Corporate Strategy: Industry Choice and Competitive Strategy Decisions (2)

Preface:

Then the last article, talked aboutThe industry in which the company is located will largely determine the structural characteristics of the company's earnings and the level of profitability. For different industries,For light and heavy asset industry companies, it's differentThe focus of the financial report analysis is different.

Here's the next article, aboutCompetitive strategy。

Three, aboutCompetitive strategy:Offensive VS defensive, cost-leading strategy VS differentiation strategy

Two different corporate competitive strategies We analyzed the issue of industry attractiveness earlier, and then analyzed the second central issue of corporate strategy: competitive strategy. Competitive strategies can be summed up as taking offensive or defensive action, establishing a well-founded position in the industry and successfully dealing with external competition, thereby earning the company extraordinary benefits.

In most industries, regardless of the industry's average profitability, there are always companies that earn more than the industry average because of their favorable competitive strategies. "Industry attractiveness partly reflects external factors that a firm can hardly influence, but the choice of competitive strategy can enhance or diminish its attractiveness in an industry;"

"Similarly, a firm can significantly improve or diminish its position in the industry by selecting its competitive strategy.""Thus, the competitive strategy is not only the company's response to the environment, but also the company's technology to change the environment in its own favour."

Scholars at home and abroad have found that companies that succeed in market competition have obvious competitive advantages. "This competitive advantage is concentrated in the low-cost advantage and the differentiation advantage, so they put forward two basic competitive strategies, namelyTotal cost leadership strategies and differentiation strategies.

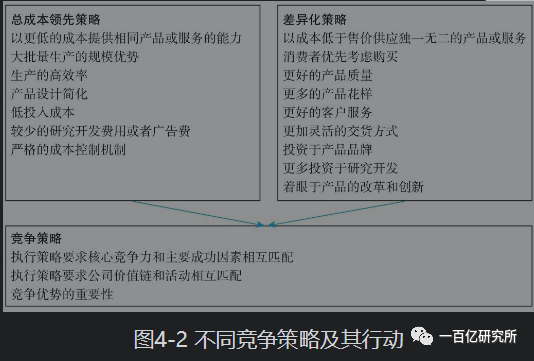

"Low cost advantages and differentiation advantages can be determined by the structure of the industry and depend on the firm's ability to compete in the market more effectively than its competitors." When a company chooses a competitive strategy, consider whether it has the ability to match it, and on this basis, take action corresponding to the competitive strategy, as shown in Figure 4-2.

In layman's terms, the total cost leading strategy is to earn hard money, hard-earned money, differentiation strategy is to earn brain money, easy money. China is known as the world's factory, more companies through the manufacturing process of low labor costs, low environmental costs and other factors in the global competitive advantage.

However, with the development of economy, the original low-cost elements are unsustainable. Therefore, the state has put forward the task of adjusting the economic structure and economic transformation. The success of economic transformation is based on the success of enterprise transformation.

Business transformation has two directions:First, the use of value chain, value engineering, operation management and other tools, from the original extensive management of low-cost to lean management of low-cost transformation;

Second, vigorously invest in brand building, technology research and development, from the total cost of leading strategy to differentiation strategy transformation.Many enterprises have been or are on the road to transformation, the transformation needs to take full account of industry characteristics, the company's existing capabilities and resources.

In terms of corporate competitive strategy, there are only two types of large enterprises in the future business world:

One is lean management of customer demand-driven low-cost production and service-oriented enterprises, such as lean manufacturing Toyota Motor, Baosteel shares;

The other category is differentiated production and service companies that innovate to create and guide customer needs, such as Apple, which creates demand for smartphones. Meeting customer needs is the source of the company's core competitiveness.

"Total cost leadership and differentiation strategies are not the opposite, and companies that pursue differentiation must gain differentiation advantage on an affordable cost basis."

"Similarly, cost front-runners cannot compete unless they are comparable or even ahead of their competitors in terms of quality and service, even if it is subtle." AndMajor changes in technology and business practices have the potential to combine high quality, good service and low prices, such as the success of Japanese automaker Toyota Motor Corp. and U.S. retailer Wal-Mart Stores Inc.

A company that chooses a competitive strategy does not automatically gain a competitive advantage. "To gain a competitive advantage, firms must have the ability to implement and maintain the strategy chosen."Either strategy requires the company to have the basic competency it needs and to plan its value chain in an appropriate way.

