2020 Asia Pacific e-commerce recovery path

The global outbreak has changed the way consumers shop and introduced e-commerce to many people around the world. To be successful in the Asia Pacific region, brands must first understand how best to reach and engage consumers in the region.

This article reveals key insights and regional differences between consumers in the Asia Pacific region, including actionable strategies to help drive growth in eight countries.

Key considerations for brands wishing to succeed in the Asia Pacific region include:

During the COVID-19 outbreak, the use of services such as food and grocery distribution, "pick-up in stores online" and video-on-demand (VOD) increased significantly, and these habits will continue to exist.

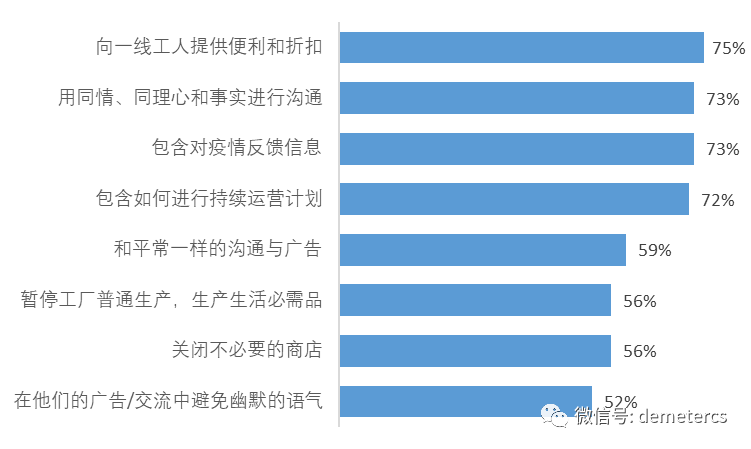

On average, three-quarters of consumers agree that brands should provide benefits to front-line health workers, while 73 percent prefer retailers to provide information about how they respond to COVID-19 and communicate with compassion and empathy.

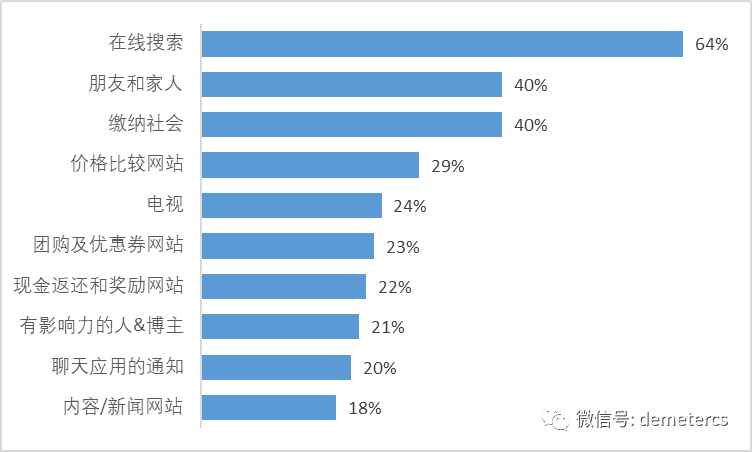

64% of Consumers in Asia Pacific find new brands through online search, followed by paid socializing and referrals from friends and family. Influencers and bloggers also play an important role in the discovery of new products.

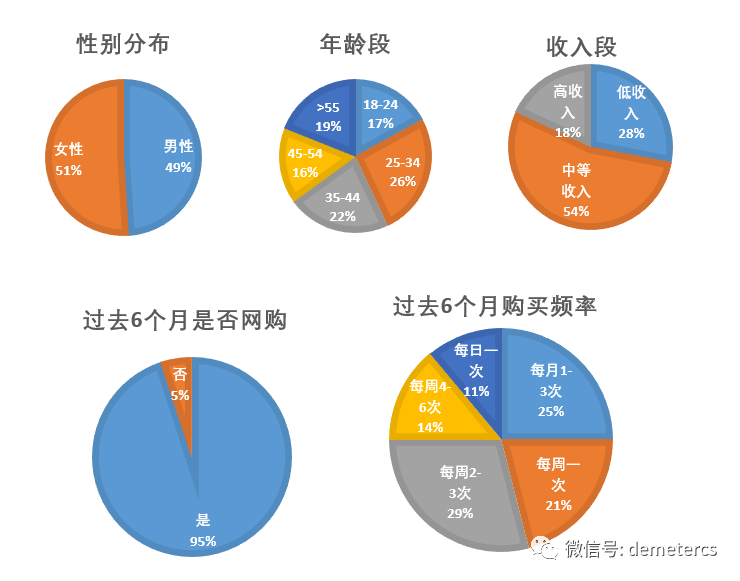

Based on a 5,000-person Asia Pacific population questionnaire, the survey includes: China (Hong Kong, Taiwan), Japan, Korea, India, Singapore, Malaysia, Australia, New Zealand. The population distribution is as follows:

