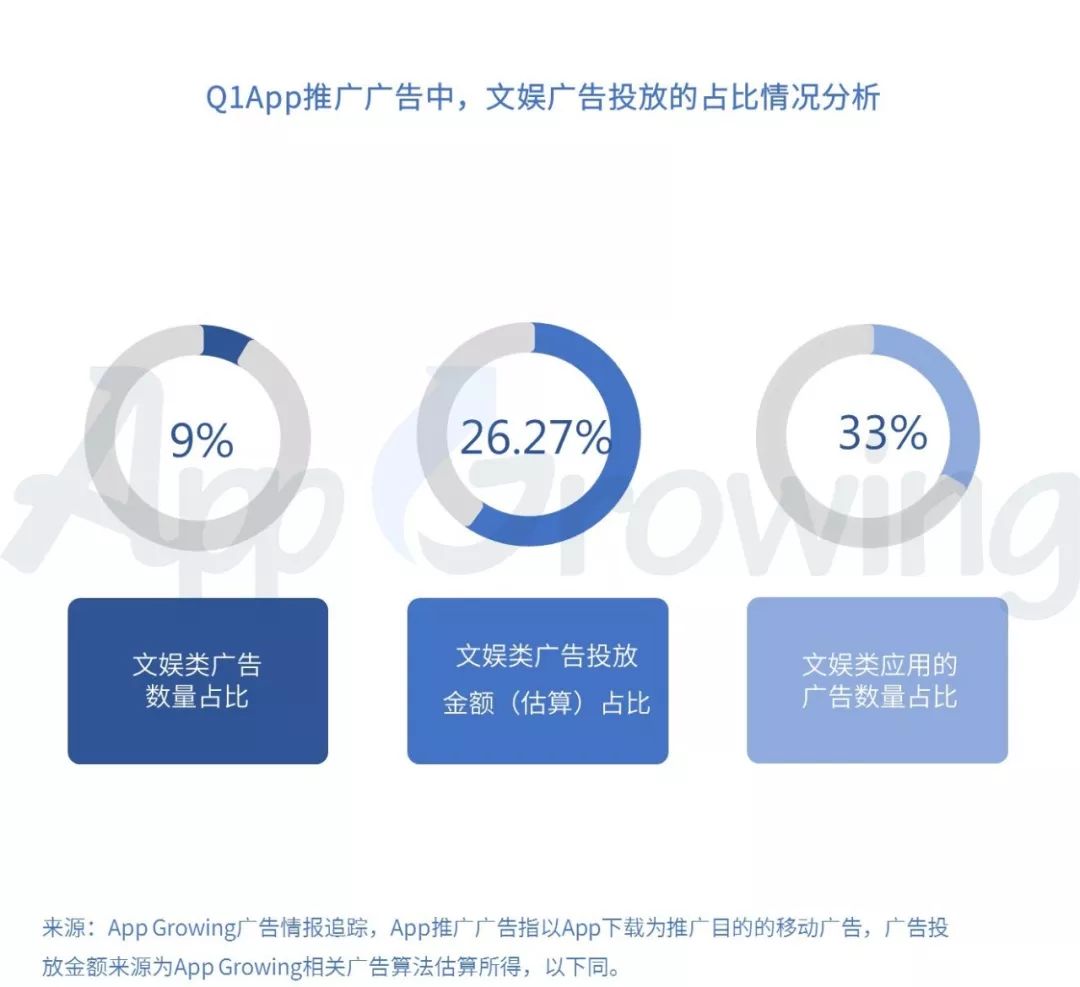

1) In app download ads, the total amount (estimated) of entertainment ads is close30%.

In 2019 Q1, App Growing monitored 32.3 W of advertising in the entertainment industry, with a total of 281,000 ads for Chinese entertainment apps, accounting for 33% of the total number of ads available in the overall app;