Basic ability refers to all kinds of resources owned by a company, while value chain refers to the combination of various links and economic activities in which the company converts inputs into outputs."The firm's basic capabilities, the uniqueness of its value chain and the ease with which competitors imitate them determine whether the firm's competitive advantage can be maintained."

Generally speaking"Compared to companies with a differentiation strategy, the more obvious difference in earnings is that the gross margin of the former is lower than that of the latter."

In the previous examples of companies in different industries, Haikangwei TV and Guizhou Maotai can be regarded as typical of differentiation strategies, Angang shares are typical of the total cost leading strategy, the gross margin of the former two is several times higher than the latter.

FourThe characteristics of a cost leadership strategy

"The total cost leadership strategy, also known as the total cost leadership strategy, is a strategy in which a firm effectively reduces costs so that all costs are lower than those of competitors and even the lowest in the industry in order to gain a competitive advantage."

Cost leadership is the most likely competitive strategy in industries that are essential products or services. Low-cost advantages not only yield rates above the industry average, but can also force competitors to phase out of the industry because they can't stand low yields.

There are many ways to achieve the leading total cost, such as economies of scale, improved economy, efficient production, product design optimization, low input costs and effective organization and implementation, it runs through investment and financing, product design, production, sales and other business levels.

"In general, companies with a well-executed total cost leadership strategy report lower gross margins in their financial statements than companies with differentiated strategies."Companies with a leading total cost strategy are more focused on managing costs and expenses, simplifying products and services that do not add value to customers.

Depending on how the company obtains the cost advantage, we summarize the cost leadership strategy into six main types:

(1) Simplify the product-type cost-leading strategy, that is, to simplify the product, that is, the product or service added to all the tricks cancelled, such as Spring and Autumn Airlines.

(2) Improve the design cost-leading strategy.

(3) Material cost-saving leading strategy.

(4) Labor cost reduction cost leading strategy.

(5) Production innovation and automation cost-leading strategy.

(6) Economies of scale cost leadership strategies, such as Glanz.

Enterprises need to enter the innovation market, looking for second-curve innovation, do not understand the buyer's perspective of the first market how to do?The 10 billion institute recently opened the second public number,Follow us on Twitter at :: xinjingjilive

The New Economy Brainstorm focuses on strategic thinking on new economic sectors, the path of enterprise innovation implementation, etc., and the scope of business is new economic advisers.

The 10 billion institute will continue to make a series of sharp dismantling, hard core investment and research consulting business links for investment in the secondary market, especially the secondary market fundamental style.

Many industries do not have a differentiation strategy. For example, when the driver refuels a vehicle, he will not consider whether to add Sinopec's gasoline or PetroChina's gasoline;

In general, cost leadership strategies apply to industries that:

(1) The price competition between existing competitive companies is very fierce.

(2) The products of the company's industry are basically standardized or homogenized.

(3) There are few ways to achieve product differentiation.

(4) Most customers use the product in the same way.

(5) The conversion cost of the consumer is very low, and their willingness to buy depends on the price.

The company implements a cost leadership strategy, in addition to the above external conditions,It must also have the following internal skills or resources: continuous capital investment and access to capital, production and processing process skills, skilled and efficient employees, design of easy-to-manufacture products, low-cost distribution systems.

The benefits of adopting a cost-leading strategy are in one or more of the following areas:

(1) Resist the confrontation of existing competitors.

(2) Reduce the buyer's bargaining power.

(3) More flexible handling of supplier price increases.

(4) Forming barriers to entry.

(5) Establish a competitive advantage over substitutes.

Risks of adopting a cost-leading strategy include:

(1) Excessive price reduction results in lower profit margins.

(2) New additions may come out on top later.

(3) Too focused on cost control and loss of ability to anticipate market changes.

(4) Technological changes reduce the utility of the company's resources.

(5) Vulnerable to the influence of the external environment.

The total cost leadership strategy requires companies to use assets efficiently.

