Mobile games and social advertising exceeded expectations Full-year earnings growth certainty - Tencent Holdings (0700. HK) 20Q1 performance reviews

Special tips

The securities research information covered in this subscription number is prepared by Everbright Securities Media Internet Research Team and is intended only for Everbright Securities professional investor clients and is used as a communication of research information and research views under the new media situation. Do not subscribe to, receive or use any information in this subscription number for non-Everbright Securities professional investor clients. This subscription number is difficult to set access, if you are inconvenienced, please understand. Everbright Securities Research Institute does not treat the person concerned as a customer of Everbright Securities for following, receiving, or reading the content of this subscription number push.

The main point of view

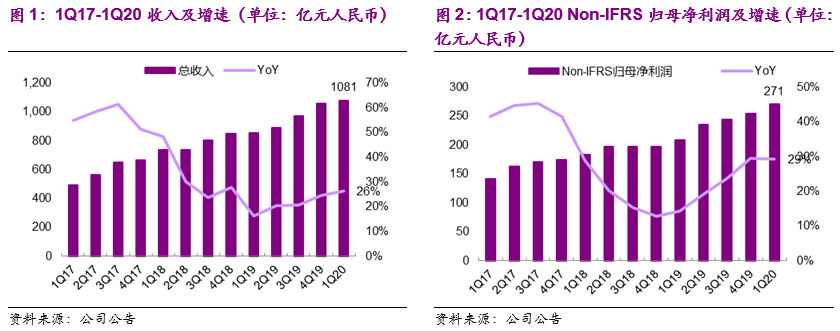

The company announced 20Q1 results. 20Q1 achieved revenue of 108.1 billion yuan, YoY plus 26%, non-IFRS returned net profit of 27.1 billion yuan, YoY plus 29%, both exceeded market expectations。

◆"Home Entertainment" drives the rapid growth of mobile games, "Glory of the Kings" and "Peace Elite" Q1 bright-eyed performance brought deferred revenue to a new high. Q1 achieves deep commercial potential through the good operation of old games:Our previous report estimated that "Glory of the Kings" flowed more than 9 billion yuan in January, home isolation allowed high flow water to continue; "Peace Elite" through IP linkage to drive a new high degree of activity; Q1 single quarter new deferred revenue reached 22.8 billion, will support the growth rate of the next few quarters;2) New games and overseas market expansion will continue to release increments:"DNF Hand Tour" is expected to be launched in the summer, Riot developed the FPS game "Valorant" has been in Europe and the United States to start testing, Twitch platform attentionhigh degree.

◆Social advertising growth far exceeded market expectations, but Q2 may have some downward pressure.Q1 Advertising revenue grew 32% YoY, driven by a 47% YoY increase in social advertising revenue.1) Q1 company's social advertising prices rose:Volume of friends circle Article 4 advertising full release, superimposed advertising alliance traffic increased, to undertake games, Internet services, online education industry during the outbreak of strong demand;Force.

◆Fintech has returned to growth track at Q2.The cloud business is under short-term pressure but the long-term logic is clear。 1) Fintech services revenue decreased month-on-month, structural payment income decreased month-on-month and financial management, loans and so on increased month-on-month.The company disclosed that in the last week of April, the average daily business transaction volume has returned to the end of 2019 level, we expect 20Q2 financial business revenue is expected to exceed 19Q4, corresponding to year-on-year growth or up to 30%.2) Due to the impact of the outbreak, project delivery and new customer acquisition in the cloud business were delayed, resulting in a decrease in Q1 revenue month-on-month.However, the "guest effect" of the outbreak is expected to gradually emerge in the medium to long term: Tencent's breakthrough success has led to the gradual migration of Tencent's product capabilities from C to B, and the C2B model's path to success has become clearer with the recognition of enterprise WeChat-based industry solutions in the retail, education and public sectors。

