How to borrow traditional media? Japan's tv advertising costs have risen sharply

On September 21st AppAnnie released its latest report, which said television advertising had become increasingly important as a channel for mobile game developers to acquire new and re-engage older users.

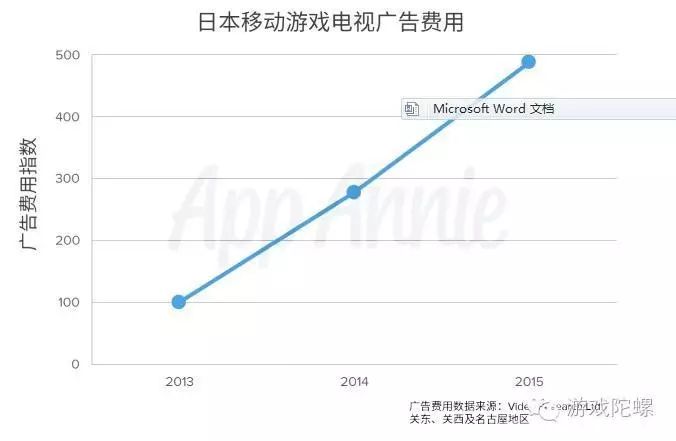

App Annie's data discovery through Video Research and Electric,Television advertising costs for mobile games in the Japanese market are growing steadily.From 2013 to 2015, TV ad costs for in-data games increased by nearly 70 percent, according to Video Research.

Since 2013, TV ads for mobile games in the Japanese market have become increasingly focused on older games, demonstrating the importance of attracting older users through this channel.

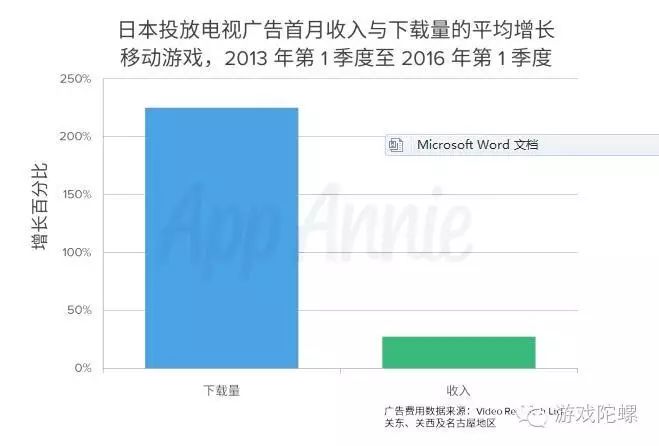

Generally speaking, the first month of mobile game TV advertising in the Japanese market,Downloads and revenue increased by about 225% and 25%, respectively, from the previous month.

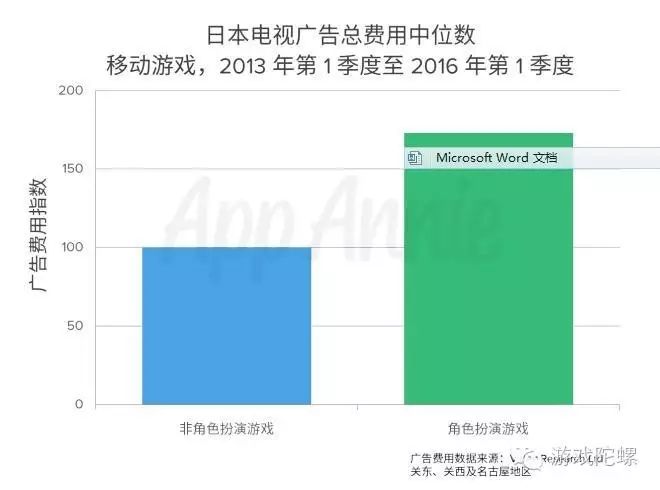

The median advertising cost of role-playing games (RPGs) is more than 1.75 times that of non-role-playing games, highlighting RPG's dominance in the Japanese market.