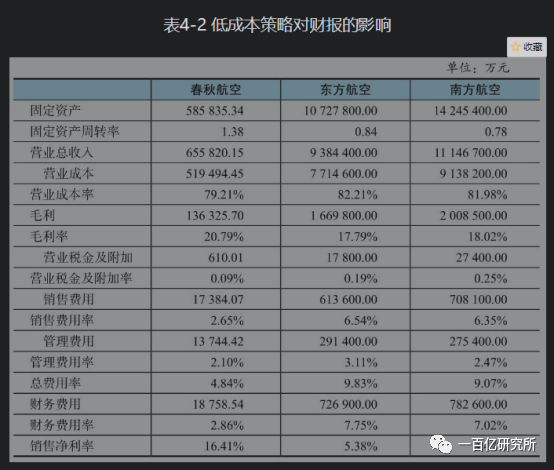

For airlines, for example, the most important asset is fixed assets such as aircraft. In terms of fixed asset turnover, Spring and Autumn Airlines had 1.38, well above China Eastern's 0.84 and China Southern's 0.78. While assets are used efficiently, companies need strict cost and expense control mechanisms.

The operating cost ratio of Spring and Autumn Airlines is significantly lower than that of the other two companies. Spring and Autumn Airlines used the advantages of sales channels, so the sales cost rate of 2.65 percent, also far lower than China Eastern Airlines 6.54 percent and China Southern Airlines 6.35 percent. The management fee rate of Chunqiu Airlines is also slightly lower than that of China Eastern Airlines and China Southern Airlines.

At the same time, Chunqiu Airlines through the capital structure management, so that the financial cost rate is much lower than China Eastern Airlines and China Southern Airlines. Because Chunqiu Airlines has successfully applied the total cost leading strategy and achieved a clear low-cost advantage, the net sales margin of Chunqiu Airlines is 16.41 percent, which is much higher than China Eastern Airlines' 5.38 percent and China Southern Airlines' 4.47 percent.

"As can be seen from the above example, if a firm can successfully implement a total cost leadership strategy, its financial results are characterized by high asset turnover, lower cost and expense rates compared to its peers, and finally a higher net sales margin."

Another example of the success of the total cost leadership strategy is the Glanz Group. In China's market-oriented manufacturing industry, you may not find a second brand as highly concentrated as microwave ovens, or even into the oligopoly industry:

The first legion of Glanz accounted for about 60% of the market share, the second legion LG accounted for about 25% of the market share, while the third and fourth Panasonic and Samsung have only about 5% of the market share. Because of this particularity, the microwave oven industry's "cost barrier" to the "technical barrier" in front. With an annual production capacity of 15 million units, Glanz leads the industry with its total cost. At present, Glanz monopolizes 60% of the domestic and 35% of the global market share, and has become the "microwave oven king" in China and the world.

Glanz Group's total cost leadership strategy can be hailed as a classic, including:

First, under the premise that the total cost remains unchanged or decreased, new products and know-how will be continuously developed;

Second, the use of total cost leadership, to the market to introduce high-quality and low-cost products, expand market share;

Third, on the basis of the above, Glanz began to use its technical strength to develop key components and put them into production, further reducing the total manufacturing costs.

Glanz's core competitiveness lies in price. Concentrated in a small number of products, high-volume, low-cost, through the price war to quickly occupy the market is the magic weapon of Glanz's success. Glanz has gained a cost advantage in the development of a long time by using equipment moved from OEMs, mass production, low labor costs, large management spans, and buyer monopolies.

Glanz's core competitiveness is summed up in four words: scale manufacturing.Glanz's entry into the microwave oven industry has always adhered to the total cost leadership strategy, and the reason why it has cut prices so frequently is that its costs are much lower than those of its competitors, and it has enough profit margins.

On the one hand, rapidly expand production capacity to achieve economies of scale, on the other hand, through price reduction and three-dimensional promotion to expand market capacity, improve market share, so as to make their own strength in a short period of time to obtain rapid improvement. The fundamental purpose of implementing the scale strategy lies in the rapid expansion of the market, reducing operating costs through the scale effect, increasing technology investment, improving international competitiveness, and so on. Glanz through efforts, in the field of microwave ovens to truly achieve large-scale operation and specialization, intensive production, so that enterprises on the track of sound development.

Strictly speaking, Glanz is a manufacturing enterprise, the larger the manufacturing scale, the lower the average cost. In addition, Glanz has made great efforts to reduce procurement costs, administrative costs, marketing costs and circulation costs, resulting in lower costs, coupled with low labor, so that Glanz in the comprehensive cost competition has a great advantage.

V. The characteristics of differentiation strategy

The so-called differentiation strategy of the financial reporting characteristics under the differentiation strategy refers to a strategy adopted to make the company's products distinct from the competitors' products and to form distinctive characteristics. In this strategy, the company's products must be made in the eyes of customers", so that customers have a heart, will not be easily replaced with other companies' products.