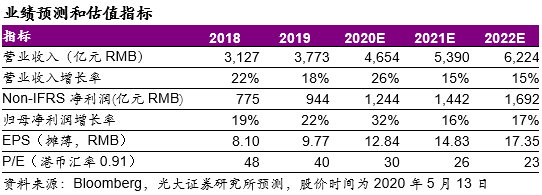

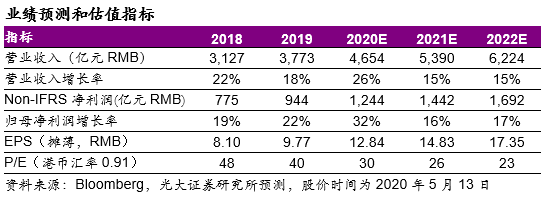

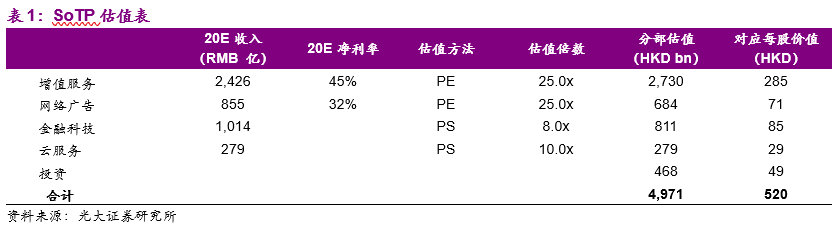

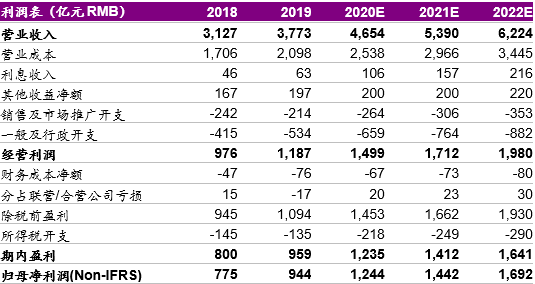

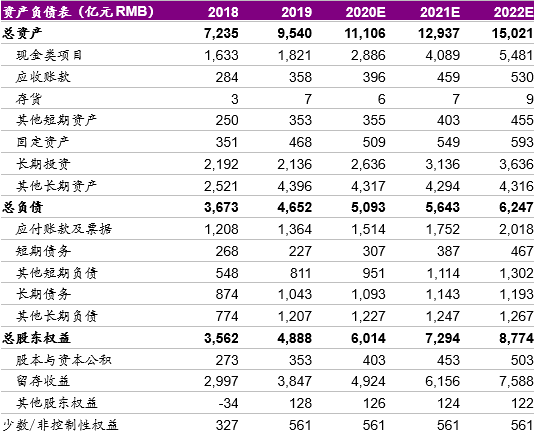

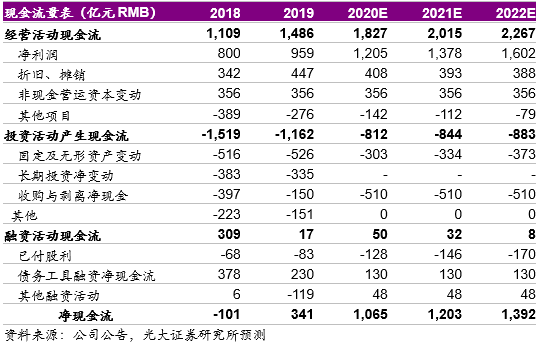

◆The company's Q1 games, social advertising growth exceeded expectations, the full-year net profit growth rate is worth looking forward to.Slightly raised the Company's net profit forecast for 20-22 years non-IFRS to RMB1,244/1,442/169.2 billion, corresponding to the current price of 30/26/23x PE. Based on the division's valuation, the target price was raised to HK$520 (of which value-added services/online advertising/fintech/cloud services/investments contributed HK$285/71/85/29/49 respectively) to maintain a "buy" rating。

Risk analysis.Macroeconomic growth is down, flow dividends are peaking, competition risks are at risk, and the epidemic is hitting

1

20Q1 achieved revenue of RMB108.1 billion, up 26% YoY.Q1 was affected by the outbreak, users' online time increased significantly, the company's gaming and social advertising revenue grew faster than the market expected, while the number of paid users of value-added services increased. Non-IFRS reported net profit of RMB27.1 billion in the quarter, up 29% YoY.