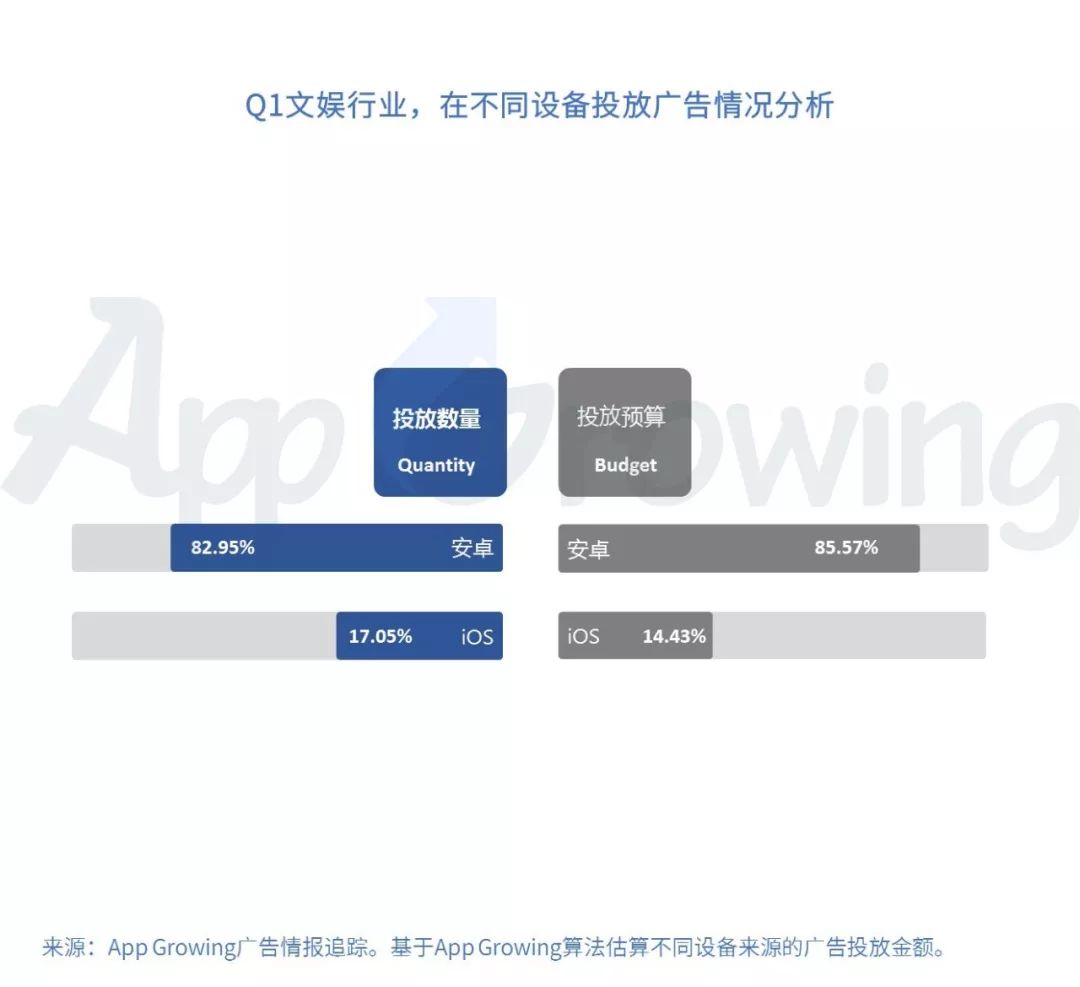

2) Entertainment apps are more likely to run ads on Android devices

App Growing tracks ads for Android and iOS, as shown in the figure below, with 82.95 percent of ads available on Android devices and an estimated amount of ad servings85.57% of the total ad serving amount.