At the heart of this strategy is to achieve a certain uniqueness that is valuable to the customer."This strategy requires that a particular aspect of consumer demand be better met than that of competitors, and that costs increase, but not exceed the maximum price that consumers are willing to pay."

This protects the firm from competitive forces and thus creates a competitive advantage. Corporate organization and control systems that pursue differentiated strategies are characterized by incentives for creativity and innovation.

However, the pursuit of differences sometimes contradicts the pursuit of greater market share. In the system integration industry, the software company's main competitive strategy is to pursue differences - to provide users with personalized, innovative software services, but not easy to form a large-scale operation. "Companies with differentiation strategies that perform well have higher gross margins on their goods or services."Because this strategy is more concerned with the degree of difference in products or services, so often in research and development, brand, marketing channels and other aspects to invest a large amount of money, the cost of products or services in the operating income of the proportion is relatively low.

For a company that adopts a differentiated strategy, we can measure the success of its strategy execution in terms of gross margin.

Guizhou Maotai's gross margin as high as 92.41%, that is, differentiation strategy, so often in research and development, brand, marketing channels and other aspects to invest a large amount of money, the cost of products or services in the proportion of operating income is relatively low.

There are five basic ways for companies to highlight the differences between their products and services and their competitors.

First, product differentiation strategy. The main factors of product differentiation are characteristics, performance, consistency, durability, reliability, ease of repair, style and design, such as OPPO mobile phones to "beautiful" performance to gain a competitive advantage.

Second, the service differentiation strategy. Service differentiation mainly includes delivery, installation, customer training, consulting services and other factors, such as underwater fishing to feature services famous.

Third, the strategy of technological differentiation. The main factors for technological differentiation are the creation and invention of unique technologies such as Apple phones, Intel computer chips, and security products and services from Hyconwick.

Fourth, the brand image differentiation strategy. Brand differentiation mainly includes unique logo, special sales channels, marketing advertising investment, irreplaceable products and services, such as Disneyland, Guizhou Maotai, Nike sports shoes, Zhang Yu wine, hexa-flower dew, Yunnan white medicine and so on.

Fifth, the strategy of geographical differentiation. Geographical differentiation is mainly due to geographical location and special features brought about by the competitive advantage, such as Zhangjiajie, Huangshan, Emeishan and so on. In the above approach, in addition to the fifth differentiation strategy, the other four differentiation strategies require the company's own efforts.

Differentiation strategies are primarily applicable to industries with the following characteristics:

(1) There are many ways to create a difference between a company and a competitor's product, and this difference is considered valuable by the customer.

(2) Customer demand for products and use requirements are diverse, that is, customer demand is different.

(3) There are very few competitors who use a similar differentiation approach, i.e. there is a real guarantee that the company is "differentiated".

(4) Technological change is rapid, the competition in the market mainly focuses on the introduction of new product features.

In addition to the external industry characteristics described above, the company must implement a differentiation strategy with one or more of the following internal conditions:

(1) Have a strong research and development ability, researchers should have a creative vision.

(2) The company has its reputation for product quality or technology-leading.

(3) The company has a long history in this industry, or draw on the skills of other companies and self-made.

(4) Have a strong marketing ability.

(5) Research and development, product development and marketing functions should have a strong coordination.

(6) The company should have material facilities that attract senior researchers, creative talents and highly skilled staff.

(7) Strong cooperation across various sales channels.

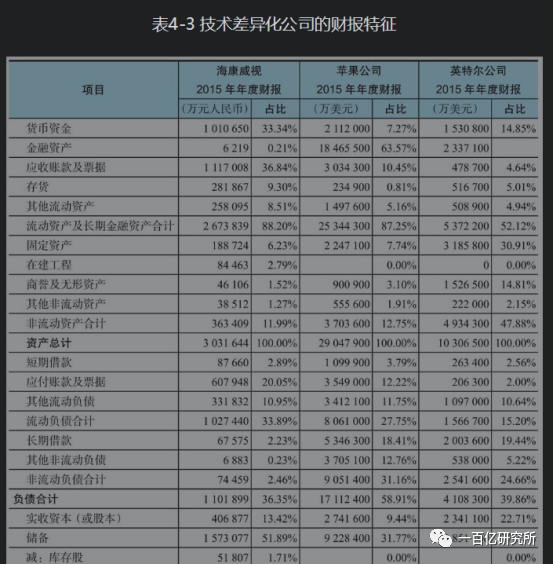

We take Heconway Tv, Apple, Intel Corporation as examples to analyze the financial results characteristics of technology differentiated companies, as detailed in Table 4-3.

