Industry depth: Facebook's increased ad value is a more important growth driver than exposure

2019Ads contribute about 98% of Facebook's revenue each year.Advertising sales rose 17% to $17.44 billion in the first quarter of March 31, 2020。 The advertising business has succeeded in monecuring the company's 2.4 billion ultra-large user traffic, with North America and Europe being the regions with the highest ARPU per customer, and emerging markets remain to be explored in the future.

2019-2020Tencent, Facebook comparative analysis report

For the public offer of 3000 yuan 1498052617

IPO Before: The rapid growth of users is the main driver, the degree of commercialization is limited, the growth driving force is relatively single; IPO Then to 2014: reduce game-related business revenue, start focusing on the development of information flow advertising, revenue per capita Feeds, Ad load, Ad price revenue formula is established;

2014Q3~2015Q3 : The growth strategy is to reduce Adload.relying on ad price to drive revenue growth, with overallCPM growth as the main driver;2015Q4-2016Q4 becomes driven by both CPM and Ad load factors. Ad impressions knotAfter four consecutive quarters of sharp declines, there was another positive growth (YoY plus 29%, compared with -10% for 15Q3), mainly from Instagram's Ad load;

Starting with 2017 Q1-Q4: Things are starting to change again, with Adprice Retest (up 14% year-on-year in 17Q1) MAU up 17% and ad load flat.

Starting in 2018, Facebook is entering its fifth growth baton switch: average ad price growth is declining, driven by increased ad exposure, behind the commercialization of the mature Instagram Stories, while Whatsapp, Facebook/Messenger Stories are still developing the ecosystem. According to Facebook's 2019Q1 results, Ad ImpressionYoY+32%, advertising price YoY-4%, revenue YoY plus 26%, mainly driven by Instagram Stories, Instagram feed and Facebook News feed.

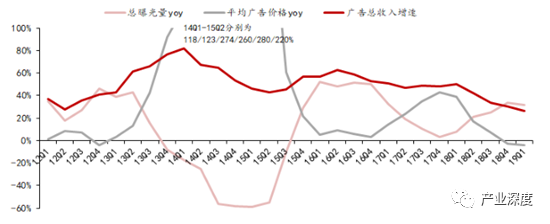

Chart. 68: Facebook's total ad revenue, total ad exposure, and average ad price growth year-on-year

Advertising prices and exposure alternately drive growth, but price increases are more critical. From 2013Q2, the average ad price per thousand ads has increased significantly from $0.19 to $1.85 for 15Q3. After six to seven quarters around $2, it quickly rose again to nearly $3. Advertising price growth is much larger than exposure growth, is the main driving force of advertising revenue growth. The rise in ad prices is partly related to the company's adjusted bidding and display rules (Facebook's restrictions on low-quality ad exposure push up advertisers' cost of single impressions when advertisers budget), and on the other hand, they reflect the value of Facebook's social traffic.

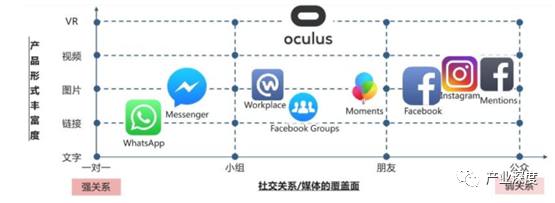

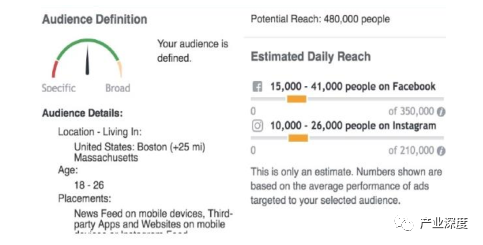

Multi-dimensional depth. Data helps deliver accurately. In addition to its main app, Facebook also has social products for 1 billion users, including Instagram, Messenger and WhatsApp, and the relationship chain covers strong relationships from one-on-one to strangers, with media forms including text, pictures, videos and even VR, and Facebook's account system has accumulated a vast amount of multi-dimensional data on users. Advertisers have a variety of advertising goals to choose from when running ads on Facebook, such as streaming, transforming, promoting brands, and attracting product purchases, to meet diverse marketing needs. After you've set goals, based on large and rich user data, advertisers can target your ads by age, gender, location, interests, education, and more.