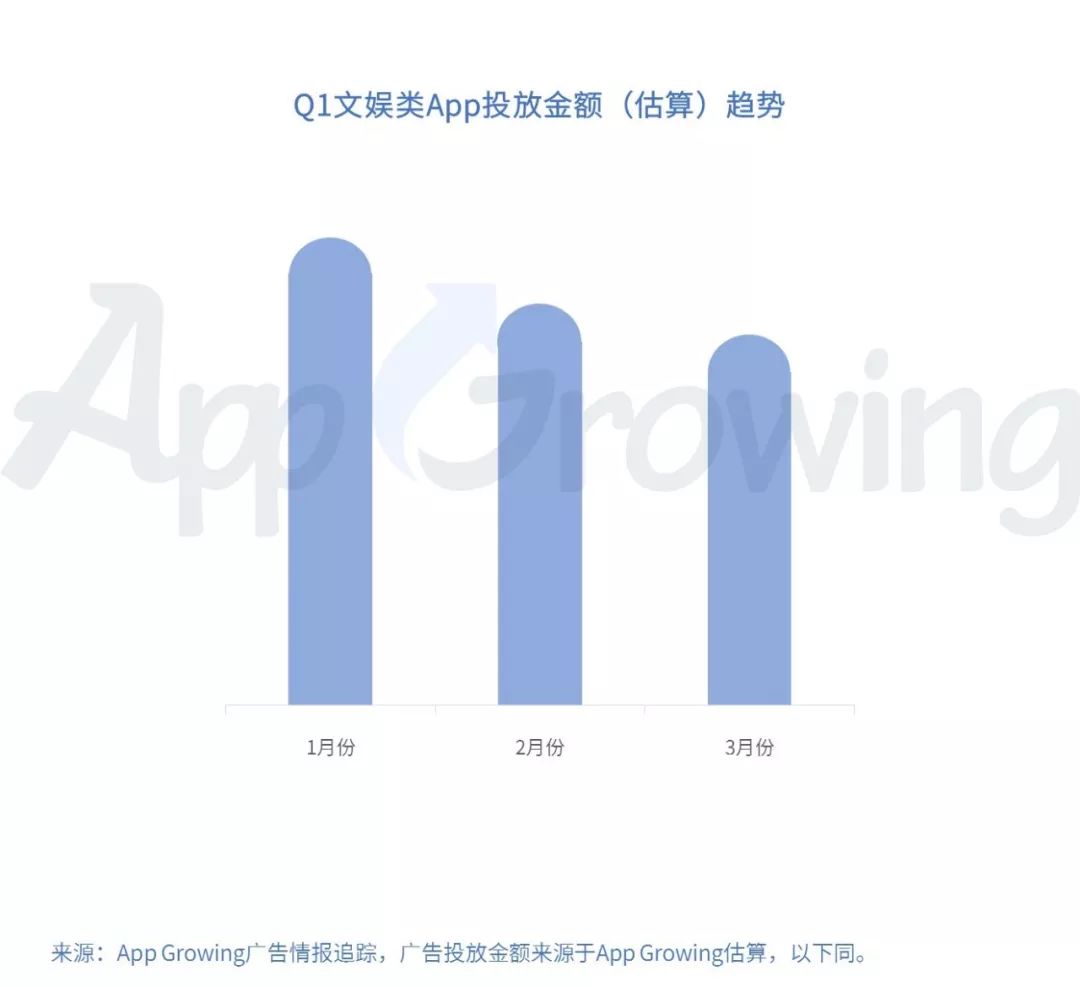

3) Q1 Months Entertainment App Advertising Number Trend

Statistics app Growing Q1 months entertainment app advertising amount (estimated) data, February and March showed a slow decline trend. Further analysis, Q1 advertising volume level slowed down, some entertainment app advertisers tend to maintain a more regular delivery, reduce new advertising and new channels to open up.

Second, entertainment application advertising purchase channel intelligence

1)Q1During this period, entertainment app advertisers preferred the mobile advertising platform

Based on the analysis of the number of ads served by each advertising platform's entertainment application, the following entertainment advertisers preferred mobile advertising platform (ranked in no order).

