Commercial advertising strategy interpretation

Share guest: Morphick

Edited by Hoh

Source: Moffick

Production platform: DataFunTalk

Note: Reprint Please reply to "Reprint" in the background of the public number.

Guide:With the rapid development of the Internet, the market size of online advertising has risen, becoming one of the mainstream real estate models of the Internet, but also gave birth to a number of advertising giants, such as Google, Facebook, the domestic byte beat, Ali, Baidu, Tencent, advertising in the entire revenue occupies an important position.

In the previous article, we introduced ad dynamics, target conversion bids, data management platform (DMP), advertising auction kernel, mechanism design, optimal mechanism and so on. For more information, please refer to:

Commercial advertising strategy

Today we will share the economic explanation of optimal mechanism, market retention price, dynamic reserve price, price squeeze factor, budget consumption control and so on.

In the introduction of the optimal mechanism, we construct a virtual valuation function for buyers under general questions:

where v is the valuation, Y is the virtual valuation, the positive assumption is Y about v monotonous increment, and the allocation rule is the highest virtual valuation, the payment rule is the second-price billing, assuming that the buyer i's virtual valuation is the highest, then the auction item is obtained, with the exception of the buyer i virtual valuation of the highest value recorded Y-iMake. Y-i=A, then the buyer i's payment at this time is:

Ti=Y-1(A)

which Y-1 Is buyer i The counter-function of the virtual valuation function, we call the mechanism without the optimal mechanism of reserved price, at this time the seller's expected income maximization, then let's start to explain why the seller should bid according to the buyer's virtual valuation, virtual valuation in economics and what is the meaning.

Suppose the seller sets a price of p for a buyer The accept-reject scheme, at which point F(p) is the buyer's valuation less than p probability, the buyer's valuation is greater than p Odds 1-F (p), i.e. the probability that the buyer will accept the scheme to obtain the item, where F Is the cumulative distribution function of the buyer's valuation, at this time, the probability of the buyer accepting the scheme to obtain the item as the buyer's demand quantity, the quantity of demand and the price of the function relationship is as follows:

q(p)=1-F(p)

The above is the demand function in economics: at different prices, the number of buyers' demand is different, and the monotony decreases, the demand curve slope is negative, and its counter-function is:

p(q)=F-1(1-q)

The seller's earnings function:

TR=p*q=F-1(1-q)*q

TR for total revenue About the quantity q DerivationPut it F-1(1-q)=p Available upon bringing in:

At this point, you can see that the marginal revenue function MR(p) and the buyer's virtual valuation function Y(v) The same, that is, the buyer's virtual valuation is the seller's marginal income, the economics marginal income refers to the seller for each additional unit of product sales increased income, in an indivisible single auction, the current seller's income is the marginal income, in order to maximize the proceeds, the seller's choice of distribution rules is to assign the auction items to the highest virtual valuation, the payment rule to choose the second price billing is to reduce the volatility of the buyer's price, conducive to the stability of the auction system.

In a real-world auction, the seller does not necessarily sell the item to the buyer with the highest virtual valuation, only the highest virtual valuation Y It is easy to understand that when the seller's valuation of the item is equal to the seller's, it is easy to understand that the seller will only trade if the proceeds are greater than or equal to the cost, at which point the seller's valuation of the item is the cost, which leads to another concept of the auction: the reserve price, as the name implies, when the buyer's price is less than the seller retains the auction item, the next section of our chat.

We have just mentioned that in an auction, if all buyers' quotations are less than the seller's valuation, then the auction items are not sold by the seller, at this time the seller's valuation is the reserve price, also known as the floor price, the full name of the market reserve price, let's go on.

1. What is the reason why the seller set the reserve price?

Don't want to lose money

For the seller, the auctioned thing itself has a certain value (cost c ), if sold at a price below that value (p ), the utility of the seller at this time:

u=p-c<0

Based on the assumption of personal rationality, the seller chooses to keep the auction item at this time, which leads to a basic assumption of the auction: personal rationality, when both parties to the auction do not participate in the auction, the return is 0 and the expenditure is 0 0Utility:

u = 0 - 0 = 0

An auction occurs on the premise that it is profitable for all participants, i.e. ui≥0。

Another basic assumption is that incentive compatibility as mentioned in the mechanism design (telling the truth guarantees the sustainable development of the advertising system).

In order to increase the intensity of the bidding environment at auction, the seller's income is protected.