Chart. 69: Facebook product matrix

Chart. 71: Facebook ad targeting dimension

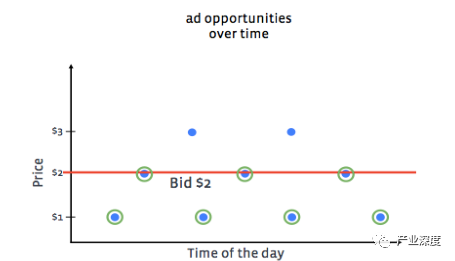

Advanced algorithms ensure efficient delivery. Pacing is a control logic algorithm in Facebook's advertising system that determines how advertisers spend their budgets over the ad lifecycle. In layman's terms, just as a runner can't get the best results by sprinting too early or too late in a race, pacing algorithms allow advertisers to automatically allocate budgets in the competition to ensure that advertisers get the maximum ROI. As shown in the figure below, the blue dot represents the opportunity for the ad to be displayed, the yellow circle represents the ad wins the display, and the red line represents the bid price.

No Pacing algorithm (accelerated delivery): Without Pacing, advertisers' budgets are consumed cleanly (potentially expensive clicks) in a short time from the start, with intense early competition and no competition in the later stages, resulting in a certain waste of resources. The result is higher average costs, but advertisers get the most out of their ad-based settings.

No Pacing algorithm (underbidding): In this case, the lowest click-through price is pursued, but the advertiser's budget is not used up in the end, and the final ad performance is the worst

Pacing Equilibrium under the algorithm: Advertisers get the most clicks, get the most revenue, and run out of daily budgets.

Chart. 72: Facebook ad targeting options

Chart. 75:P run when using the acing algorithm (balanced state)

The body directory

1TencentFacebookFinancial.

1.1Tencent's financial situation

1.2、FacebookFinancial position

2TencentFacebookThe user platform

2.1Tencent user platform

2.1.1Social.&IM

2.1.2video platform

2.2、FbThe user platform

2.2.1、FBSocial.

2.2.2、FbVideo platform

3TencentFacebookCommercial realization

3.1Tencent Commercial Realization

3.1.1Game.

3.1.2Fintech

3.1.3advertising business

3.1.4, prospects

3.1.5Tencent.AIStrategy.

(1), the base layer

(2), the technical layer

(3), the application layer

3.2、FBCommercial realization

3.2.1, advertising forFacebookThe main realization mode

3.2.2expansion of emerging marketsARPU

3.2.3、FacebookFinance begins to commercialize

3.2.4、FacebookAR/VRStrategy.

(1), the next generation of universal computing platform

(2Business model: hardware+The content is one wing

4、TencentFacebookOutlook

Chart catalog

Chart 1:2012-2019Global social giant market capitalization (US$100 million)

Chart 2:2018-2020Tencent's revenue composition and trends in the first quarter of the yearUnit: RMB million

Chart 3:2016-2019Annual Tencent Revenue (100 million yuan)

Chart 4:2016-2019Annual Tencent fee rate

Chart 5:2016-2019Annual Tencent gross margin

Chart 6:2016-2019Annual Tencent Net Profit (RMB 100 million)

Chart 7:2009-2019Facebook Operating income (US$ billion)

Chart 8:2009-2019FacebookProfit margin and expense rate

Chart 9:2009-2019Facebook Net profit

Chart 10:2010-2019FacebookRevenue split

Chart 11:FaceBookTencent product matrix

Chart 12: Tencent: With WeChat / QQTencent: To WeChat / QQ The two platforms are centered

Chart 13: Platform; Interest Tribes build a community of user interests

Chart 14:2016-2019Number of users of the company's social platform

Chart 15:2018-2020Tencent's active user size in the first quarter of the year

Chart 16: Tencent VideosMicroscopy

Chart 17:Facebookwatch & IGTV

Chart 18:2017-2020Three domestic online video MAU (Millions)

Chart 19:2017-2020Domestic short video MAU

Chart 20: Online social product matrix

Chart 21: Revenue Structure Split (2019Q4)

Chart 22:FacebookStreaming ads

Chart 23: The company's products complement each other

Chart 24:2018-2019FacebookIts products to heavy user size total

Chart 25:2014-2019U.S. Market APPThe share of downloads

Chart 26:FacebookCompete with Google in video streaming

Chart 27: The share of fintech revenue is gradually increasing

Chart 28: The gross margin of online advertising has improved significantly

Chart 29: Tencent Deferred Revenue (100 million yuan)

