Facebook's advertising hegemony: Building a business is more important than inventing a feature

According to the New York Times: "On Wednesday, Facebook released its second-quarter financial data, which beat Wall Street expectations despite slowing revenue growth. Facebook's second-quarter revenue of $9.3 billion, up 45 percent from a year earlier, rose 71 percent to $3.9 billion from a year earlier, and earnings of $1.32 per share beat Wall Street's expectations of $1.12 per share and revenue of $9.2 billion. "

Facebook also says it will continue to attract new users and institutions, even though a large proportion of the world's population is already registered. More than 2 billion people visit Facebook each month, up 17 percent from the same period last year, with about two-thirds of them daily users.

If Google continues to face problems with the impact of additional ad space on revenue growth, Facebook faces the opposite:The company has been warning for nearly a year that the content of ads in feed streams has reached saturation, which will slow revenue growth.

Since then, every time the results are released, I've asked, what impact does this have on advertising pricing?

When Chief Financial Officer Dave Wehner first commented on the issue last year, I said: "Wehner's evasiveness means that for all comments that claim that Facebook can charge higher ad prices because of its high audience targeting, what really drives Facebook's business is its attention and the volume of its ad units." In other words, if Facebook ads are indeed irreplaceable by other media, the decline in the supply of advertising space should lead to increased demand (which leads to higher prices). But Wehner doesn't want to admit that's the case.This suggests that Facebook's ads are only part of the broader digital advertising market, and that the decline in Facebook's ad space supply will directly lead to ads flowing to other platforms.”

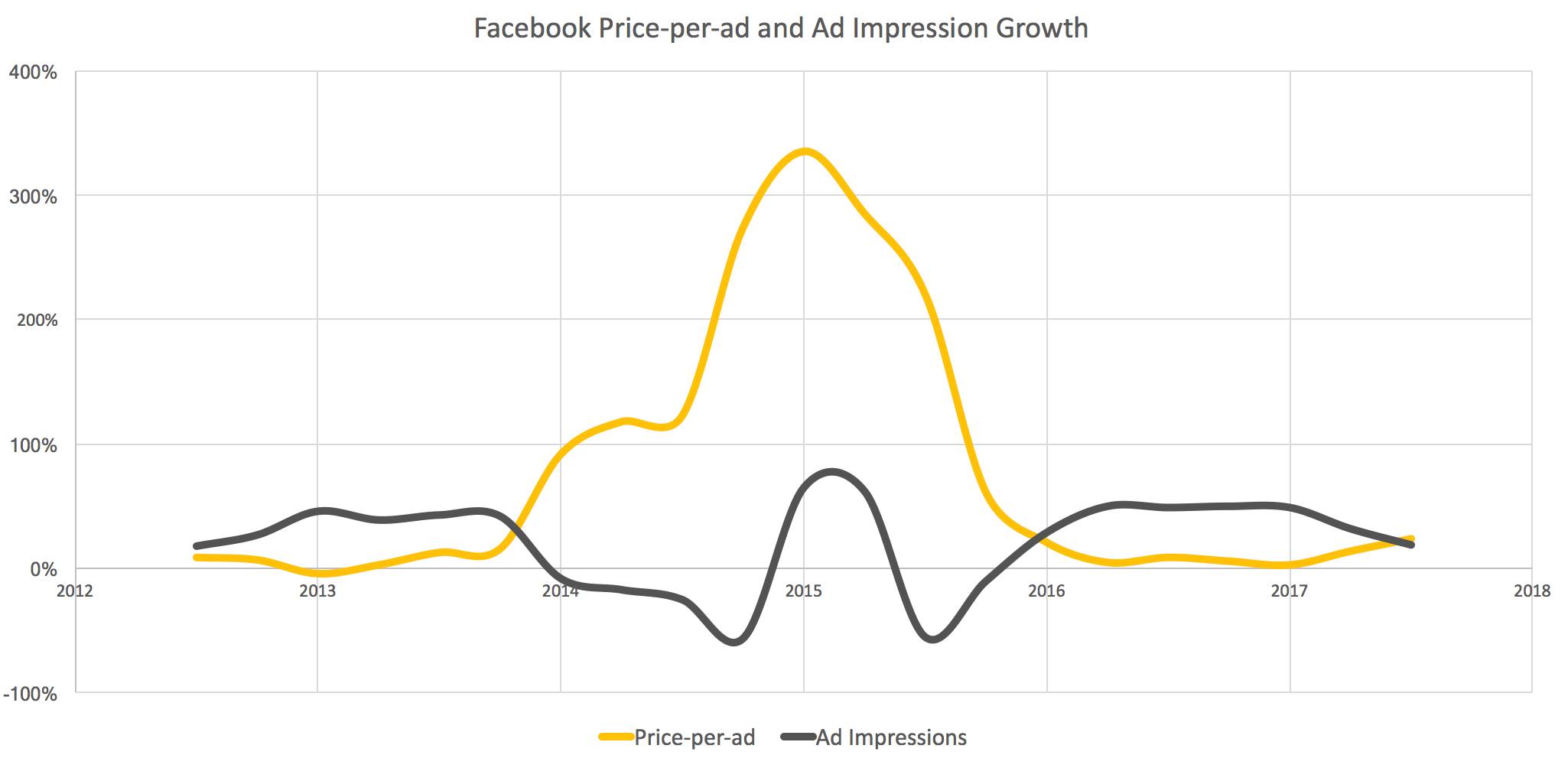

It wasn't until last quarter that I realized that Wehner's statement was clearly not true:The decline in ad exposure is indeed linked to higher ad prices, and the trend is more pronounced this quarter.