Especially in the cooperative game, there is collusion between buyers (bidding ring), through cooperation to continuously reduce the price increased the buyer's income in the ring, the operation of the ring will not affect the probability function of the out-of-ring buyer's access to items and expected payment, the increased income in the ring comes from the seller's loss, at this time the seller can use the reserved price mechanism to counter the bidding ring.

2. What is the overall impact of setting a reserve price on an auction?

The auction may no longer be valid

After setting the reserve price, the seller may retain the auction item, not assigned to the highest-valued buyer, at this time the auction is no longer valid, affecting the social effect of the auction, of course, if it is based on the auction of private value then not too many people care;

The bidder's payment function may change

When only one buyer's offer is higher than the reserve price, in the general secondary price, the reserve price changes the winner's payment price, assuming the buyer i Quote. bi:

bi>bj≠iAnd. bi≥r

The highest offer except for the winner is recorded as:

maxbj≠i=b-i<r

Winner pays when there is no reserved price:

pi=b-i

When there is a reserve price, it is paid:

pi=MAX(b-i,r)

At this point the seller's earnings increase.

3. The reserve price has many advantages, how does the seller set the reserve price in a particular auction?

If the price is too high, the auction item cannot be sold, at this time the seller utility is u-0The price is too low for the buyer i if the bid is insufficient Items may be obtained at a very low price, at which point the seller utility u Did not meet expectations.

For the advertising system, the rough practice is based on the historical bidding situation of advertisers, take a fixed value so that the fill rate does not significantly decrease as a reserve price, relatively simple, to a certain extent, can also prevent advertisers from unlimited bids, reduce platform revenue; The calculation relates to the virtual valuation we mentioned in the optimal mechanism, the details of which we'll talk about next section.

In the auction seller in order to increase the intensity of the auction bidding environment, to protect revenue, set a reserve price, for the advertising platform, there are many advertisers to participate in the auction, the unified set of fixed reserve price can not make the platform income optimal, for this reason put forward a dynamic reservation price, let's talk about.

In terms of calculation, the main difference between dynamic retention price and fixed reserve price is that different prices are set for different advertisers, more fine, thousands of people need to understand the characteristics of advertisers and the valuation distribution of advertising exposure. "In the optimal mechanism, we propose that the criteria for bidding at auctions with the optimal mechanism are not advertiser valuation but virtual valuation, and explain why virtual valuation is used instead of the economic explanation of valuation, which represents the seller's marginal gain and the allocation of items to the highest marginal gainer in a single auction, with an implicit assumption:

The highest virtual valuation is higher than the reserved price, i.e.:

Y≥V0=r

Among them,V0 Represents the seller's valuation of the item, i.e. the reserve price ris also the cost to the seller.

When we ask for a dynamic reserve price, we make Y-r, that is:

v-(1-F)/f=r

Unseed the v in the upper version*, you get a dynamic reserve price for the buyer, and you can see from the above that you must know f(v) to solve the order., that is, the density function of the buyer's valuation, the premise is consistent with the optimal mechanism:

It is not known that the valuation distribution of individual buyers cannot be targeted to set reserved prices and optimal mechanisms to maximize seller returns.

There may be a question here as to why Y-r is madeand, to be solved v* On behalf of the dynamic retention price, let's explain the economics.

From an economic point of view, as the supply of goods increases, the marginal income decreases and the marginal cost increases, when

MR=MC

Maximize corporate profits. In a single auction, the virtual valuation is Y Represents marginal revenue, reserved price r represents marginal cost,令 Yer , that is:

Y=MR=MC=r

At this point the seller is most profitable.

Also because the advertising auction is exposure, there is a difference with other auction items, can not be stored for a long time, then waste, so in practice sometimes make r -MC=0,At this point, the upper style becomes:

v-(1-F)/f=0

That is v*=(1-F)/f The buyer's dynamic reserve price is available.