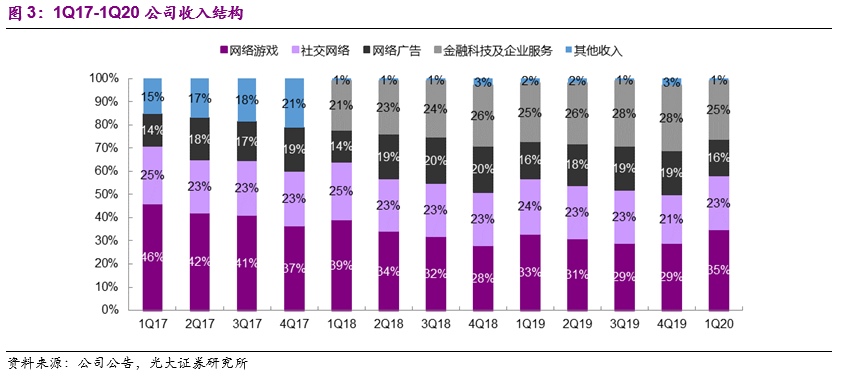

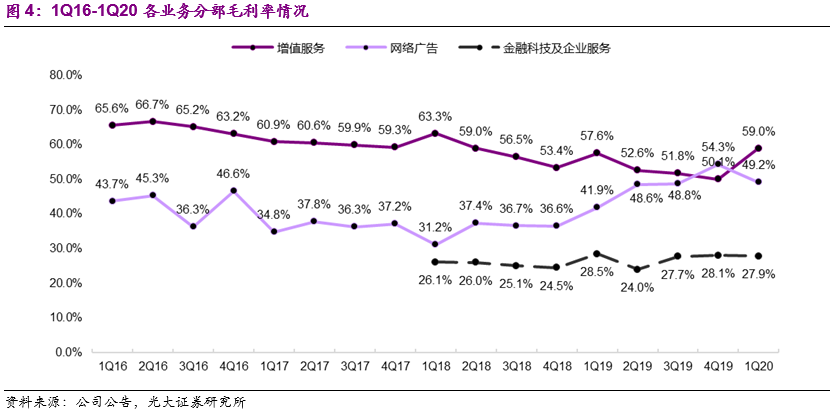

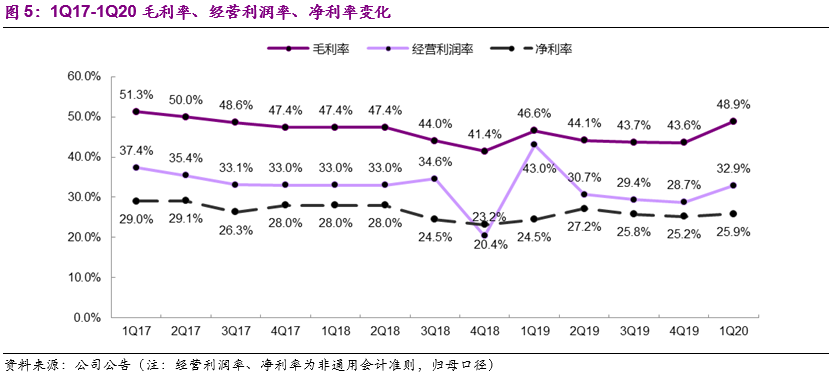

20Q1's overall gross margin increased by 5.3pct to 48.9% month-on-month, mainly due to an increase in the proportion of the gaming business with high gross margin. 1) Value-added services business:20Q1 gross margin increased by 8.9pcts to 59.0% month-on-month, mainly due to a 6pcts to 35% increase in the share of the higher gross margin online gaming business in the division;2) Network advertising business:20Q1 gross margin decreased by 5.1pct to 49.2% month-on-month, and the level of gross margin of advertising business has improved significantly in 19 years compared with 18 years due to the increase in the proportion of social advertising;3) Fintech and Corporate Services:Gross margin of 20Q1 decreased slightly by 0.2pct to 27.9%, while Q2 is expected to increase as payments business and cloud services pick up.