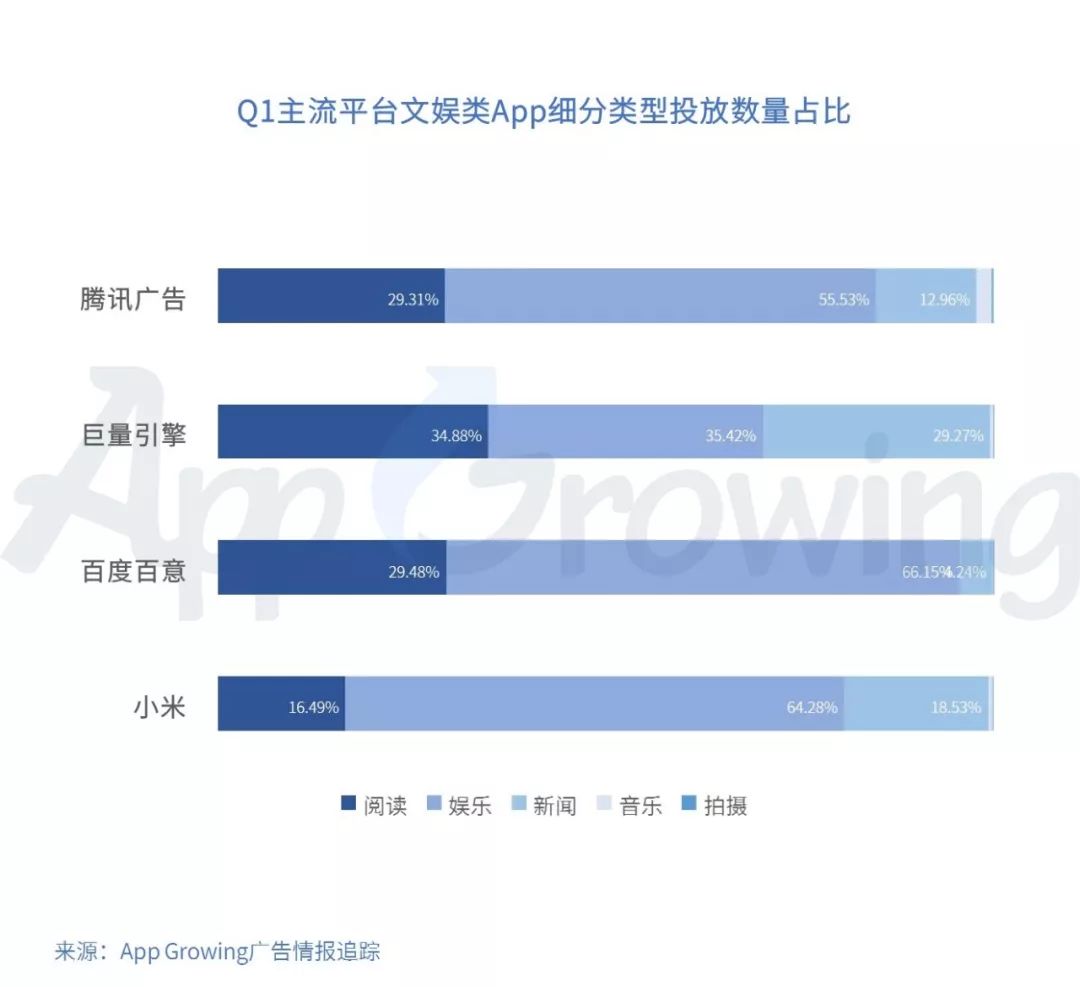

2) The proportion of the number of sub-categories of mainstream platform entertainment applications

In order to make it easier to observe the mainstream advertising platform's delivery intelligence, to Tencent advertising, huge engine, Baidu Baidu, Xiaomi four advertising platforms as an example. App Growing further counts the number of ad deliveries in different sub-categories for entertainment applications on various mainstream platforms, and the distribution of the number of servings for entertainment sub-application types is shown below.

Among them, the huge engine platform launched reading applications, entertainment applications and news applications accounted for nearly 30% of the number. Tencent advertising, Baidu Baidu and Xiaomi platform to run entertainment applications accounted for more than 50% of the volume. Entertainment applications (short video-based) are the main force of entertainment products.