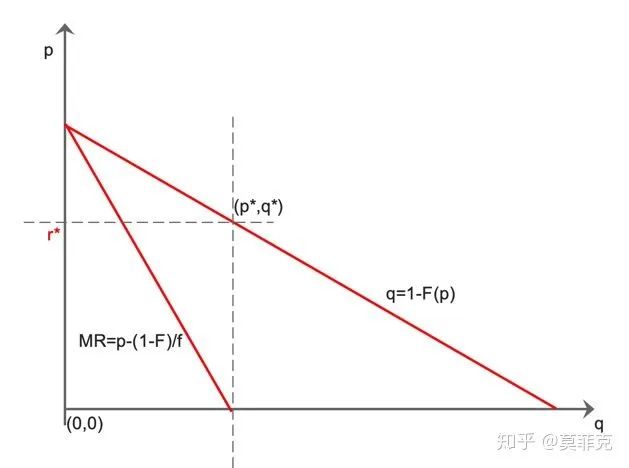

Here's what we can feel more intuitively with the diagram:

where, q is 1-F(p), which represents the demand function,MR=p-(1-F)/f, which represents the marginal revenue function (which is also the buyer's virtual valuation function).

When MR is 0 to get the optimal yield and price (p*,q*) , at this point p* Corresponds to the dynamic reserve price r above*。

For the advertising system, different advertisers have different valuations, and the valuation distribution function needs to be fitted according to historical data, based on which the advertisers' respective reserve prices are set separately.

Here we can refine the previous description of the optimal mechanism:

Allocation rule: When maxY ≥ r when the virtual valuation is highest, otherwise the item is retained; Represents the buyer's virtual valuation;

Payment Rules: The bidder will be charged Z,Z=max(Y-1(A),r*)

Where A isY-i, which means to remove the winner from the buyer i the highest virtual valuation, Y-1 Represents buyer i The counter-function of virtual valuation,r*=Y-1(0)

If the buyer is symmetrical, at this point f(i) is f

则:Z=max(maxXj,Y-1(0))

Among them,maxXj Represents except the winner i the highest offer outside.

That is, the reserved price is r*=Y-1(0) The second-price auction is the optimal auction mechanism.

Advertising as a special auction inherits the kernel of the auction, but also developed some features, such as exposure as an auction item is not easy to store expired or void, such as the highest bidder may not win the auction, which involves the special logic of advertising bidding.

Bid ads start with thousands of impressions (cpm). Bid, the highest bidder gets exposure, and then, driven by the performance advertiser, the bid extends back and develops by click (cpc). Bids, allocation rules or high bidders, are not good for the ad platform/media (equivalent to free advertising to advertisers who bid high but click low), and then Google introduces click-through rates into the bidding formula, splitting bids from bids and turning the bid criteria into ecpm, this is a major innovation, the high price must be turned into ecpm High, ecpm Not only includes the economic dimension of the bid, but also includes the content of the ad quality dimension and the degree of user fit, taking into account advertisers, platforms, and users. For ads that follow a click bid, the formula is as follows:

ecpm=1000*pCTR*bidc

Where, pCTR is the estimated click-through rate,bidc Is the advertiser's click bid. Advertisers who want to win exposure need to increase ecpm as much as possible, the main focus is pCTR And. bidc, pCTR Affected by three factors: ads, users, ad scenes (context), bids are primarily influenced by the advertiser's valuation.

In the actual operation of the advertising platform will face different situations and demands, such as poor quality of media feedback ads, affecting the user experience; The platform wants some operating space to influence the auction results, which leads to the price squeeze factor p, through the extrusion factor platform can effectively balance quality and revenue, the bidding formula after adding extrusion factor is as follows:

ecpm=1000*pCTRp*bidc

where p>0,0< pCTR<1,bidc>r,r is the reserve price.

The following conclusions can be drawn from the formula:

When p As the value gradually increases, the click-through rate is at ecpm The weight in increases, and the weight of the price decreases to ecpm The effect is squeezed out, which is also p the reasons for being called the price squeeze factor;

When p As the value decreases, the click-through rate is ecpm The weight in will decrease and the influence of the price will continue to increase.

In what scenario will the platform adjust p Value and how to adjust it?

The platform can reduce p when the bidding environment reduces revenue value, increase the price weight, at which point the advertiser lowers the bid, ecpm The proportion of decline will be greater than the proportion of bid reduction, resulting in an accelerated decline in advertisers, because it is the use of second-price billing, as rational advertisers will stop price reduction and then raise prices, price increases after the proportion of increase in prices is greater than the proportion of actual cost increases, to encourage platform advertisers to continue to raise prices, and ultimately improve the overall bidding environment.

When feedback ads are of poor quality and affect the user experience, the platform can improve p for long-term reasons value, increase the click-through rate weight, at this time advertisers find that the effect of increasing bids to increase exposure is far less than by optimizing the material to increase the click-through rate of exposure, as a rational person, advertisers will continue to optimize the material to improve the quality of creativity, and ultimately optimize the user experience.