Chart 30: Peace Elite, King Glory Global Internal Purchase Revenue (millions of U.S. dollars)

Chart 31: Tencent Key Game 2020Year 3 Monthly domestic bestseller list ranking

Chart 32:DNFThe hand tour version is expected in 2020H1End online

Chart 33:2018-2019Annual Tencent government cloud orders of more than 100 million yuan

Chart 34: Tencent Cloud Enterprise Services

Chart 35: Cloud Computing: Fast growth, close to half the level of Ali

Chart 36:2018-2019Annual domestic cloud vendor revenue data (100 million yuan)

Chart 37:2019Domestic share of cloud computing in the year

Chart 38:2015-2019The size of third-party mobile payment transactions

Chart 39: Share of third-party mobile payment transaction size

Chart 40:2018-2020Tencent's online advertising revenue grew in the first quarter of the yearUnit: RMB million

Chart 41: WeChat social advertising products

Chart 42: Tencent APP and the business matrix

Chart 43: Tencent's vertical sector of out-of-country investment

Chart 44: Overall APP mid-MAU More than 500 the number of million and the number of WeChat programs

Chart 45: Tencent video data performance

Chart 46:2017-2019Year-on-year growth rate of Tencent's social advertising

Chart 47: Penetration rate of Internet users in all regions of the country

Chart 48:2018 Comparison of e-commerce user penetration rates in all regions of the world

Chart 49: Increased share of overseas game revenue

Chart 50:2015-2022Global regional market game revenue share structure

Chart 51: Basic calculation - general technology - application scenario

Chart 52:2018 Year 9 March 30 Tencent's adjusted organizational structure

Chart 53:AIThe smart cloud of the service

Chart 54: Tencent Cloud Solutions for Different Industries

Chart 55: Tencent's main AIThe time when the laboratory was set up

Chart 56: Tencent's three AILaboratory.

Chart 57: Tencent AILabFocus on four basic research and application exploration combined

Chart. 58: Tencent Youtu Lab research, scenarios, data integration

Chart 59: WeChat AI The team makes the product smarter

Chart 60: Tencent AI Experience Center, Tencent Listen to Smart Speakers and Tencent Translation Jun

Chart 61: Tencent technology robot DramwriterAuto-written press releases

Chart 62: The king honors the first intelligent robot

Chart 63: Time for mainstream social platforms at home and abroad to launch streaming ads

Chart 64:FacebookThe form of information flow advertising

Chart 65:FacebookAd revenue drivers split

Chart 66:FacebookTotal ad exposure

Chart 67:FacebookAverage ad price

Chart 68:FacebookTotal advertising revenue, total ad exposure, and average ad price growth year-on-year

Chart 69:FacebookThe product matrix

Chart 70:FacebookOptional ad targets

Chart 71:FacebookAd targeting dimensions

Chart 72:FacebookAd targeting selection

Chart 73: No PacingAd serving at the time of the algorithm (accelerated delivery)

Chart 74: No Pacing Ad serving at the time of the algorithm (underbidding)

Chart 75:PacingAd serving at the time of the algorithm (balanced state)

Chart 76:2017-2019FacebookIncome structure (millions of United States dollars)

Chart 77:2010-2019年Facebook ARPU Structure (USD)

Chart 78:InstagramstoriesProgress in commercialization

Chart 79:InstagramstoriesAd style

Chart 80:2018-2019Internet penetration in some countries

Chart 81:2017-2019Global ARPU(USD)

Chart 82:2010-2019Facebook Global MAU (Millions of people)

Chart 83:Facebook: E-commerce Payments are about to be commercialized

Chart 84:FacebookAbout marketplaceexpression

Chart 85: U.S. P2PThe size of the payment transaction

Chart 86: North American e-wallet penetration and mobile payment scale

Chart 87:Facebooksuffered from data privacy penalties

Chart 88:FacebookAR/VRStrategy.

Chart 89:OculusThe market share has steadily increased

Chart 90: Mainstream VRManufacturer's equipment shipments (millions)

Chart 91:OculusThe main way to make money

Chart 92:AR/VRThe main application direction

Chart 93: Average daily online time (min) for users of short video apps in China

Chart 94:VooVMeeting Global ranking

Chart 95: Changes in the type of advertising market in the United States

Chart 96:FacebookVideo feature Watch

Chart 97: North American advertiser channel strategy changes

Chart 98: North American advertiser delivery policy selection

Send to the author