Baby elephant mutual entertainment, goose culture, game MCN head mergers and acquisitions, industry development opened a new article.

Head acquisitions happened again, this time in the game MCN field.In August 2012, Youku and Tudou merged into Youku Tudou Co., Ltd. in a 100% share swap, and the combined Youku Tudou monthly user size exceeded 400 million, meaning that Chinese was a third of Youku Tudou's users at the time. In November 2015, Alibaba Group and Youku Tudou Group announced that they had signed a merger agreement to acquire Youku Tudou shares in an all-cash deal expected to total more than $4.5 billion.In August 2016, Drop, which accounts for the largest number of orders in China's online car market, announced a merger with Uber China. The combined company is understood to be valued at $35 billion, and after a strategic agreement was reached, DT Travel and Uber globally held stakes in each other and became minority shareholders. After the merger with Uber, which accounted for more than 80 percent of the total market share in China, it was easy to ask china's Ministry of Commerce's Antitrust Bureau for an investigation shortly after the merger.In March 2020, China's two major games MCN enterprises, Baby Elephant Entertainment and Big Goose Culture, officially announced the merger. Under the merger agreement, the two will jointly set up Shenzhen Xiaoxiang Big Goose Culture Co., Ltd., the former founder of Xiaoxiang Mutual Entertainment Du Yuyu will serve as ceo of the new company. According to relevant media reports, Baby Elephant Mutual Entertainment expects the company's full-year 2019 revenue of more than 1 billion yuan, while Big Goose Culture expects full-year revenue of more than 500 million yuan.Eight years ago, the Uber merger kicked off a new war on video sites, and four years ago, the Uber merger ended the sharing economy war in the automotive sector. Another 4 years, the opportunity of head mergers and acquisitions came to the game MCN this emerging industry, is to end the old war or start a new war, we do not know, but it is certain that the head merger and acquisition to promote the Chinese game MCN ushered in the industry maturity period, the scale effect will make the head game MCN development break through the next stage.Oligarchs.The revenue model behind the pattern is in trouble

