Why are Facebook and Google the kings of advertising?

This article is from the English-language blog Stratechery.com, translated by Tech2IPO's Yu Jiajun, and is fine-tuned by Tiger Sniff:

In the advertising-backed service model, experts unanimously promote the maxim: "If you are not a customer, then you are a product." "But what's interesting is that people tend to put that maxim behind them when they measure the viability of a service, and Twitter is a great example."

My post on How Facebook crushed Twitter received this reply:

I've been stressing for years that the basic problem is that Twitter is often used to compare with Facebook, which is not the right thing to do. Facebook has a huge audience of billions of people, enough to reach the vast majority of the world's population, while Twitter has an audience of just over hundreds of millions. Twitter's achievements are certainly enviable, and they carry great value, but it's not Facebook. No matter how many new features developers add to Twitter, it's unlikely that they're going to make it as popular as Facebook. The indiscriminate addition of new features only dilutes Twitter's core values, which in turn undermines its popularity and usefulness.

From the user's point of view, I fully agree with this statement. But what that maxim reveals is that the most important thing is undoubtedly the customer, who sees the comparability of Facebook and Twitter from an advertiser's point of view, which is a fundamental problem that Twitter needs to overcome. The digital advertising world is evolving toward a simple proposition: either Facebook or Google, and everything else is floating clouds.

The slaughter of consumer services

On Friday, LinkedIn's share price experienced one of the worst in the stock market's history: it fell as much as 40 percent, even though it exceeded analysts' expectations in both revenue and adjusted earnings. Such a huge drop is completely beyond investors' expected.

LinkedIn must be aware that the company's share price is not a credit card for the company's performance and reflects the market's valuation of the company's future performance. Changes in the Company's valuation based on existing income levels reflect investors' expectations of the Company's future performance. There is no denying that LinkedIn's relatively mature core business, which is aimed primarily at recruiters, has performed well, which is why the company's business has outperformed expectations. "However, due to the natural constraints of the market, firms need to seek growth in other areas." LinkedIn hopes to make a breakthrough in advertising, but unfortunately, LinkedIn's performance in this area has not been as good as expected. LinkedIn's desire to grow in advertising has been made even more difficult by the suspension of its off-site advertising program, Lead Accelerator, following LinkedIn's decision to stop page display ads.

Yelp's shares also fell 11% after the release of the not-so-ugly earnings figures on February 8. The biggest one-day drop in the company's share price (up to 28 per cent) came last summer, when the company underper's performance fell short of expectations (related to the decision to stop brand advertising).

As revenues and earnings continue to slide, yahoo's core business has become worthless. Twitter's valuation has been lowered to less than $10 billion, a small comparison to Google, which is often compared to Twitter, which is valued at $460 billion and has become one of the world's most valuable companies, and Facebook, which is valued at $267 billion.

The contrast depends on the most important and critical "customers": advertisers who choose to buy ad delivery services on the "free" consumer service platform.

A brief history of the pan-advertising industry

Newspapers are the oldest advertising tool used by advertisers and the only one they have used for years. This was not a problem at the time, because newspapers had the magic to continue to expand on the basis of daily advertising sales. From a business point of view, everything other than advertising is just stuffing.

In the first half of the 20th century, newspaper revenues in the United States grew roughly as much as GDP. Since its inception, advertising has accounted for about 1.2% of the U.S. economy. By the second half of the 20th century, with the ad emerging of radio and television, the growth of the American newspaper industry had declined slightly.

Compared with newspapers, the advertising business, which relies on radio and television, has obvious advantages over the former in terms of both narrative and the efficiency of capturing the attention of potential customers. However, although the newspaper industry no longer dominates the whole mountain, because of the inherent limitations of radio and television, the growth of the newspaper industry in advertising is still a welcome performance. The inherent limitations of radio and television are as follows:

1. Because both radio and television programs are significantly time-thy-time, there is limited space for advertising. With too little supply and demand, advertisers will have to pay a high price if they want to advertise on radio or television.