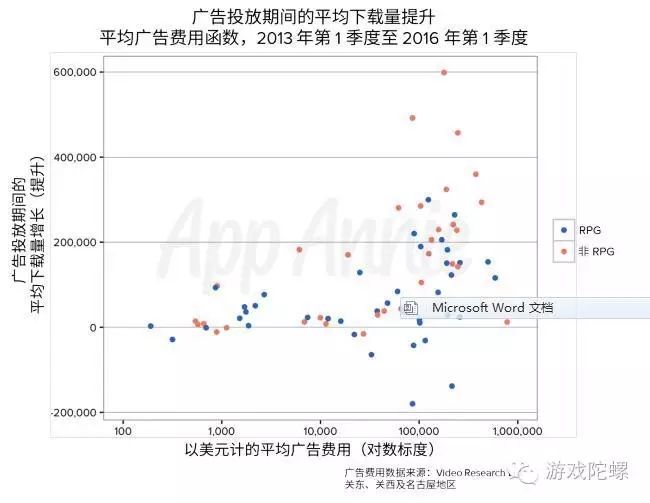

But in terms of downloads, TV ads seem to have a big boost for both RPG and non-RPG games. This means that TV ads leave a lot of opportunities for non-RPG games.

Here are the details of the report:

Market opportunities in Japan

Japan has always been one of the world's leading mobile gaming markets, and the iOS App Store and Google Play generate far more revenue than other countries. Such a brilliant achievement is due to Japan's long history of gaming. Japan has always been home to many of the world's game enthusiasts, creating a number of high-profile games, including Pac-Man, Mario and Pokémon. Of course, today's Japanese game culture has been completely transformed into mobile games. AppAnnie discusses in the Understanding the Japanese Mobile Game Market report that Japanese gamers tend to be more engaged and willing to pay for it than in other countries.

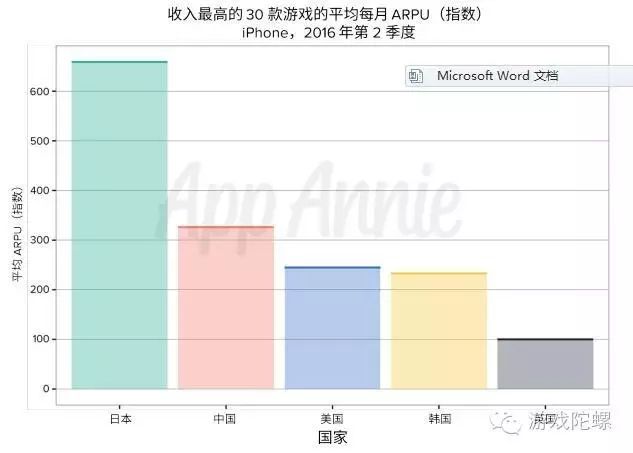

Moreover, the recent "Identifying the Best Target Market for Mobile Games" report also focuses on the Japanese mobile gaming market. In Q2 2016, Japan's top 30 best-selling games had a significant average revenue per user (ARPU) advantage over the 30 best-selling games in other major markets analyzed by App Annie.

Japan's best-selling game ARPU is ahead of other major markets

While the opportunities in the Japanese market are attractive, competition is also recognized as fierce, especially for foreign publishers: 90% of mobile gaming revenue in the Japanese market in 2015 was covered by local companies. The key for publishers to gain a place in this rewarding but challenging market is to build visibility and drive user acquisition.

With the rapid rise of the mobile side, it is easy to overlook one of Japan's most powerful user acquisition and visibility-building channels, television advertising. According to Telecom, television advertising has consistently accounted for 30% of Japan's advertising costs over the past 10 years, with some ace apps in the region achieving encouraging results. This report will be presented

App Annie Intelligence combines Video Research TV advertising expense data from Q1 2013 to Q1 2016 to cover three major regional markets in Japan (Kanton, Kansan, and Nagoya). App Annie analyzes tv ads for mobile games in Japan, including the increase in advertising costs, the categories involved, and the impact on downloads and revenue.