1.1

Online games: Overseas revenue more than doubled year-on-year deferred revenue to a record high

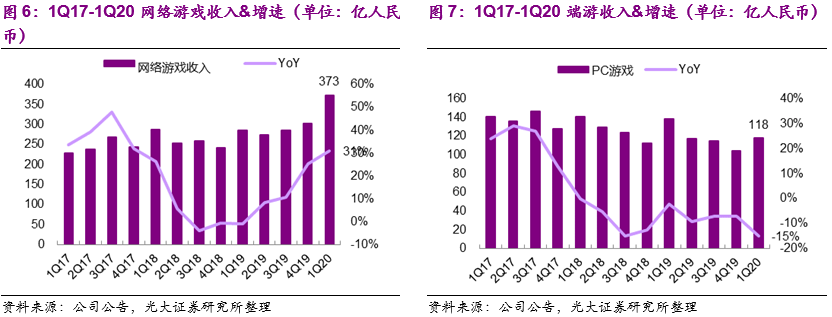

1.1.1、20Q1 online game revenue of 37.3 billion yuan, up 31% YoY

End-of-line travel revenue was 11.8 billion yuan, down 15% year-on-year.Q1 Under the impact of the outbreak, the domestic Internet cafes industry suspended operations, and the "Dungeon and Warriors" performance did not meet expectations led to the impact of domestic business.

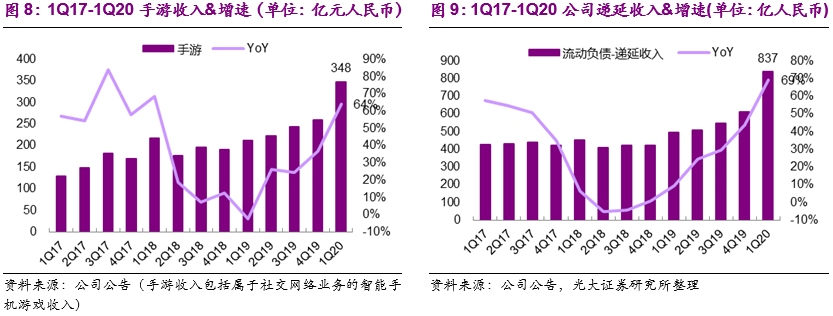

Hand-travel revenue (including social networking) was 34.8 billion yuan, up 64% year-on-year, exceeding market expectations, mainly due to the excellent performance of King's Glory, Peace Elite and the growth of overseas markets.1) The IP linkage between "Peace Elite" and "Rocket Girl 101" makes the user's activity a new high, and the upgrade of the game engine of "King Glory" makes the audio and visual effects of the in-game props improve greatly, and promotes the paid conversion of players;2) The global strategy continues to advance, enhancing overseas operations through localization.PUBG Mobile, a key game overseas, stimulates players to pay through two-year events, and Supercell's Wilderness Fight enhances the user experience by optimizing player matching algorithms.

Deferred revenue under current liabilities reached 83.7 billion yuan at the end of 20Q1, up 69% YoY and a net increase of 22.8 billion yuan YoY.The release of deferred revenue in the following quarter is expected to continue to support the high growth of the gaming business, and we forecast Q2-Q4 hand-held growth of 46%/33%/24%.

1.2

Digital content: Tencent Video's full-year operating loss narrowed, and micro-visual data changed significantlyGood.