2. Advertisers have to bear the high cost of creating effective radio or television advertising compared to advertising in newspapers.

3. It is difficult for advertisers to measure the input-output ratio of radio and television advertising, although the reporting industry does not have a significant advantage at this point, but at least the form of coupon advertising can give advertisers a more intuitive feeling.

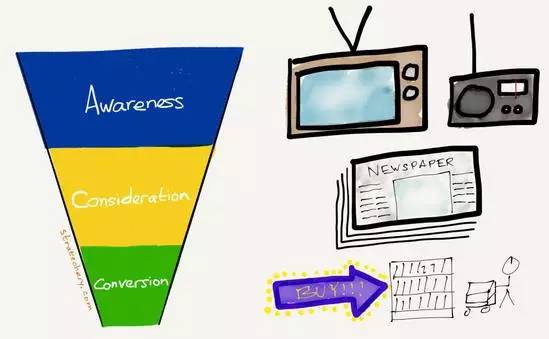

Eventually advertisers (also known as "brand managers" in the consumer packaged goods industry) came up with marketing strategies that could accommodate both of these three media, plus on-site promotions, in order to attract more willing customers:

At the level of consciousness development, television and radio are undoubtedly the two most effective ways to make customers aware of the existence of a product, and thus build brand affinity. In this case, customers will have a subconscious preference for your product in their mind, and they will have a greater chance of choosing your product when they buy similar products. Newspaper advertising, on the other hand, is aimed at the "consider" level: newspaper advertising can help consumers decide which specific product to buy (advertising in the form of coupons is particularly important). "Finally, brand managers spend a lot of time and money building close relationships with retailers, which tend to drive customer transformation." Their views on customer loyalty are very ambiguous.

Digital Advertising 1.0

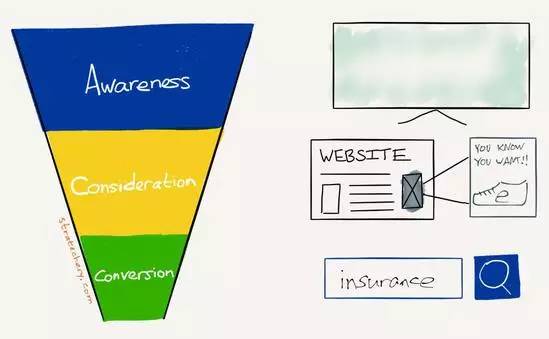

The first wave of digital advertising was aimed at the very end of three levels: the computer records everything, so the buying behavior caused by an ad is very intuitive in the world of computers. In this case, the biggest gainer is undoubtedly Google. Ads that rely on searches are very effective because customers who type keywords to search already have the will to buy (to the conversion level). For example, Google can charge advertisers for related businesses high advertising fees for people who already have a willingness to buy services such as insurance, travel, or lawyers.

In order to make good use of digital advertising tools, advertisers have made a variety of attempts, the boldest and most efficient way is undoubtedly to watch the relevant content of the user as a marketing target. This approach allows the customer to skip the consideration layer directly, although it tends to make the customer feel weird because it is too direct. But the upper level of consciousness has not improved: people have yet to come up with a way to build awareness in the digital world with less effort.

To develop brand marketing on the Internet, brand managers need to overcome two major problems: First, the Internet does not have a good advertising unit. Banner advertising is just a clumsy imitation of print advertising, a form of display that is not even comparable to immersive broadcasting, let alone television;

But all this is no longer the same today.

Digital Advertising 2.0

Sheryl Sandberg, Facebook's chief operating officer, said of an anecdote during a recent Facebook conference call:

On Black Friday, Shop Direct, the UK's second-largest online retailer, has released a dynamic chart of its upcoming sales extravaganza to build product awareness. The company then launched a one-day promotion aimed at users who had viewed the dynamic image. On Black Friday, they promote products of interest to users through our ads that rely on data processing algorithms. "In this promotion, they earn 20 times the cost." For them, Black Friday was undoubtedly the most successful ever, setting a new one-day sales record.