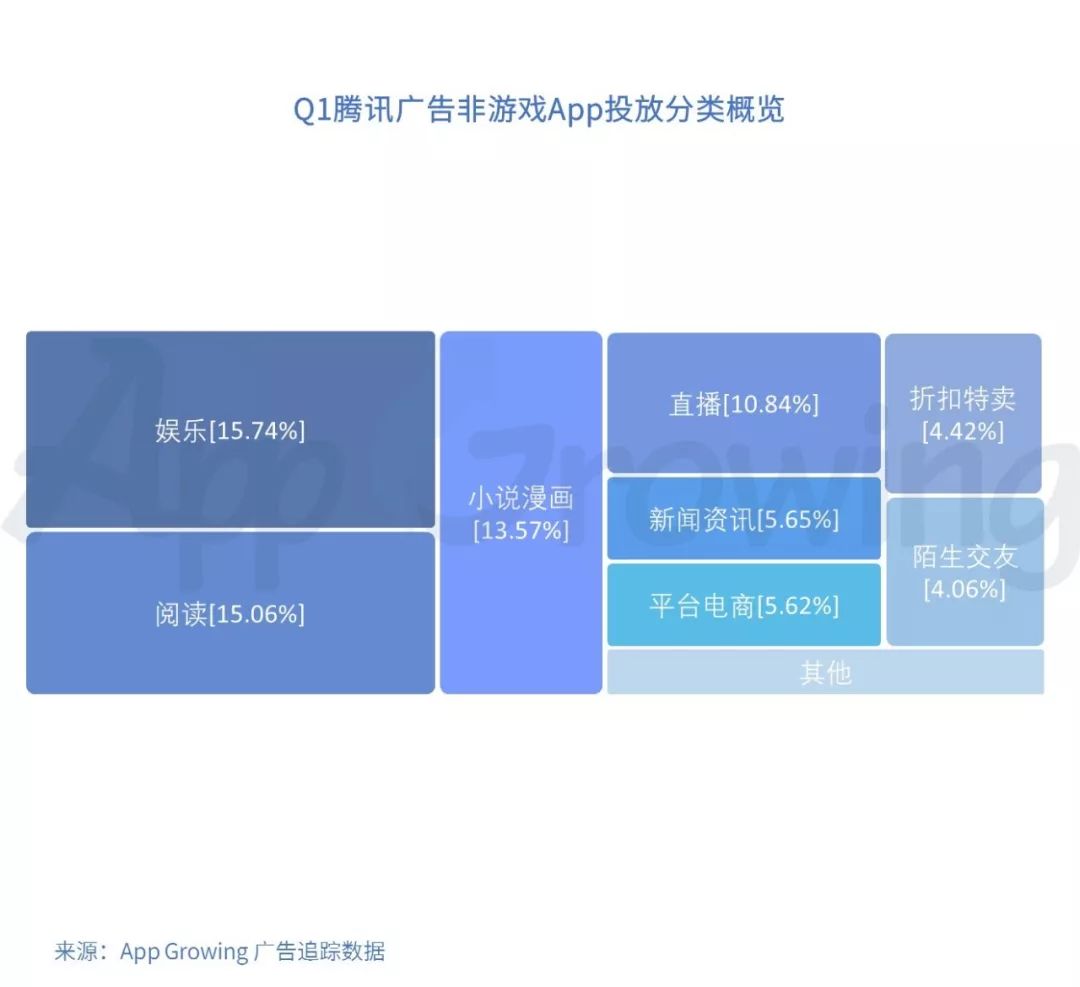

3) Among the non-gaming apps of the mainstream platforms, the number of entertainment app ads is high

Analysis of Q1 Tencent ads and the huge number of ads running non-gaming apps, including entertainment, reading, fiction comics and news and information categoriesThe ratio is averageHigher.

Third, the number of entertainment app launch leaderboard Top20 and proportion

1) Entertainment app launch leaderboard Top 20

Based on.App Growing algorithm estimates the amount of entertainment app delivery, combs out the Q1 entertainment promotion leaderboard Top20 and Q1 entertainment app manufacturers release amount Top20. Baidu is the main platform for the application for its own platform and Tencent advertising. The headliner app has five seats on the top 20 list.

2) Top5 of the mainstream advertising channel entertainment app list (estimated amount of advertising)

App Growing-based advertising algorithms estimate the amount of ad delivery for individual apps tracked, and organize the amount of Q1 ad servings on mainstream platforms to rank top5 entertainment apps. Judging from the estimate of the amount investedShort video apps still lead entertainment apps, followed by reading apps.

China's entertainment market stock market is huge, the incremental market with the overall economic recovery can be expected to be strong growth potential in the future. Entertainment app advertising overall delivery situation is stable, whether it is the short video application market at that time, or steady growth of reading and other applications, after the purchase dividend returned to rationality, the entertainment app market as a whole into the deep cultivation fine operation and product innovation rational, positive competitive landscape.

/End.

Community Nana

Promoter finds organization to help you solve 3 promotional problems every day.

Contact Nana, join the exchange community for free, and get a sample book

History Articles

Spend 200,000 on the appstore!How hard is it for IOS to go on the shelf when the price skyrockets?

Apply bao "clear words", this article takes you to "avoid the pit"

Go to "Discovery" - "Take a look" browse "Friends are watching"