According to Video Research, mobile gaming advertising costs in the Japanese market exploded between 2013 and 2015

Japan's mobile game TV advertising costs are exploding

According to Video Research, TV advertising costs for mobile games in Japan continue to climb, increasing by nearly 70% from 2013 to 2015. The steady increase in costs shows that television advertising is still very effective as a user access channel.

Despite the high cost of a single installation in Japan and the difficulty of entering the market, video Research data show that foreign gaming companies have used television advertising to break into their own world. It has been observed that while advertising costs are still a major share of local companies, advertising spending by foreign gaming companies has also been increasing. According to Video Research, foreign gaming companies accounted for less than 4% of advertising in 2013 and more than 20% in 2015.

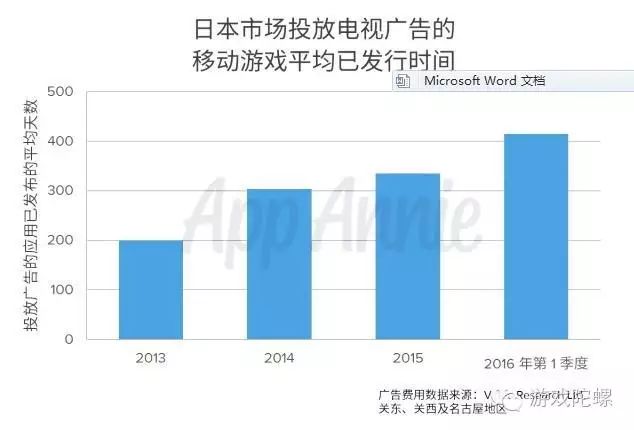

App Annie also analyzes the average release time of games that run ads on an annual basis, revealing a clear trend: Data show that the average release time for mobile games has steadily increased since 2013 when ads are available.

Since 2013, the release time of mobile games for television advertising in the Japanese market has been increasing.

This trend is a testament to the continued success of Japan's mobile gaming veterans. Classic old games such as "Puzzle and Dragons" and "Monster Strike" are still being promoted and are making huge revenues at the same time. Thus, TV advertising is not only suitable for new games to acquire users, but also more and more old applications to attract old users again.

TV ads can drive app downloads and revenue growth

To assess the impact of mobile game TV ads in Japan, App Annie compared downloads and revenue in the first month of ad launch with data from the previous month. Analysis shows that in the first month of advertising, both indicators tend to improve significantly. Although other channel advertising and power factors are not taken into account at the same time, this analysis can help to analyze the impact of TV advertising on Japanese games.

There was a significant increase on both fronts: revenue grew by about 25%, while the average percentage increase in downloads was much higher, reaching nearly 225%.

In general, mobile game downloads in Japan increased significantly in the first month of TV advertising.

Given the general pattern behind the application market, the differences between the two types of data are also expected. Download volume is the first key metric that user acquisition activity can affect. Over time, users' game participation has increased, and revenues have tended to rise. The 225% increase in downloads provides a solid foundation for future revenue growth. Moreover, the average 25% increase in first-month income is not to be underestimated in itself. This growth comes not only from newly acquired paid users, but also from older players who are re-playing with ads. In Japan, for example, there are often advertisements promoting special events in the game. Action class RPG "Monster Marble" uses this strategy to promote in-game activities, more than such advertising.

Focus on role-playing games

RPG advertising costs more than other types of games

As described in Understanding the Japanese Mobile Game Market, RPG is second to none in the Japanese mobile gaming market and is often more profitable than other game types. In addition to being outstanding in terms of single user usage and length of time, Japan RPG also has a higher ARPU than other categories. Behind this performance is the long RPG tradition in the Japanese market. Famous hosts of RPG series such as Final Fantasy, Dragon Quest and Monster HunterMobile RPGs such as Monster Hunter, as well as The White Cat Project and Gran Blue Fantasy, originated in Japan.

Japanese RPGs tend to spend more on TV ads than other games

App Annie's analysis of Telecom's TV advertising data shows that RPG has an overall advantage in Japan's mobile gaming market. App Annie found that, based on the data, the median tv advertising cost for RPG (by electricity classification) was 75% higher than the non-RPG median, roughly the same as the median income ratio for both RPG and non-RPG.