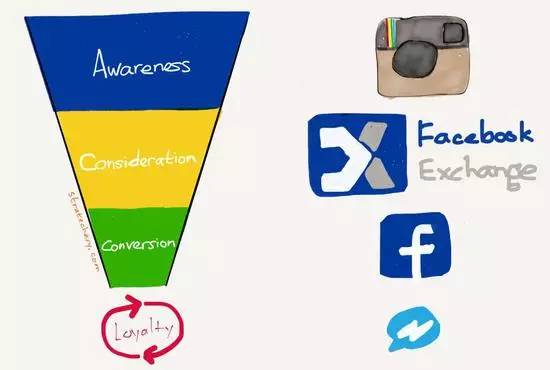

Here, Sandberg presents a detail that should not be underestimated: Facebook has accelerated the transformation of Shop Direct's customers on every level. From the awareness layer that originated in Instagram video ads to the consideration of repositioning users, to the transformation layer that relies on Facebook's dynamic product ads, the speed of consumer conversion has been greatly improved. It's not hard to see how Shop Direct will increase customer loyalty in the future by connecting directly with customers through Facebook's Messenger app.

Google can offer similar services to advertisers: YouTube for the level of consciousness, DoubleClick for the level of consideration, and AdSense for the layer of conversion. At the same time, both Facebook and Google are making sure advertisers get better results from using their services: because both companies have excellent customer targeting and conversion identification capabilities, their services can undoubtedly make advertisers more effective, and advertisers can monitor effective conversions through the interfaces provided by both companies to optimize the cost allocation of ads overall.

At this stage, Facebook and Google have successfully overcome the inherent limitations of broadcasting and television:

1, Facebook and Google have plenty of inventory, and both have growing user numbers and ad loads, and neither company has time limits. To further expand its ad reach, Facebook also plans to apply its data to platforms outside of Facebook.

2. It's cheaper to create ads for Facebook and Google than other ad platforms with different specifications.

3, Facebook and Google have outstanding tracking capabilities that not only track online purchases, but also offline purchases.

Both companies, most notably Facebook, dominate the advertising industry, and the advantages of the two platforms speak for themselves compared to other digital platforms: efficient, widely accessed, and with significant output-to-output ratios. Smaller platforms such as LinkedIn, Yelp, Yahoo and Twitter mentioned above are struggling.

Winner-take-all mode

I've always believed that the entire technology sector is fine, and the ad-based service is a good example of my view: we might as well look at the six companies, Google, Facebook, Twitter, LinkedIn and Yelp as a whole, which saw a 19% increase in performance last year. Google and Facebook posted a 31% increase, despite a 53% decline in the results of the last four companies.

It's not hard to understand that while the advertising industry as a whole is a zero-sum game, it's shifting from print to radio, television, and digital, so we're seeing significant growth in the digital advertising industry. But the digital advertising industry is also subject to the aggregation theory, which is based on the "winner-take-all" model, so Facebook and Google, as kings, can certainly claim all the rewards.

I think this trend will accelerate even further: first, in the digital advertising industry, it's hard to see substantial growth in third parties other than Facebook and Google (the best chance is to consider buying Yahoo's Verizon and Snapchat, which already has a partnership with Viacom, which has a large young market). In digital advertising, any business that wants to leap over carpgate needs to show advertisers why advertisers are worth spending their time on.

More broadly, the aggregation theory of "winner gets everything" is also a wake-up call for investors who fear missing out, and many unicorn companies are scrambling to become the "king" of the field. I think the recent cooling in valuations and financing is partly due to the fact that these unicorn companies are in a very similar position to Their competitors at Facebook and Google: they have either lost their dominance in their areas or are not attractive enough in their areas.

To some extent, we can attribute this phenomenon to inequality in technology: mediocre companies will be further divided. This is not a bubble, but the result of industry rebalancing. In the field of science and technology, the real "king" will stand before our eyes in an unprecedented, rich and powerful posture.

Source: Tiger Sniffer.com

Go to "Discovery" - "Take a look" browse "Friends are watching"