"In general, technology differentiation firms rely on technology to make a profit, and the direct cost of a product or service as a proportion of revenue is not high, so gross margins tend to be higher."At the same time,Technology differentiation companies are mainly technology research and development, rather than the steel industry and other large-scale fixed asset investment, so the proportion of fixed assets in the asset structure is often relatively low.

"If the firm capitalizes research and development expenditures, buys technology externally, or expands through mergers and acquisitions, the ratio of goodwill to intangible assets is high."

Due to the existence of technical barriers, can bring shareholders a more ideal return, the return on net assets will often be relatively high.

As can be seen from Tables 4-3, the financial reporting structures of Heconway, Apple and Intel are: the combined ratio of financial assets to current assets is 88.20%, 87.25% and 52.12%. Fixed assets accounted for 6.23 per cent, 7.74 per cent and 30.91 per cent. Goodwill and intangible assets accounted for 1.52%, 3.10% and 4.81% in turn.

In terms of asset structure, Hyconwicze and Apple are typical light-asset companies. Intel's fixed assets and intangible assets together account for a relatively high percentage, related to Intel's strategy.Intel, which makes its own chips, must invest in factories and production equipment, and as Intel expands through ongoing mergers and acquisitions, combining goodwill and buying out intangible assets is high, resulting in Intel's non-current assets accounting for significantly more of the total assets than the other two companies.

Apple outsources production to outside companies such as Foxconn, which does only research and development, not manufacturing, so the proportion of fixed assets is relatively low.

The proportion of goodwill and intangible assets of Hyconway is the lowest of all three:One is that Haikangwei's merger and acquisition activities are very small, and the other is because Haikangwei, as a domestic listed company, has taken a cautious approach in the accounting of research and development expenditure, that is, the current cost.

It is important to note here that in my analysis I have adjusted financial assets such as available-for-sale financial assets, holdings to maturity investments, and placed them in the total of financial assets and current assets. This is because financial assets are completely different from fixed assets. Fixed assets achieve future benefits through depreciation, while financial assets achieve future gains through the recovery of principal and interest or cash dividends, and financial assets are often better realized than accounts receivable and inventory, so I made the above adjustments.

In terms of capital structure, all three companies are relatively robust, with both Wellcome and Intel with lower balance sheets and Apple with the highest 58.91 percent.

Apple and Intel have significantly higher ratios of short-term and long-term borrowing than Hyconway, which has a very low share of interest-bearing debt. This is related to the lower debt financing costs of high-credit rating companies in the United States and the higher financing costs of domestic corporate debt, so Apple and Intel use higher financial leverage than Hyconway.

But the high proportion of accounts payable and notes payable by Hyconway and Apple suggests that the two companies are making good use of interest-free liabilities in their operations, so their financial expenses are negative:Accounts payable and notes take up vendor funds that do not pay interest, but bring in interest income.Intel, for its part, borrowed mainly, and therefore had a financial expense of $213 million.

In the profit statement,In terms of gross margin, all three companies have gross margins of more than 40%, with intel at the top of the list at 62.65%, a typical differentiation strategy.

"However, the three firms account for a higher proportion of operating expenses, particularly those with research and development expenditures relative to the leading strategy of total cost." Intel's operating expenses amounted to $20,323 million, accounting for 36.71 percent of revenue, and Apple's operating expenses amounted to $22,396 million, due to revenue of 233 715 million yuan, so the proportion of operating income is 9.58%, and the amount of operating expenses of Haikangwei is RMB4,587 million, and the proportion of operating income is 18.51%.

Here, you need to explain the difference between total operating costs and operating costs:Operating costs include the direct costs of goods and services, while total operating costs include the direct costs of goods and services in operating activities and other costs that occur.

For example, Maotai, GuizhouWhen selling liquor, the direct cost of producing liquor, such as grain, workers' wages, bottles and boxes, utilities, depreciation of fixed assets, etc., is the operating cost, together with advertising fees in the sales process, sales staff wages and expenses in the enterprise management process, etc., which is the total operating cost。

For example, you to the hotel set up a table to invite guests, the production of this table banquet chicken and duck fish, water and electricity coal, master and waiter to this table banquet wages are the direct cost, hotel managers' wages, promotional fees, etc. are operating expenses.