The key part of the chart is on the far right - the growth rate of the unit price of the ad exceeds the growth rate of the number of ad impressions. However, the figures cover Facebook's entire evolution since its launch, because I think that explains why Wehner has been avoiding the questions mentioned earlier.

Specifically, as you can see, both curves fluctuate greatly. Notably, every time Wehner conducts a earnings conference call, he takes the time to explain what's happening on Facebook. After Facebook's IPO, for example, he said the main positive factors were the transition to feed streaming (price increases) and more ad space (increased exposure), followed by the elimination of the price line (increased ad exposure), the transition to mobile devices (lower exposure, higher prices), fewer ads on the right side of the desktop (lower exposure, higher prices), more mobile, more users, and so on.

The details don't matter, it's important that Wehner always gives priority to explaining what's going on every time.

That's why I've been surprised by the content of the last two quarters, because there's no background in the speech we're ready to speak about. On yesterday's earnings conference call, for example, he simply said: "In the second quarter, the average unit price of ads rose by 24% and a 19% increase in ad exposure, thanks in large part to mobile streaming ads on Facebook and Instagram." "

I don't want to read too negatively, but I look back at every earnings conference call since Facebook became a public company and see that there was a big difference in content this time. And, despite the risk of "self-confirmation bias," I am increasingly skeptical that Wehner's silence is to avoid questioning Facebook's influence in the advertising market. Because of the ad pricing signals, the advertising market is the best place to prove that Facebook does have a monopoly.

In order to understand this problem, we must understand what Wehner has said more carefully. Several analysts asked him about pricing strategies over the phone, acknowledging that slower advertising supply growth could lead to higher pricing.

However, it is clear that Facebook ads are more important than they are.

"We've talked a lot about the increase in ad exposure and how it's going to slow down in the second half of the year, and now the growth in ad exposure in the first half of the year has slowed considerably," Lloyd Walmsley of Deutsche Bank said on a conference call. And, as you pointed out,As ad supply growth slows, pricing will rise because you're delivering returns to advertisers.So I'm wondering why this phenomenon won't continue to lead to ad revenue growth in the second half of the year. "

Wehner's response: "What you just asked is why the value we've provided to advertisers so far has only been reflected in advertising prices, and I have to tell you, these aren't just happening, and it takes a series of hard work to make our ads more targeted and advertisers more valuable." We will continue to work hard to improve our advertising products, and we believe there are many opportunities to continue to improve our customers' return on delivery. "

Wehner's reinterpreted of the question made me almost laugh: "What you just asked was why the value we've offered advertisers so far is reflected in the price of advertising." "

As a result, the focus has become clearer, and Facebook wants to make it clear that it has pricing power because its ads are "better", in other words, it has pricing power because Facebook will gradually become the only option for advertisers, which sounds like a monopoly.

To be sure, Wehner is telling the truth, and Facebook's pricing power comes mainly from its strong ad targeting and follow-up tracking capabilities, as well as its ability to reach the widest audience in one place. This proves once again that, while this is partly due to Facebook's own hard work, the decisive factor in pricing power is still Facebook's sheer size.

At this point, we already know that Facebook can use its user base to dominate other product categories, most notable for Facebook's use of Instagram to crush Snapchat Stories, and that WhatsApp Stories now has more monthly activity than Snapchat Stories.

But Facebook has more than just users, it's a multi-market of users, content producers and advertisers, and the same leverage synergies exist in other parts of the market.

Chief Operating Officer Sheryl Sandberg's statement on the future of Messenger advertising surprised me: "We do believe that the advertiser community and the way we target and measure our target audience will be a very significant advantage for us. There are 5 million advertisers on Facebook and 1 million on Instagram.One of the reasons we've been able to expand Our Instagram reach so quickly is because of Facebook's advertiser base. Similarly, the work we do on Facebook and Instagram will help us extend the same thing to Messenger.”

I fully agree that a dominant position in an area would have a very significant advantage in its adjacent business.That's it againSpeaking of Snapchat Stories, Mark Zuckerberg made no secret of the fact that Facebook was inspired by Snapchat at this year's F8 conference. In other words, Facebook has made a big profit on what it does well: doing business around the products consumers like to use.

"This quarter, we've also launched ads on Instagram Stories for a variety of marketing purposes," Sandberg said in another statement. As Mark describes it, Instagram Stories is growing very well, and this is a great opportunity for advertisers. From increasing brand awareness to increasing sales, businesses can now use full-screen Instagram Storie ads to achieve any goal. For example, Ben and Jerry's used vertical video to launch a brand campaign on Instagram Stories, and its new Pint Slices ice cream increased ad memories by 14 percent and purchase intentions by 2 percent. "

Snapchat's drop is striking, and a few months ago, The Information published a well-documented story with the following passage: "Spiegel finally believes that Snap's growth is indeed slowing and that the company needs to act now." But what he's doing at this point is removing a feature he thinks interferes with the user, Auto Advanced, which automatically plays the next video. According to a person close to Snap, there is no data to show that Auto Advanced has cut Snap's user growth. "

Videos on Instagram are also automatic, and that's a key factor in making ads and impressions work, effectively making Stories a dynamic message of passive consumption rather than active consumption, which is better suited for advertising.In fact, Facebook has turned Instagram Stories into a business, not a simple feature, which is as important as inventing it.

But in the future, I think it's more important to start a business than to invent a function.Because, in the digital world, easy-to-replicate features are worthless.Real innovators create businesses, not just features, so as I continue to look at Facebook, I have to be rightSpiegelWith sympathy, Snap may not go too far at all.

Go to "Discovery" - "Take a look" browse "Friends are watching"