China: A growing Chinese mainland consumer prefers to buy internationally branded skincare products, while Hong Kong consumers prefer to discover new brands through paid social platforms, and Taiwanese consumers often use door-to-door pick-ups during shopping

Japan: Japanese consumers are more likely to choose shopping sites based on product type

South Korea: South Korean consumers spend 50% more on fashion than Asia-Pacific average

India: Forty-three percent of Indian consumers follow influential people who they think are important in discovering new products

Singapore: Many Singaporeans say high shipping costs are a major obstacle to online shopping

Malaysia: Malaysian consumers plan to increase travel spending over the next 12 months

Australia: Australian consumers are more likely to support local brands

New Zealand: Many New Zealand consumers find new retailers through online searches

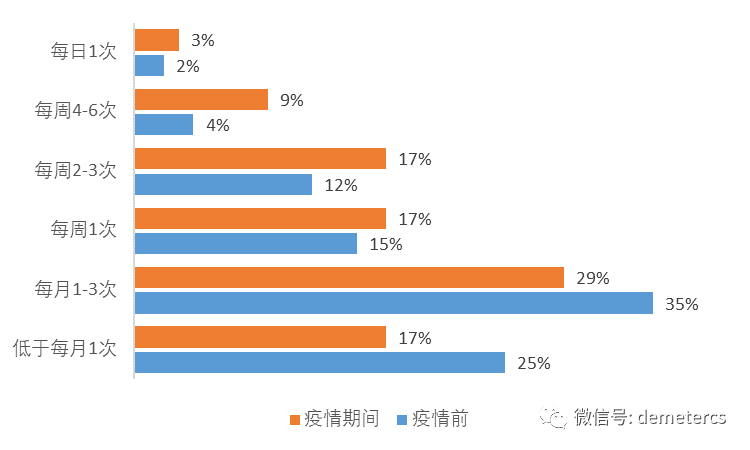

There is no doubt that the outbreak has changed the way consumers shop, with online shopping up 14 per cent during the closure period.

Figure 1: Frequency of online shopping during the pre-epidemic vs outbreak

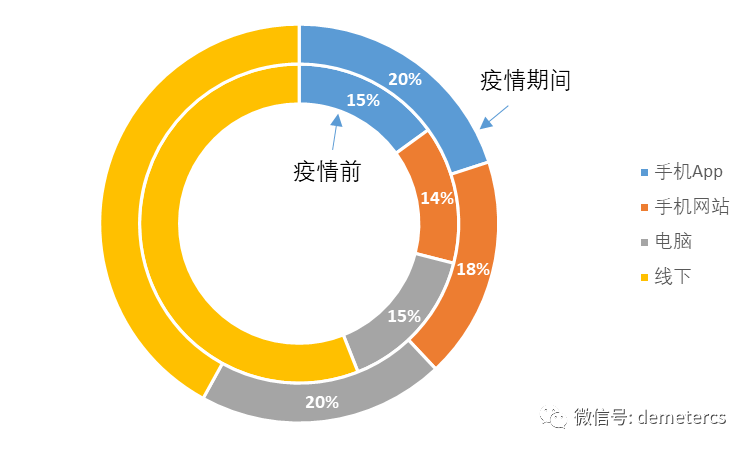

Figure 2: Percentage distribution of online shopping during the pre-epidemic vs outbreak

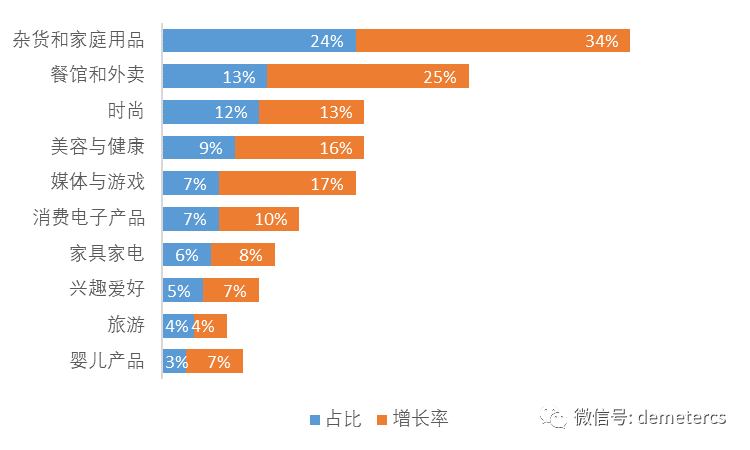

Groceries and household goods account for 24 per cent of online consumption.