The above is about the impact of the squeeze factor on the allocation rules, the impact on the bidder's payment is as follows, in the second-price billing of the actual payment of the bidder Ti Here's what it looks like:

Ti=ecpmn+1/(1000*pCTRp)

The billing price is always less than the bid.

Advertising platform in the long-term development of the business to explore a set of effective tools, each has a god, through the use to guide the trend towards the desired direction of development, squeeze factor is one of the sharp tools, the greater the size of the advertising ecology, the more significant the effect, the other members of the tool set we follow up chat.

Advertising platform hope that more and more advertisers to participate in the delivery, the demand will enhance the bidding environment, platform revenue naturally rising, there is a premise: there is enough large traffic plate to meet the diverse demands of different advertisers. There are pros and cons to everything, and traffic comes with a problem:

Small and medium-sized advertisers have a limit to their daily budgets, and if traffic is allocated in ecpm order, many advertisers will quickly run out of budget to stop bidding in a short period of time and will have to wait until the new cycle begins to re-engage.

Is there a solution to this problem that leads to a platform tool: Budget consumption control, and let's talk about it.

What is the meaning of budget consumption control is mainly expounded from three dimensions.

1. Advertisers

You want your budget to be smooth enough to consume (Smooth delivery) throughout the day, and the life cycle of the plan is long enough to reach users at different times of the day.

2. Platform

Hope that in the middle and late part of the day can maintain the pre-bid environment, especially for the second-price billing, if the mid- to late-stage participants significantly reduced, will greatly affect the income;

The lag of consumption data leads to overs run, which is inevitable to some extent, and can be reduced by budget consumption control.

3. Users

Don't want frequent repetitive ads throughout the day, reduce duplication rates, and improve the experience.

Based on the above considerations, the solution is proposed to control budget consumption, the mainstream has two directions:

Adjust the participation rate

By adjusting the probability of participating in the auction to affect the number of times the advertisement participates in the auction, consumption is faster to reduce the probability, consumption is slow to increase the probability.

Adjust the bid rate

Change your bid to affect the number of times your ad wins, reduce your bid if you consume it faster, and increase your bid if you consume it slowly.

There are several questions to consider about how modifying bids affects bid rates:

Bidding environment at any time, adjust the current advertising bid, the large-cap bidding environment may change at the same time, the bid rate may not be in accordance with the preset direction of development;

SSP part of the location may set the floor price, if the need to reduce the bid is less than the floor price can not take the amount, to a certain extent, limit the space for price adjustment;

By coupling budget consumption control and optimizing ROI, multiple targets associated with one behavior can constrain each other.

In summary, it is recommended to use adjusted participation rate to control budget consumption speed, adjust participation rate also has a variety of implementations, below we introduce the Method used by LinkedIn.

Basic idea: By adjusting the participation rate, the budget consumption curve of the advertising plan (campaign) is proportionally consistent with the exposure curve obtained by the program (budget control is generally at the plan level), consumption decreases the participation rate faster than exposure, and increases the participation rate slower than exposure.

Based on the historical data for Plan j, estimate the distribution of traffic planned for the day, divided the day into k time slices, with a daily budget Bj (Advertiser Settings), scheduled traffic distribution for each time slice:

I=(i1、i2、i3、i4 ... ik )

Distribute your budget proportionally:

Bj =(b1、b2、b3、b4 ... bk )

which bt≥0,;

Fjt is estimated from 0:00 to the time slice t the cumulative exposure before,;

Fjk is the cumulative estimated total exposure for a day, ;

Sjt It starts at 0:00 to time slice t the cumulative actual consumption before;

Ajt It starts at 0:00 to time slice t Before the cumulative planned consumption, then:

Ajt=Fjt/Fjk*Bj

Pjt is the participation rate of plan j at the time slice t;

R Is.Adjustment factor;

When the actual consumption is higher than the planned consumption, the participation rate of the next time slice is reduced by R on the basis of the participation rate of the previous time slice, and when the actual consumption is lower than the planned consumption, the participation rate of the next time slice is increased by the proportion R on the basis of the participation rate of the previous time slice, i.e.:

Pjt=Pjt-1*(1-R),Sjt≥Ajt

Pjt=Pjt-1*(1+R),Sjt<Ajt

There are a few points to note about the initial value setting in the above algorithm:

Time slice

The length is set to 1-3 mins, and the shorter the time slice span, the smoother the consumption curve and the more frequently calculated.

