Television advertising is no longer the boss, with the U.S. toping digital advertising revenue in 2016

Compilation of Qiu Yue Source Sina Technology

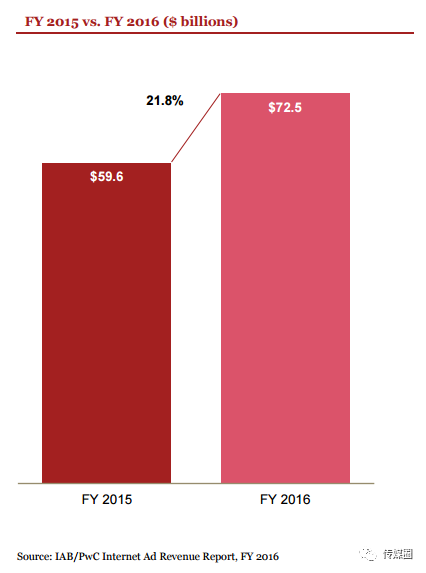

BEIJING, April 27 (Xinhua) -- U.S. digital advertising revenue rose 22 percent year-on-year to $72.5 billion in 2016, up from $59.6 billion in 2015, the IAB said Thursday. The report was produced by PwC.

U.S. digital advertising revenue rose 22 percent year-on-year to $72.5 billion

U.S. digital advertising revenue rose 22 percent year-on-year to $72.5 billion

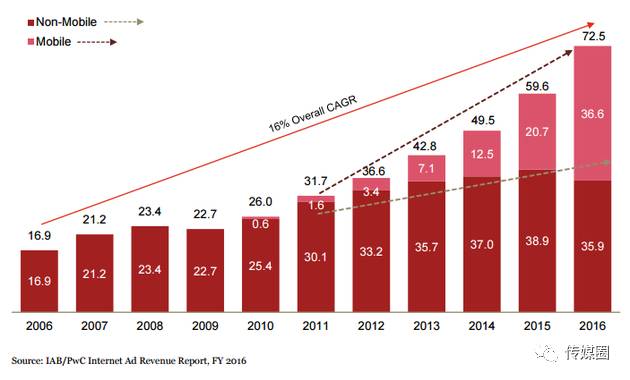

While U.S. digital advertising revenue hit an eight-year high, the report's data show that mobile ad revenue outpaced desktop for the first time, while total digital advertising spending outstripped television advertising for the first time.

Television advertising is no longer the boss

The U.S. Interactive Advertising Agency has been recording digital ad data since 2014. Since then, TV advertising spending has been higher than digital advertising until 2016.

U.S. television advertising revenue in 2016 was $71.3 billion, down from $72.5 billion in digital advertising revenue, according to eMarketer, a market research firm.

Digital video ad revenue was $9.1 billion in 2016, up 53 percent from a year earlier, according to the U.S. Interactive Advertising Bureau. On the mobile side, video advertising revenue rose 145 percent year-on-year to $4.2 billion.

The media overstates the pattern of "double-headed monopoly"

Last year, Facebook reported global revenue of $27.6 billion, while Google reported revenue of $89.6 billion.

David Doty, executive vice president and chief marketing officer of interactive advertising, said there were many inaccurate reports in the media that the two companies were driving almost all of the digital advertising industry's revenue growth.

"We've seen some of the calculations in the media using revenue data from outside the US for these companies, and that's one of the mistakes," he said. Another thing they don't understand is the cost of getting traffic. Moreover, they do not take into account that some companies are not being paid attention to in the overall development of the industry. "

In the fourth quarter of 2016, all member companies of the U.S. Interactive Advertising Agency experienced significant growth, Mr. Dodi said. "In the fourth quarter, 73 per cent of revenue came from the top 10 digital companies, but these companies only driven 69 per cent growth." "This means that 31 per cent of the growth is coming from non-top 10 companies," he said. So the media got it wrong. "

David Silverman, a partner at PwC, agrees. "It's clear that a wider range of companies are driving growth," he says. The ranking of the top 10 companies has been changing, which means that the top 10 companies are different from previous years, and these companies are becoming the dominant force in the market. "

Search ads are driving mobile growth

In 2016, mobile advertising accounted for 51% of all digital advertising revenue in the United States, or about $36.6 billion. Of that, 47 percent, or $17.2 billion, came from mobile search ads.

Overall, desktop search ad revenue fell 13 percent to $17.8 billion for the first time in 2016 from a year earlier.

Mobile advertising revenue accounted for 51% of all digital ad revenue in the U.S., while desktop search ad revenue fell for the first time in 2016

The U.S. Interactive Advertising Bureau does not list individual companies' digital advertising revenue. But in 2017, Google's share of the global search advertising market was nearly 78 percent, equivalent to $28.5 billion in revenue, according to eMarketer.

On the mobile side, banner ads ranked second among all ad types, with 38 percent, followed by video ads with 11 percent.

Digital broadcasting has arrived

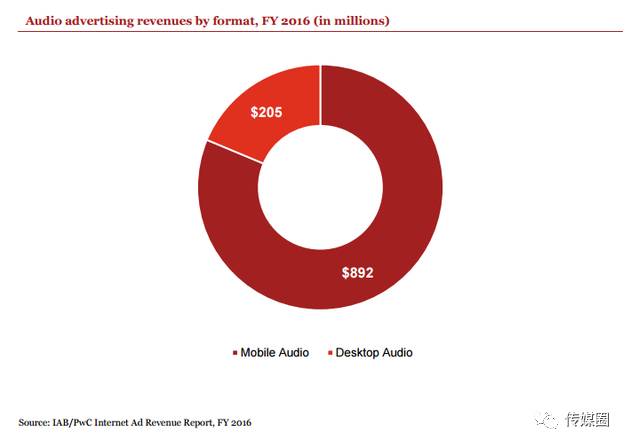

In 2016, digital audio became a separate category in the Interactive Advertising Bureau survey. Advertising revenue in this vertical sector exceeds $1.1 billion.

Desktop and mobile digital audio advertising revenue

"Young people don't listen much to the radio, " says Mr Schefferman. They get audio content through streaming services. They may listen to podcasts instead of traditional broadcasts. This is similar to the trend towards networking of print media. "

About 40 percent of marketers have expressed interest in Spotify ads, according to a study released by RBC Capital Markets. That's up from 35 percent for Snapchat.

Report other key points

In 2016, social media advertising revenue was $16.3 billion, up 49% year-on-year.

Retail, financial services, automotive, telecommunications and travel were the top five sectors for advertising spending in 2016, accounting for 21%, 13%, 12%, 9% and 9%, respectively. Travel advertisers spent 8% year-on-year, while advertising spending in other industries was flat.

On the desktop side, video advertising was the only type of ad that grew, up 16% year-on-year to $4.9 billion.

Recommended articles, click on the title to read

"The Name of the People" classic Taiwan vocabulary total

Uncover professional viewers of Chinese variety shows

"The People's Name" slapped old experts in the media

Television won't die for a while and a half

I'm sorry about the traditional media for not jumping ship

Where is the spring of traditional media

- It's over-

Long press and hold QR code recognition, one-click attentionThe media circleThe official number

Media CircleWeChat self-media platform, is a leading media, film and television, brand, marketing and other fields of information and intelligence library. Every day by 200,000 quality people attention, the annual reading of more than 50 million people.

If you would like to communicate, please add a personal microseelect:dianyingquanwill have the opportunity to participate in offline communication and other activities.

Go to "Discovery" - "Take a look" browse "Friends are watching"