A-share flavoring industry advertising-es promoted growth: 20% increase in advertising costs in the first half of the year revenue increased by 15%

Text . . Dig the bay net Zhang Dou

As a member of the food industry, the condiment market can not be underestimated, in 2018, China's fermentation flavoring industry size of about 340 billion yuan. Leading enterprise Haitian Taste Industry (603288) by selling soy sauce, the market value of nearly 300 billion, more than Ping An Bank (000001), China Unicom (600050) and other large enterprises A-share total market value.

In the first half of the year, A-share flavoring industry to increase the intensity of advertising to promote performance growth, advertising costs increased by 20% YoY, the industry's total revenue increased by 15%, the total profit increased by 26%.

All 11 companies are profitable

China's condiment industry, "oil, salt, sauce, vinegar, etc." is the most basic rigid demand for food and clothing, condiment industry rich in variety, development and stability.

A-share 11 flavoring enterprises, is the best in the flavoring sub-sector. In the first half of the year, the overall performance of 11 enterprises performed well, with revenue of 17.6 billion yuan and home-made profit of 3.8 billion yuan, up 15% and 26% year-on-year, respectively.

In terms of their respective performance, 11 companies were profitable, of which 8 saw positive year-on-year profit growth.

Haitian taste industry performance is the first, operating income of 10.2 billion yuan, home net profit of 2.8 billion yuan, more than the size of the remaining 10 enterprises.

Advertising for growth

In the first half of the year, advertising for flavoring enterprise performance growth can not be ignored.

Data show that from January to June, 11 enterprises 438 million yuan in advertising costs, compared with 366 million yuan in the same period last year, an increase of 20%. With the exception of a slight decrease in advertising costs at Zhongju Gaoxin (600872), the remaining 10 companies all increased.

The largest advertising investment is the performance of the largest sea taste industry, the first half of the year, the company spent 344 million yuan on advertising, up 17% year-on-year. In the China Daily, Haitian taste industry said that this year continued to focus on media head resources, brand communication, and with the development of new media, increased investment in new media.

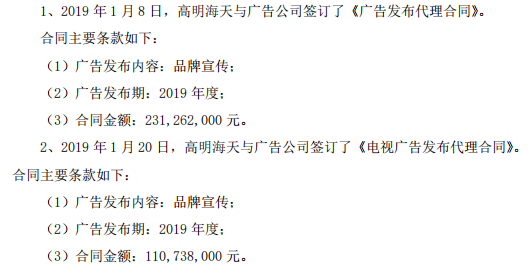

(Sea taste industry in the first half of the advertising contract signing overview)

The second-highst advertising service was Chiyu (603027), which spent 19.49 million yuan in the first half of the year, up 44% year-on-year. The company said that the first half of the air media, ground media, mobile terminal media, store publicity and other ways to combine marketing, with high frequency, scene-style characteristics, high-end product increments are obvious.

Strengthen repayments to improve cash flow

While the company's performance grew steadily, the first half of the repayment capacity was generally strengthened and cash flow improved. The turnover rate of accounts receivable of 7 companies increased year-on-year, the balance of accounts receivable and notes receivable decreased in 6 companies, and the operating net cash flow of 6 companies increased. Among them, cfOs have a great job to do.

In order to evaluate the practice level of CFO of listed companies, since January this year, the company has developed a comprehensive evaluation system for senior executives of A-share listed companies, and made an objective evaluation of the professional ability of more than 3,600 CFOs.

Dig Bay network noted that the objective evaluation score of more than 80 CFO enterprises, the first half of the repayment capacity outstanding. For example, Liu Xin, finance director of Hengshun Vinegar Industry (600305), scored 81.3. The turnover rate of the Company's notes receivable and accounts receivable increased to 7.22 transactions this year from 6.76 in the first half of last year. The balance of accounts receivable and notes receivable decreased by nearly one million.

Introduction to the Outstanding CFO Selection Event:

Among all the executives of listed companies, the CFO has a special position in listed companies, he must participate in the formulation of the strategic objectives of listed companies, must have a full understanding of the strategic tasks established by the top management of listed companies, in how to turn strategic tasks into strategic objectives must put forward their own professional advice for the top management for reference. CFO is a key figure in mastering the distribution and flow of funds throughout the company, and this position influences the sustainability of the entire listed company. It can be said that CFOs play an irreplaceable role in listed companies.

Based on this, the company began to develop the CFO Comprehensive Evaluation System for A-share listed companies in January 2019. The comprehensive evaluation system consists of two parts: objective evaluation and subjective evaluation.

In the objective evaluation section, 5 first-level indicators and 20 secondary indicators were set. At present, the average age of CFOs of listed companies is 46.73 years old, with an average annual salary of 655.7 million yuan and an average objective score of 76.41 points.

Voting, which affects subjective scores, is currently under way until 30 September.

In October, the net will calculate the final CFO score based on a weighted average of objective evaluation scores and subjective scores. According to the comprehensive score and industry division, selected the A-share listed companies outstanding CFOTop100 and 28 industry outstanding CFOs, and awarded honorary awards to the outstanding.

Come and cast a valuable vote for your favorite CFO!

- END -

This article is the original "Dug Bay Net"

Please indicate the source of the reprint

Go to "Discovery" - "Take a look" browse "Friends are watching"