Over the past year, interest in buying groceries and household goods online has soared, followed by meals and takeaways, and consumers have increased their online spending on media and games.

Figure 3: Percentage of online consumption per category and growth rate during the blockade period

New Zealand consumers spend a third of their time on groceries and household goods, Singapore consumers spend 48 per cent on groceries and household goods, Singapore and Hong Kong spend 20 per cent of their online shopping on restaurants and takeaways, South Korean consumers spend 18 per cent on fashion, Chinese consumers enjoy their days at home, spending more than 25 per cent on media and games, and a quarter of Indians are concerned about their health and spending significantly more on beauty and health products.

During the outbreak of neo-crown pneumonia, the use of services such as video-on-demand, grocery delivery and "online pick-up" increased, and these habits, old and new, will continue to exist.

On average, three-quarters of consumers agree that brands should provide benefits to front-line health workers, while 73% prefer retailers to communicate in a sense of mind.

Figure 4: What Asia-Pacific consumers think brands should do

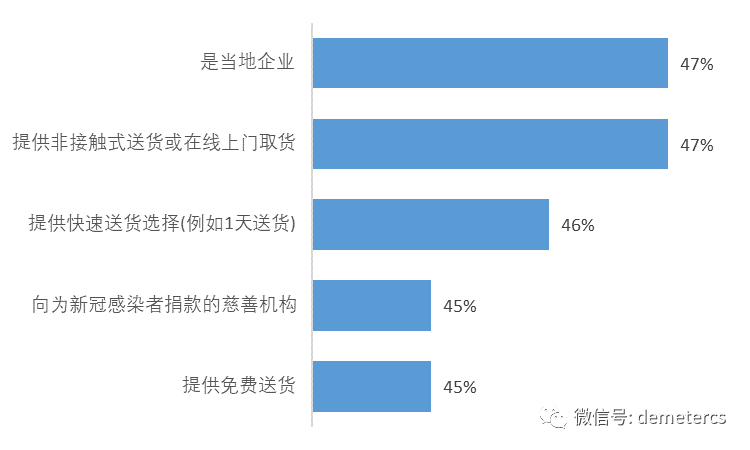

Figure 5: Asia Pacific consumers may support the following brands

Sixty-four percent of Consumers in Asia Pacific use online search to find that, in addition to online search, paid social and family recommendations are the main ways for consumers in the region to find new retailers.

Figure 6: Asia-Pacific consumers are discovering new retailers through the following channels

72% of Malaysian and New Zealand users search for new retailers, 53% of Indians and 51% of Singaporeans access new brand information through paid social media, 33% Chinese discover new e-commerce through influential people and bloggers, while only 8% of Australians use the channel

More than half of consumers interact with brands through social media

Figure 7: Social media usage by consumers in Asia Pacific

China: 37 per cent of mainland users use Weibo, 50 per cent use WeChat, 23 per cent use TEXT, 41 per cent of Hong Kong users use Facebook, 35 per cent of Hong Kong users use Instagram, 41 per cent of Taiwanese users use Facebook, 37 per cent of Taiwanese users use Line and 25 per cent of Taiwanese users use SMS

Japan: 18% of Japanese users use e-mail

South Korea: 20% of Korean users use Kakao

India: 53% of Indian users use Facebook, 58% of Indian users use YouTube, 39% of Indian users use Instagram and 34% of Indian users use apps

Singapore: 38% of Singaporean users use the app

Malaysia: 42% of Malaysian users use Facebook and 42% of Malaysian users use Instagram

Australia: 31% of Australian users use email

New Zealand: 35% of Australian users use email

E-mail remains an important channel of communication. Receiving coupons, promotional updates, and product news is the number one reason consumers choose to subscribe to a brand.

72% of Asia Pacific consumers follow influential people

Influential people and bloggers play an important role in the discovery of new products, particularly in India, China and Malaysia.