Another typical feature of technology differentiation companies is that in operating expenses, the absolute amount invested in research and development expenses accounts for a relatively high proportion of operating income.

The three companies invested RMB1,722 million in research and development expenses in 2015, Intel's RMB12.1 billion accounted for 21.86 percent of revenue, and Apple's $8.15 billion accounted for 3.5 percent of revenue. Among domestic listed companies, Haikangwei TV's research and development expenditure as a proportion of income already belongs to the relatively high ranks.

According to media disclosures, Chinese technology giant Huawei spent Rmb59.6bn on research and development in 2015. This has to be lamented by the gap between Chinese and American companies, which spend tens of billions of dollars a year on research and development and create incredibly strong technical barriers.

The success of China's economic transformation depends on the success of the transformation of enterprises, not always rely on Sinopec, PetroChina, State Grid and other traditional industries of the company, but must produce some technology differentiation of large companies. If we can't make a difference in technology, then our gross national product can only be said to be "big but not strong". When Can Chinese companies invest as much in research and development as large international companies, so that Chinese companies have a higher level of strength with international companies.

The financial reporting characteristics of brand image differentiation strategy companies are similar to technology differentiation strategy companies in terms of asset structure, capital structure and gross margin.

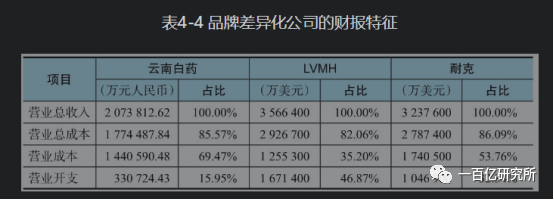

The obvious difference is that in terms of operating expenses, the research and development investment of the technology differentiation strategy company is relatively large, while the brand image differentiation strategy company's sales expenditure in advertising, sales channels and so on is relatively large, accounting for a relatively high proportion of operating income. We can take a brief look at the profit statement structure of Yunnan White Medicine, LVMH and Nike, as shown in Table 4-4.

Yunnan white medicine accounted for 69.47 percent of operating costs, gross margin of 30.53 percent, operating expenses accounted for 15.95 percent, sales expenses in operating expenses of 2.7 billion yuan accounted for the majority. LVMH's operating costs were 35.20%, gross margin was 64.80%, operating expenses were 46.87%, Nike's operating costs were 53.76%, gross margin was 46.24% and operating expenses were 32.34%. LVMH and Nike account for most of their operating expenses, especially advertising.

Seven, the company's strategic transformation of the financial results explained: Apple and Leibao Gables, for example

We can only see from the comparison between the two companies the importance of building the core competitiveness of enterprises. There is a lot of research literature on core competitiveness.

In short, the company's core competitiveness refers to the company can not be imitated, can not be surpassed. Analyzing a company's core competency is intuitive in its ability to determine whether the company has a sustainable competitive advantage, and can be examined in the following ways:

(1) The sustainability of competitive advantage. It mainly refers to its durability as a source of profit, not to physical durability. As long as the company's most basic characteristics of innovation, prolifies and high quality do not change significantly, its goodwill will not be eroded over time.

(2) Cannot be transferred. "The easier it is for core competents and resources to be transferred, the less sustainable the firm's competitive advantage will be." "A fundamental feature of true strategic assets and core competency is its know-how to the firm, i.e. it is rooted in the organisation and integrated into the firm's culture and management model."

(3) Cannot replicate. "The implication is that a firm does not have a truly sustainable competitive advantage if its core competency or resources cannot be easily transferred, but competitors can develop almost identical productive capacities with appropriate investments or direct acquisition of the same assets."

Lepper Gable is an A-share listed company in Apple's product delivery system and was once regarded as the leader of the A-share touch screen. Apple has adopted a competitive strategy of technological differentiation, while Leppingoco has adopted a cost-leading competitive strategy.

We compared the balance sheet structure and profit statement structure of the two companies in 2015. A 2015 comparison of the assets structure of Lebego and Apple shows that The proportion of fixed assets in Leibo Gables is 35%, well above Apple's 7.74 percent, which is typical of manufacturing and production companies. As can be seen from the profit statement structure, The gross margin is only 3.49 per cent, compared with 40.06 per cent for Apple;

So is the difference in 2015 due to the special reasons of the year? Let's look at the profit statement data for the two companies from 2011 to 2015.