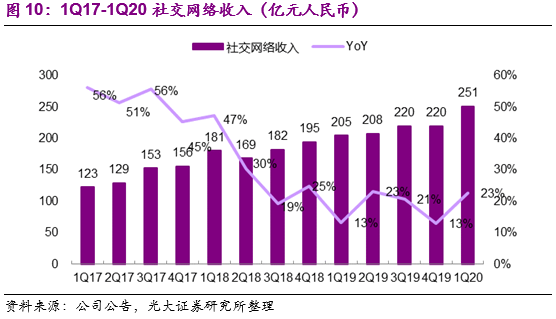

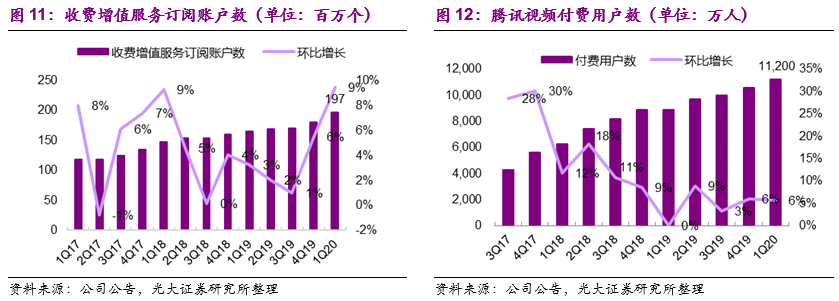

20Q1 social network revenue increased 23% year-on-year to 25.1 billion yuan, up 14% month-on-month.The number of fee-based value-added service accounts increased 19% year-on-year to 197 million, mainly due to a significant increase in video and music service membership. During the outbreak, there was strong demand for Internet entertainment products, with 20Q1 Tencent video membership up 26% year-on-year to 112 million and music service membership up 50% year-on-year to 43 million.

High-quality content is the core driver of user payment, "new creation" or into the power stage.1) Q1 company's home-made animation and episodes such as "Third Season of Douro Mainland" and "Three Lives III Pillow Book" to promote the free user's pay conversion, the overall payment rate steadily increased trend is stable.2) The company's will to strengthen cooperation and coordination between content platforms is gradually clear:Cheng Wu, vice president of the company, and Hou Xiaonan, vice president of PCG, respectively, took over the position of CEO and president of the Reading Group, and in the future, it is expected that the huge amount of literary content will be adapted into series, animation, games and other media forms, using the company's distribution capacity to expand user coverage, thereby strengthening the overall content ecology.

1.3

Online advertising: Social advertising is growing faster than expected, and media advertising continues to struggleWeak.

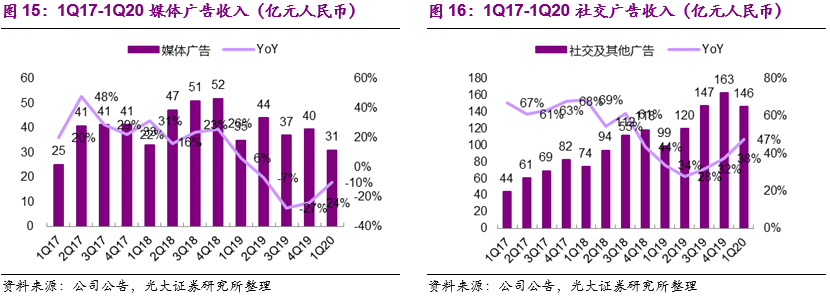

20Q1 online advertising revenue of 17.7 billion yuan, up 32% year-on-year. 1) Media advertisingRevenue was $3.1 billion, down 10% year-on-year, mainly due to weak macroeconomic conditions and the suspension of sporting events, resulting in lower advertising revenue for video and news platforms.2) Social and other advertisingRevenue of 14.6 billion yuan, up 47% YoY, during the epidemic quarantine period, games, Internet services and online education industry to strengthen online advertising for customers, and the company by increasing the circle of friends / small programs / public number of advertising inventory effectively to undertake strong demand, so the volume of social advertising prices rose.

1.4

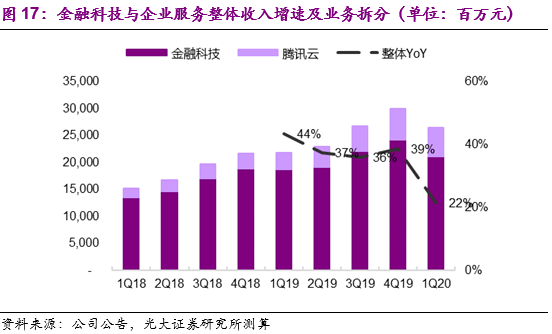

Fintech and Enterprise Services: Financial Q2 is back to growth, and cloud services are much shorter

20Q1 Fintech and Corporate Services business grew 22% year-on-year to $26.5 billion, but was down 12% month-on-month due to the outbreak.