Initial participation rate Pj1

Pj1=0.1, starting at a low speed and giving the model plenty of learning time, even if the initial participation rate for some plans is low, can be close to a reasonable value through a quick iteration, and if the initial set is too high, it may result in a situation where the budget has not been adjusted and has been consumed.

Adjust factor R

R is 0.1, and the complex calculation method is for Sjt/t The calculation is guided.

The length of the cycle

The total length of the day is estimated at 22h, buffered by the last two hours to prevent model errors.

In the whole feedback control, the key point is to predict the traffic, determine the budget allocation curve, it is necessary to predict the traffic distribution of the targeted target population of plan j, combined with the historical bid rate of the plan to get the planned traffic distribution.

These are the budget consumption control methods used by LinkedIn, the idea is simple but the results are effective, and we'll talk about other control methods later.

The paper on LinkedIn, just mentioned, controls budget consumption speed by dynamically adjusting the participation rate. Its basic ideas are as follows:

Calculate the actual cumulative consumption and the planned cumulative consumption, the actual consumption is greater than the plan to reduce the participation rate, less than the plan to increase the participation rate, each time the target request is launched through the probability to discard part of the advertising request.

This discard in the above method is random, whether there is a way to determine whether to drop according to the quality of the request, when high-quality requests (high conversion) to participate in bidding, low-quality requests to drop, so that you can control the consumption speed, while optimizing the effect, improve ROI, which leads to the following we describe in a Yahoo paper described methods.

Basic ideas:

According to the advertising effect (such as click-through rate) the ad request is divided into multiple layers, the participation rate of each layer is different, the high click-through rate of the layer participation rate is high, the low click-through rate of the layer participation rate is low.When a target request is initiated, the click-through rate estimate model falls to a specific tier and participates in the auction based on the participation rate of that tier. If the next time slice needs to increase consumption, increase the participation rate from the highest level in turn, and if you need to reduce the consumption, from the level where the participation rate is greater than 0, then decrease the participation rate, and always keep the actual consumption curve close to the planned consumption curve to achieve the effect of budget smooth consumption.

Specific implementation logic Let's expand a little bit, the basic setting is as follows:

Plan budget consumption B based on historical data, divided into K parts over the course of a day:

B=(B1、B2、B3... bk )

Among them,Bi≥0,,Bm is the actual remaining budget after m time slices,Actual consumption in one day:

C=(C1、C2、C3... Ck )

Divide the planned target request into Ls based on different values for the conversion goal layers, assuming that the target picks up click-through rates, the click-through rates for each tier are as follows:

S=(S1、S2、S3... SL )

Cost of clicks:

E=(e1、e2、e3... eL )

T-1 Participation rate for each layer at the time slice:

Rt-1=(rt-11、rt-12 ... rt-1L)

t-1 Actual consumption of each layer at the time slice:

Ct-1=(Ct-11、Ct-12 ... Ct-1L)

The adjusted consumption of time slice t should be:

Among them, Represents passing through t-1 The difference between the planned and actual consumption after the time slice;

Indicates that the difference is spread equally across subsequent time slices.

Make F. .Ct-Ct-1 Represents the consumption difference between the two adjacent time slices.According to F The value score of to calculate the determining time slice t The participation rate of the inner layers.

F=0

Explain that the adjusted consumption of the t-time slice is consistent with the actual consumption of the t-1 time slice, and the participation rate of each layer in the last period of time should not be adjusted, that is:

Rt=Rt-1=(rt-11、rt-12 ... rt-1L)

F>0

Explain that the consumption of the time slice t is greater than t-1, at which point the participation rate needs to be increased until the additional consumption is complete, and the participation rate is increased from the highest level L Increase the bid rate down layer by layer (the click-through rate is higher at the top level) and the participation rate for each layer at t rtL The formula is as follows:

rtL=min(1,rt-1L*(ct-1L+F)/ct-1L)

F=F-ct-1L*(rtL-rt-1L)/rt-1L

until F-0 so far;

F<0

Explains that the consumption of time slice t is less than the actual consumption of t-1, at which point the participation rate needs to be reduced until the difference is offset, and the participation rate is from the lower l (The smallest tier where the participation rate is not 0) decreases the participation rate from layer to layer (lower click-through rate is lower) and the participation rate for each tier rtL The formula is as follows:

rtL=max(0,rt-1L*(ct-1L+F)/ct-1L

F=F-ct-1L*(rtL-rt-1L)/rt-1L

until F-0 So far.