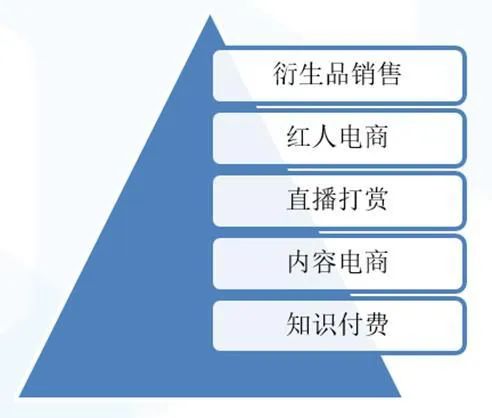

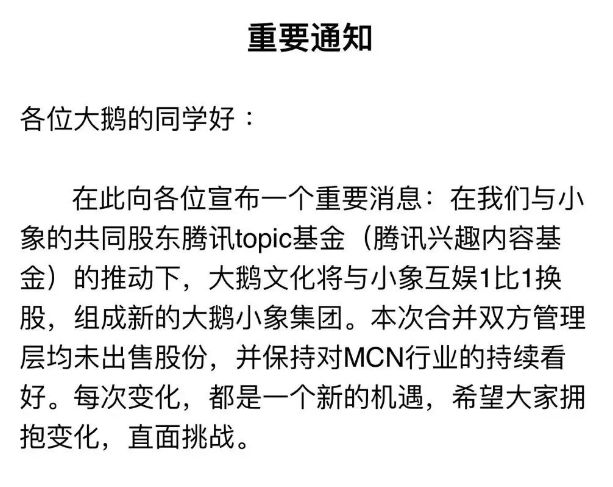

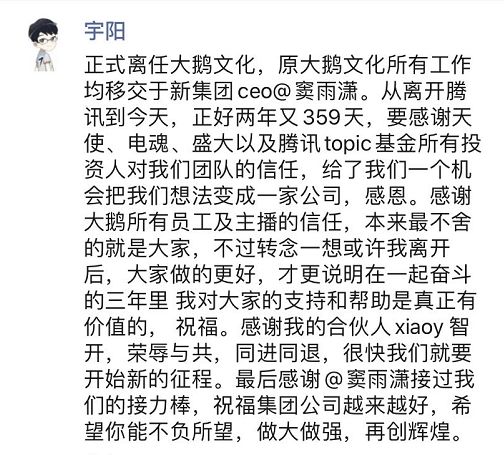

The resources of the live market are exclusive, and the merger of the heads of the little elephant geese will seek more development resources in the face of increased oligarchy.In the past, the development of Chinese game MCN industry is oligarchy trend, the head mechanism and the bottom mechanism in the resource gap is large, and can stabilize in the middle waist position of MCN is not much. According to the 2019 China MCN Industry Research White Paper, the number of MCN institutions in China will reach 6,500 in 2019. According to incomplete statistics, it is expected that by 2020, China's live game and game MCN market size will exceed 40 billion yuan. But at the same time, the white paper notes that as of December 2018, only 6% of MCN institutions had revenues of more than $100 million.In the battleground of the game MCN, resources such as head IP content, KOL, etc. are always limited. Baby elephant entertainment and goose culture have absorbed the vast majority of well-known anchors in the industry. Not only the brokerage model, in recent years, more and more head anchors in partnership to join the game MCN, such as the former electric campaigner PDD, leading the small elephant entertainment 125 million A-turn investment.As head MCN embarks on more video games for KOL, popular anchors are happy to embrace the development. At present, the revenue of the popular tv competition anchor mainly comes from the live broadcast reward, the user's payment habit is not good to cultivate, it is difficult to cause long-term stable output. By becoming a partner and gaining equity, entering the MCN field, it can make people angry and expand their revenue model, making their career planning more stable.McN Institutional C end of the main profit modelFor game MCN, the partner's stake marks a portion of the company's revenue figures for these head anchors. McN's own profit margins are relatively low. Head anchor's revenue is incorporated directly into the company's revenue data, which makes the financial statements look better in numbers. In addition to the reward share, there is the use of KOL as a product promotion and other revenue models, however, the upstream area of the e-game oligarchy is far more serious than the MCN field, with huge resources of the head of the number of customers will not be too many.With more resources in the field of e-sports is Tencent, baby elephant mutual entertainment and goose culture in the previous round of financing is not short of Tencent's figure. Tencent's Interest Content Fund (TOPIC Fund) made its first investments in baby elephant entertainment and goose culture in April 2018 and November 2019, respectively.The current situation of the game MCN faces a special situation: in the downstream, the host needs to seek resources to develop, the revenue model is still not mature; MCN as the connection between the two points, is also in this not down, said maturity is not immature is not the position.In recent years, Tencent's integration of the live streaming industry news has come out, Tencent's capital layout fish, tiger teeth, fast hand, B station, last September also media said Tencent IEG will start to integrate tiger teeth, fighting fish, penguin e-race three. The battle for the live platform is still in the knockout stages, but the game MCN is close to the grand final, the final whistle, blown by Tencent.Multi -.Interwoven Game of ThronesIn an internal letter to Big Goose Culture, CEO Wang Yuyang said: "With the promotion of our co-shareholder Tencent TOPIC Fund, Big Goose Culture will exchange 1:1 shares with Little Elephant", "Neither management of the merger has sold shares and remains optimistic about the MCN industry." "Two elements. That is to say, the focus of the merger: Tencent as the main pusher, baby elephant goose head after the merger of the status of e.g.However, according to some sources, the merger will be dominated by the small elephant, by the eyes of the sky to understand that the merger of the small elephant goose shareholder information is only small elephant entertainment CEO Du Yuyu one person. Wang Yuyang, CEO of Big Goose Culture, who had previously sent an internal letter, announced his departure from Big Goose Culture in a circle of friends shortly afterwards, and said that all the work of the original Big Goose Culture was handed over to Xiaoxiang CEO Du Yuxuan.It is reported that wang Yuyang, who left The Goose, has decided to join Station B, which itself is one of Tencent's capital layouts. Left the goose, also did not walk out of Tencent's five-finger mountain. It is expected that in the future Wang Yuyang will form a special competitive relationship with the baby elephant geese, but this competition will still be digested by Tencent, is a new journey, but with the MCN competition nature of the Goose period has not changed much.Previously, The Goose Culture has experienced a number of financing processes since 17 years, including E-Soul, Shanda and Tencent. Wang Yuyang owns 17.47 percent of the shares. In the name of Dou Yuyu, only on the Shenzhen Xiaoxiang Mutual Entertainment Culture and Entertainment Co., Ltd., Dou Yuyu owns 49.78 percent.In this case, the Baby Elephant Side will undoubtedly dominate, and the stake in the Big Goose Side start-up team will be further diluted in the merger. From The Goose's point of view, Tencent, led by the TOPIC Fund, has choked the Goose's throat, but little elephant mutual entertainment in the face of this merger still retains the strength. Back in that internal letter, the TOPIC fund led the way.By rewarding revenue, the game broadcast platform and the game MCN eat the same bowl of rice, but the same Tencent, IEG and TOPIC fund is not the same table of people. As mentioned above, last year it was reported that Tencent was considering integrating tiger teeth, fish fighting, penguin e-race three, when the main pusher mentioned is IEG. However, TOPIC fund does not belong to the IEG department, from its public investment events, is indeed "interest content"-based, did not set off a huge wave in the value of the content of the project.TOPIC Fund Public Investment EventsCompared with these projects in the past, this leading small elephant goose head acquisition, in terms of value will become the TOPIC fund in the three years since the creation of one of the huge projects. It is reported that the stage goal of the baby elephant goose will be to go to the United States listing, which will also become an important performance of TOPIC.Content support is the field of DEEP cultivation of TOPIC fund, the head acquisition of small elephant geese is good for the formation of scale effect, integration of resources to reduce costs. TOPIC wants to use the snowballs that the two balls of together to roll over valuations and take them to the fast lane to achieve a new level of higher profitability.If the IPO is successful, Little Elephant Goose will become the first Chinese game MCN to list in the United States. Last year, the e-commerce sector such as Han Holdings has been successful. If you can build the gaming world, the TOPIC Fund will write down the first credit.underOne such as a han? Or a new self?