66% of consumers in the Asia Pacific region shop in international stores

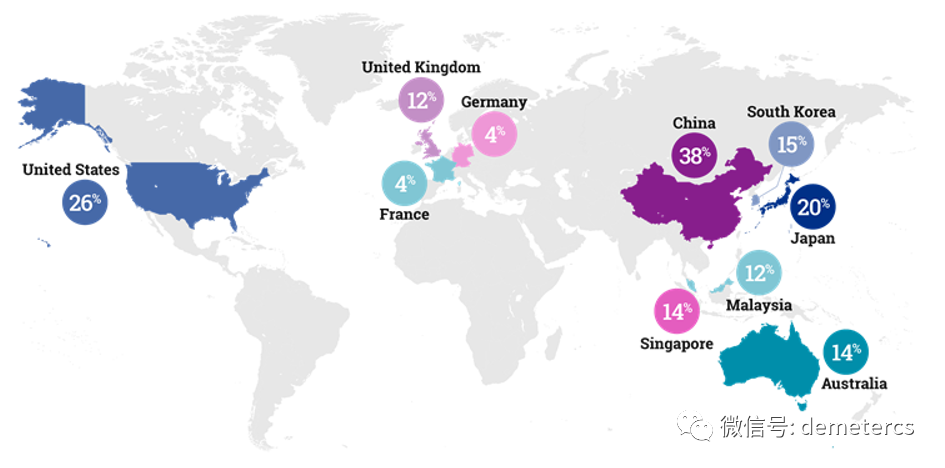

Thirty-eight percent of those who shop overseas prefer to shop at Chinese retailers, followed by the United States, Japan and South Korea.

Figure 8: Shopping in overseas malls

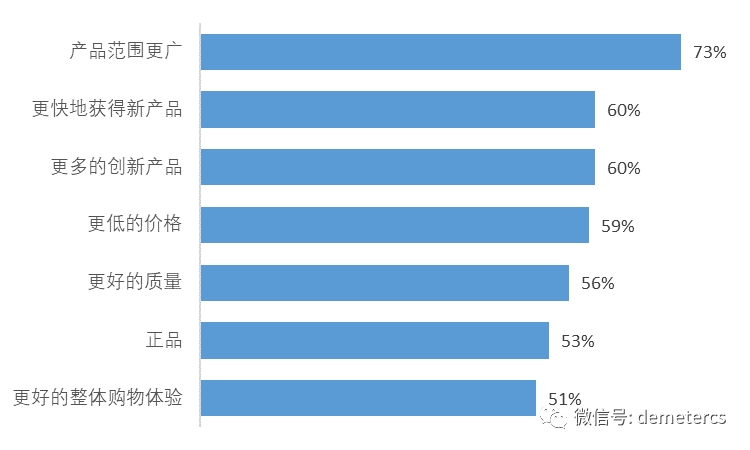

Reasons why consumers in the Asia Pacific region are buying overseas products

Most consumers in the Asia Pacific region choose to shop on international websites because it offers a wider range of options and faster access to new products.

Figure 9: Why Asia-Pacific consumers prefer international websites

Eighty-seven per cent of Malays and 84 per cent of Indians prefer international shopping because of the wider range of products, 78 per cent of Chinese consumers believe that international retailers can offer more authentic and authentic products, and 52 per cent of Australians and 66 per cent of New Zealanders buy lower-priced goods in international stores.

China.

92% of Chinese mainland consumers follow influential people. For brands, it is important to leverage alliance channels and work closely with content publishers to provide customers with detailed information such as best-selling products, inventory levels, and new product releases. Launch a green promotion strategy and make sure that this is available to publishers for promotion.

WeChat is the social networking and communications app of half of Chinese consumers, so it may be useful to consider local platforms in social strategies.

Hong Kong, China

Forty-four per cent of Hong Kong consumers find new brands through social media advertising and advise retailers to launch paid social programs to reach new customers effectively. Implement a "never-stop" strategy to increase brand awareness and provide information about product scope and availability.

More than a third of Hong Kong consumers interact with brands through Facebook and Instagram, followed by YouTube (29%) and email (24%). In addition to Facebook and Instagram, brands could consider implementing a promotional strategy on YouTube to attract more viewers.

Retailers could also consider working with affiliate publishers, which offer paid newsletters to reach readers who prefer to work with brands via email.

Taiwan, China

With 25% of Taiwanese consumers finding new brands through cashback and reward sites and increased mobile use, it is critical that retailers implement app tracking to ensure the best shopping experience for consumers.

Brands should consider investing in fixed-fee advertising or CPA activities through affiliated channels to increase brand exposure while maintaining profit margins.