Both RPG and non-RPG games can benefit from TV advertising.

App Annie also analyzed the average effectiveness of TV ads to determine if there was a difference between the effect values of RPG and non-RPG advertising costs. To do this, App Annie calculated the average difference in downloads for each game in the months before and after the ad was available, and plotted the average "boost value" against the average ad cost for each game (during the months of ad run) to determine if there was a difference in ad effectiveness between RPG and non-RPG games.

Studies have shown that there is a clear positive correlation between the average increase in downloads and the average ad cost, whether non-RPG or RPG. In other words, games with higher advertising costs tend to experience significant changes in downloads during ad periods. This approach is not perfect because advertising that is also invested in other channels can be an uncalculated growth variable. But this apparent relationship suggests that there will be a significant increase in the number of months in which more ads are placed than in months when no ads are running.

The higher the average ad cost, the greater the gap in average downloads between the months in which ads are run and the months in which they are not.

The higher the average ad cost, the greater the gap in average downloads between the months in which ads are run and the months in which they are not.

Despite the high median TV advertising costs in the Japanese market, there is a similar relationship between advertising costs and increased downloads, whether RPG or non-RPG. In fact, in the Japanese market, non-RPG downloads seem to be more sensitive to TV advertising costs than RPG, considering that the most important thing for non-RPG is to acquire new users, and RPG's key is to attract older users. Of course, this result needs to be validated with more in-depth analysis. This data at least shows that non-RPG is not much different from RPG in terms of benefiting from TELEVISION advertising.

As mentioned above, given that RPG has a relatively large number of TV ads available, TV advertising is a great opportunity for non-RPG publishers who want to delve deeper into the Japanese market.

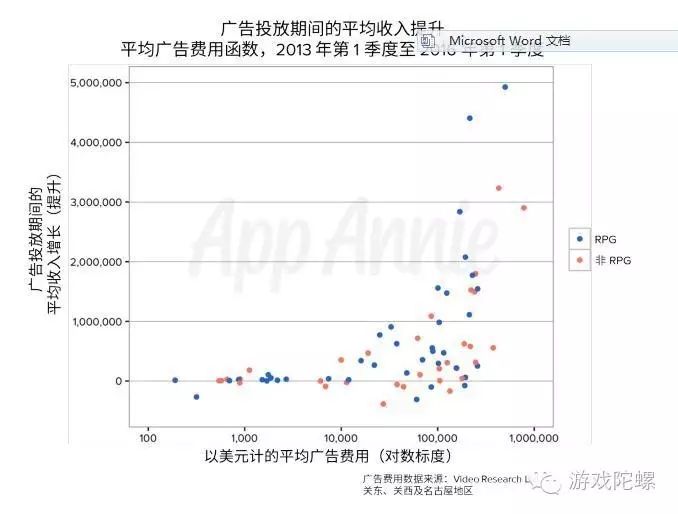

During ad serving, there is also a positive correlation between average ad spend and average revenue growth. The more you spend on advertising, especially if you spend more than $10,000 a month, the greater the increase in game revenue during the ad period.

It has been observed that, as with downloads, there is a positive correlation between average revenue increases and average advertising costs.

It has been observed that, as with downloads, there is a positive correlation between average revenue increases and average advertising costs.

Conclusion

As the market with the highest revenue from the iOS App Store and Google Play, Japan plays an important role in the overall mobile app economy. Japan's mobile game TV advertising costs have soared, underscoring the channel's growing importance in acquiring new and attracting older users. The average download volume and revenue of mobile games increased significantly in the first month of advertising, which is strongly supported by this. Although RPG's median total TV advertising costs in japan's mobile gaming market are higher than in other categories, App Annie analysis shows that non-RPG, like RPG, can get value from TV ads. This suggests that non-RPG has more opportunities to benefit from the increasing cost of television advertising in the Japanese market.

WeChat ID: vrtuoluo

WeChat ID: vrtuoluo Press and hold the QR code on the left to focus

Press and hold the QR code on the left to focus

Go to "Discovery" - "Take a look" browse "Friends are watching"