In practice, it can be based on F The specific values use different calculation formulas to calculate the participation rate of each layer within the time slice t.

Example: For example, in the 3rd time slice, the target user initiates an ad request, and the model estimates the click-through rate pCTR3%, there are 5 layers, the click-through rate range of layer 2 is 0.02,0.04, then the request falls on the second tier, the participation rate of that layer r32=30%, divide the intervals of 0, 29 and 30-99, the random number generation is 28 to participate in the auction, the generation of the random number is 45 to abandon the request, do not participate in the auction.

The basic idea of layering advertising requests that have just been put forward isEach tier participates in the auction according to different participation rates, so as to control the speed of budget consumption, while effectively improving the effectiveness of advertising.

There's a premise here, the advertising plan doesn't have clear effect constraints, and if there's a way to deal with it, Yahoo's thesis suggests an exploratory solution to this situation, so let's talk about it.

The assumptions are consistent with the previous article, including budget allocation, time division, request stratation, before and after time slice consumption difference, and so on. On this basis, the following assumptions have been added:

Ads follow cpm Bid, the effect target is cpc The price cannot be above a certain threshold ( goal );

This is understandable, from the conversion path, the effect target constraints after the bid, otherwise directly through the bid to control the effect can be.

Proposed layered add-on ecpc (Ct-1,Rt-1,Rt,E,i) Concept, represented from i Layer to L layer, in the time slice t the add-on ecpc;

The formula is as follows:

Where the molecules represent the time slice t Inside from i to L The total consumption of the layer, the denominator represents the time slice t Inside from i to L The total number of clicks on the layer, divided by i to L layer

ecpc(Ct-1,Rt-1,Rt,E,i)

referred to simply as ecpc(i) 。

Here's how to calculate the participation rates for each tier:

Using the unconstrained algorithm in the previous article, the participation rate of each layer is derived:

Rt-1=(rt-11、rt-12 ... rt-1L)

and calculate ecpc (1) :

When. ecpc(1)≤goal, continue to use the unconstrained algorithm;

When. ecpc(1)>goal , the following algorithm is used to obtain the participation rate of each layer:

Start with the first layer of the loop, and then calculate up, i=1,2...L,ecpc(i)>goalTo calculate ecpc (i1):

When.ecpc(i+1)≥goal time

Tier i participation rate rti=0

When. ecpc(i+1)<goal time

Among them, Represents i1 to L The consumption is:

ct-1i+1、ct-1i+2 ... ct-1L when,amount less than the cumulative amount of the target cost;

ct-1i*(1-goal/ei) Represents Tier i consumption ct-1i is greater than the amount of the cost.

Time slice t inside rti Depending on the scale adjustment, if >1, increase the participation rate, if <1, reduce the participation rate, and eventually make epc(i) s goalto meet the target constraints.

Here's a hypothesis:The participation rate of this layer is positively related to consumption.

The new plan has no effect data and has the following recommendations for taking values for experimental parameters:

Find a running old plan based on similarity, and find a global race r that can run out of budget,

The number of order layers L=1/r;

In the cold start phase, all layers use a uniform bid rate to sort the number of requests for exposure by estimated click-through rate and to determine the click-through rate boundaries for each layer by taking the same number of established tiers.

To sum up, we introduce two ways to control budget consumption:

LinkedIn method to achieve simple, do not layer, according to the actual cumulative consumption and planned cumulative consumption of the relationship between the adjustment of participation rate, although the effect can not be guaranteed, but can effectively control the consumption speed;

Yahoo's method can take into account both consumption speed and effect, but the model is relatively complex, especially according to the availum of clear effect objectives to propose two algorithms, adding a lot of difficulty.

The above-mentioned schemes have their own characteristics, the applicable scenarios are also different, the specific application needs to be judged according to the actual situation.

This share is here, thank you.

The author describes:

Morphick, an advertising practitioner with a strong interest in advertising.

Link to original text:

https://www.zhihu.com/people/mophic/posts

If you like this article, welcome to share the article to the circle of friends

About us:

One.I'm watchingA.Time.!👇

Go to "Discovery" - "Take a look" browse "Friends are watching"