In addition, 37% of Taiwanese consumers prefer to deal with brands through the messaging and social media platform LINE. Brands are advised to work with publishers who have the ability to reach consumers through these local channels to maximize their presence in the region.

Japan

Since most Japanese shoppers choose to buy a wider range of goods or products globally, brands should share their products with a subsidiary network so that publishers can get the latest information on product prices and availability.

57% of Japanese consumers use search to discover new brands. Retailers should consider implementing a paid text search campaign and focus on testing different copies of ads.Effectively demonstrate product diversity. Brands should also expand their shopping activities to further enhance the product search experience and ensure that all specialty products are available.

Korea.

South Korean shoppers are smart and always looking for the best deal, with 52% choosing to shop on international websites because they offer lower price points.

Brands with affiliate plans should consider giving gifts to top publisher partners to promote sales in the region.

In addition, retailers can engage consumers as they research new products and trends by running paid search ads on Naver, South Korea's most used search and content platform.

India.

More than half of Indian consumers learn about the new online store through paid social networking, and 53 percent say they prefer to interact with brands through Facebook.

Activating an ongoing paid social event can help brands get new customers. Ideally, paid social advertising should show your brand information to consumers unfamiliar with your product or service, and show top products and benefits to existing customers.

In addition, it is recommended to use audience targeting to reach consumers through personalized and highly relevant ideas and, where possible, to highlight new products and promotions.

With 58 per cent of Indians contacting brands through YouTube and 69 per cent searching for new brands, retailers could consider introducing YouTube keyword strategies and other performance channels.

Singapore.

More than half of Singaporean customers find new online stores through paid social events. Brands should consider launching a pay-per-view social event that is always online to appeal to consumers, especially on platforms such as Facebook and Instagram.

Social ads should include information about retailers to help identify brands and, where possible, show delivery times.

To complement our social activities, we recommend a paid search program to help reach customers after brand discovery and research.

Retailers should also consider partnerships with cashback publishers. Invest in cost-per-acquisition (CPA) activities to increase brand awareness and maintain positive margins.

Malaysia.

Nearly a third of Malaysian consumers know new retailers through bloggers and influencer figures, with 25 per cent saying influencer played an important role in discovering new products.

To acquire these customers, brands should consider implementing a multi-touch delegation strategy in their affiliate programs to effectively reward content publishers and strengthen their partnerships.

In addition, brands have access to highly engaged cashback shoppers, while combining commissions with business objectives through dynamic delegation.

Dynamic delegation allows brands to delegate differently based on business objectives, such as new customers, existing customers, or specific products. This allows publishers to gain a deeper understanding of what is important to a brand and adjust their marketing campaigns accordingly.

Australia.

Sixty-seven per cent of Australians use search to find new retailers. Brands may consider launching an always-on search program that includes generic keywords and customized ads to highlight product categories, inventory, and availability. This ensures that retailers remain the most important in the minds of customers, especially as they discover new retailers and searches may increase.

In addition, brands should implement a diverse alliance strategy to reach highly engaged audiences by working with cashback, incentive publishers, and coupon publishers. Use these partnerships to provide free shipping to a larger user base.

New Zealand.

Search will become increasingly important in New Zealand, with 72 per cent of consumers searching through the channel to discover new brands. Retailers may consider upgrading their paid search strategies to stay ahead of their competitors.

Analyze and identify the most effective types of activities and direct investments to those activities.

In addition to search, brands are advised to launch paid social projects, especially facebook and Instagram, to attract new consumers. Using the "never-out-of-time" strategy, combined with timely promotions, can help brands show up in front of new customers.

Trading and coupon sites are becoming more and more popular.

In New Zealand. When running a subsidiary program, it is important to include trading and coupon issuers in their publisher portfolio to capture these savvy viewers.

While consumers in the Asia-Pacific region have changed their shopping habits to accommodate life in confinement, these new behaviors will continue.

As e-commerce blurs international boundaries, it's more important than ever for brands to adjust their marketing strategies for each region and reach consumers effectively through the right channels.

Strategic changes that can be made today include:

Recognize and respond to COVID-19, provide benefits to front-line workers, and communicate with consumers with compassion and empathy

Expand your affiliate program by diversifying your portfolio of publishers, including local publishers and content creators in each country, such as bloggers and influential people

Consider search strategies in Australia and New Zealand to help identify new products and brand awareness in these markets

Learn about the social media ecosystem in the Asia Pacific region and identify the best social channels to reach the right customers

Go to "Discovery" - "Take a look" browse "Friends are watching"