Fintech services revenue decreased month-on-month, structural payment income decreased month-on-month and financial management, loans and so on increased month-on-month.1) In terms of break-up, we estimate that the overall financial business decreased by 13% month-on-month, with payment business down 19% month-on-month, financial revenue up 10% month-on-month and loan revenue up 6% month-on-month;

As a result of the outbreak, project delivery and new customer acquisition in the cloud business were delayed, resulting in a quarter-on-quarter decline in revenue.Tencent Conference has surpassed 10 million DAU in the two months since its launch at the end of December 19, making it the most widely used videoconcing-specific application in China, and its foreign companies have further deepened the interoperability of WeChat and Enterprise WeChat to assist enterprises in customer management and sales transformation, and millions of enterprises have successfully resumed their operations through Enterprise WeChat during the outbreak.We believe that the new users brought about by the outbreak will reduce the company's subsequent customer costs, and the promotion of industrial Internet business is expected to accelerate after the outbreak.

2

The company's Q1 games, social advertising growth exceeded expectations, the full-year net profit growth rate is worth looking forward to.Slightly raised the Company's net profit forecast for 20-22 years non-IFRS to RMB1,244/1,442/169.2 billion, corresponding to the current price of 30/26/23x PE. Based on the division's valuation, the target price was raised to HK$520 (of which value-added services/online advertising/fintech/cloud services/investments contributed HK$285/71/85/29/49 respectively) to maintain a "buy" rating.

3

Risk analysis

(1)Macroeconomic growth down:The downward trend of macroeconomic growth has not yet seen clear signs of stabilization, the company's advertising business is expected to continue to bear pressure;

(2)Population dividend fades:The number of mobile Internet users and the length of users in China have basically peaked, which has a negative impact on the company's gaming, digital content and advertising business;

(3)Increased competition:Fintech and enterprise services business from overseas cloud services giants such as AWS, Microsoft, as well as the domestic first-in-the-first advantage of Alibaba Cloud competition;

(4)Impact of the outbreak:The new crown outbreak has had a significant impact on the company's offline payment business, which could have a negative impact on the company's business if the economic recovery does not respond as expected to affect business expansion and revenue growth.

Everbright Media Internet

Holes

Contact: 18616810009

Fan Jiajun

Contact: 18001820121

Le Ziming

Contact: 13761276979

Special statement

This subscription number is the official unique subscription number established by the media Internet research team of Everbright Securities Co., Ltd. Research Institute (hereinafter referred to as Everbright Securities Research Institute) and operated independently by law. Any other subscription number registered in the name of The Media Internet Research Team of Everbright Securities Research Institute, or containing information such as Everbright Securities Research and the brand name of Everbright Securities Research Institute, is not the official subscription number of the Media Internet Research Team of Everbright Securities Research Institute.

The information published in this subscription number is based on the research report that Everbright Securities Research Institute has officially issued, only for the timely communication and exchange of research information and research views under the new media situation, in which the information, opinions, forecasts, etc., all reflect the judgment of Everbright Securities Research Institute on the day the relevant research report is first published, may need to be adjusted at any time, this subscription number does not assume the obligation to update the push information or other notice. For detailed securities research information, please refer to the full report published by Everbright Securities Research Institute.

Under no circumstances shall the content contained in this Subscription constitute any investment proposal, and no investor shall use the content contained in this Subscription number as a basis for investment decisions, and the Company shall not be responsible for any loss caused by the use of any content contained in this Subscription Number.

The copyright of the content contained in this subscription number is only owned by Everbright Securities Co., Ltd. No institution or individual may reproduce, reproduce, reproduce, publish, publish, tamper with or quote in any form without written permission. Everbright Securities reserves the right to pursue all legal liabilities if any direct or indirect loss is caused to Everbright Securities as a result of the infringement.

Go to "Discovery" - "Take a look" browse "Friends are watching"