Last April, Chinese e-commerce company MCN Ruhan Holdings listed on NASDAQ. The model is deep vertical: in the past only sell their own brand of clothing, in recent years also tried to help other merchants bring goods. In expanding the scale of net red at the same time, the integration of e-commerce industry chain, expand more cashing channels. Adjusted earnings for the third quarter of fiscal 2020 were -21.6 million yuan, 2.48 million yuan and 21 million yuan, respectively. Turning a profit shows that the development of enterprises is in good shape.In the gaming MCN field, there are very few listed companies in the United States. In 2007, Youtube launched a partner program that provides advertising and video subscription revenue to good content creators, with a 45% revenue stream. Content creators have re-established professional MCN institutions recognized by Youtube, which charge about 40 per cent of Youtube's first draw.Maker Studios, which Disney bought for $500 million in 2014, is a well-known overseas MCN, with more than 100 million subscribers and PewDiePie as its signed anchor. Maker Studio was eventually disbanded and restructured by Disney in 2017, and in Disney's view, Maker Studio has a single revenue channel and a lack of branding.Revenue channels are also an important issue for The Big Goose IPO to pay attention to. Unlike the e-commerce MCN advertising effect of the belt mode, the game MCN to star anchor's reward income accounted for a huge proportion of the traditional concept of Europe and the United States game anchors to subscription fees and membership fees, TOPIC and baby elephant goose how to convince European and American investors its model is sustainable?Two weeks ago, Doodle was investigated by three U.S. law firms for low stock prices. Whether China's live game model can be understood by European and American investors still needs to be a huge question mark. The ancients had cloud lips and teeth cold, although far less than the degree of death, small elephant geese may also face fish-fighting embarrassment, need to do a good job of warning.In any case, the combined little elephant goose will be china's game MCN undoubtedly the leader, its experience in the United States will also show the game MCN in the eyes of investors the real value positioning, when the specific profitability of the small elephant goose will also be revealed by the prospectose. TOPIC funds and other management, baby elephant goose itself, whether the two can lift China's MCN to the next peak, it is also worth looking forward to.Through head mergers and acquisitions, the Chinese game MCN realized its own shuffle, in the opening of a new stage in the industry at the same time, the oligarchy pattern is bound to be more intensified, but there has been a narrow revenue model, too dependent on unstable live broadcast reward model also urgently need to be resolved. Will the baby elephant goose, which is being held back by Tencent as the first multi-stakeholder, hit NASDAQ in an unfinished state?In terms of a series of stock price events in the past, the author is not optimistic about the current baby elephant goose to the United States listing. Especially in the impact of the outbreak, U.S. stocks triggered a fuse many times, I am afraid the economic decline will continue for a long time. Ending the industry's old war, opening a new chapter in the market, Game of Thrones is nearing dust, and everyone left behind should fight for the construction of the head game MCN.

I'm looking for gyro race:

Business Cooperation/Interviews/Drafts:Contribution email:18222595920@163.comLive platform for 2019I don't knowLPL onlineI don't knowSino-foreign ion competition outbreak response

Go to "Discovery" - "Take a look" browse "Friends are watching"