As shown in Tables 4-7, in just five years, The gross margin of Leppingoco has fallen from 50.06 percent in 2011 to 3.49 percent in 2015, while Apple's gross margin has stabilized at about 40 percent over five years, while the net sales margin of Rybo Gables has fallen from 37.13 percent in 2011 to -25.12 percent in 2015.

Why is Apple's gross margin and net sales margin very stable at a high level, while Leppingoco has fallen from a roller coaster to a loss in a short period of time?

The deep-seated reason is that Apple has built a deep barrier to competition through technology patents, the so-called "moth" that Buffett calls a moot that ordinary competitors simply cannot cross, thus guaranteeing its competitive advantage.

It is clear that the production and manufacturing of Leppon Gables cannot establish competitive barriers. As a supplier to Apple, The main product is the touch screen. Touch screen industry entry threshold is not high, there is no special core technology, the requirements of manufacturers mainly concentrated in the process, new entry to catch up or even replace the old company is relatively low difficulty. Therefore, in addition to Leibao Gaoke, Changxin Technology, Ophthalmology and other industries in the company has expanded production, ultrasonic electronics, Nanbo A, East China Technology and other companies have also poured in, resulting in increasingly fierce market competition, gross margin and net sales margin fell sharply.

Without the competition of core competitiveness, and finally can only fall into a price war, the current situation of the touch screen industry is a good illustration of most Chinese companies in the industrial chain of the ecological bottom.

Of course, it may be a bit of a dilemma to ask Leppitko to be a great company like Apple. We can only see from the comparison between the two companies the importance of building the core competitiveness of enterprises.

There is a lot of research literature on core competitiveness. In short, the company's core competitiveness refers to the company can not be imitated, can not be surpassed. Analyzing a company's core competency is intuitive in its ability to determine whether the company has a sustainable competitive advantage, and can be examined in the following ways:

(1) The sustainability of competitive advantage.It mainly refers to its durability as a source of profit, not to physical durability. As long as the company's most basic characteristics of innovation, prolifies and high quality do not change significantly, its goodwill will not be eroded over time.

(2) Cannot be transferred."The easier it is for core competents and resources to be transferred, the less sustainable the firm's competitive advantage will be." "A fundamental feature of true strategic assets and core competency is its know-how to the firm, i.e. it is rooted in the organisation and integrated into the firm's culture and management model."

(3) Cannot replicate."The implication is that a firm does not have a truly sustainable competitive advantage if its core competency or resources cannot be easily transferred, but competitors can develop almost identical productive capacities with appropriate investments or direct acquisition of the same assets."

One proposition left for Chinese companies and entrepreneurs is how to create barriers to competition, stand at the top of the industrial chain, and become a core competitive company, resulting in satisfactory financial results and digital characteristics.

EightThe two core issues to be addressed by the strategy

The company strategy and the company's financial reporting relationship summarize the company's strategy to solve two core issues: first, what industry to enter, and second, how to form a competitive advantage in the industry entered.

Companies in different industries have different financial reporting digital characteristics. Some industries belong to the heavy asset industry, fixed assets, intangible assets and other long-term assets accounted for a very high proportion of total assets, such as steel industry, cement industry, etc. , some industries belong to the light asset industry, monetary funds, inventory, accounts receivable and other assets accounts accounted for a very high proportion of total assets, such as science and technology industry, liquor industry.

There are also significant differences in the structure characteristics of profit tables in different industries. In standardized manufacturing and services, gross margin and net sales margin are relatively low, while in industries that emphasize differentiation, gross margin and net sales margin are higher. In the same industry, there are differences in competitive strategies between different companies.

The main competitive strategies include total cost leadership strategies and differentiation strategies. Either strategy, the focus is on building the company's core competencies and ensuring continued profitability through the moth. Different companies in the same industry may be at different stages of the industry value chain, which can also lead to significant differences in the digital characteristics of earnings.

Related reading articles are:What are the best scenarios for a $10 billion investment? (2)

What are the best scenarios for a $10 billion investment? (Medium)

What business scenarios are best for a $10 billion investment and research? (Up)

Say what's wrong with the high-profile investment community!? On the value investment under the new economy: How to construct a complete secondary market investment and research system and obtain long-term income?

Bonus Today: Welcome to WeChatmimiwong17, reply to keywords#公司战略 #, get the title of the book. Hard Core Learning (Company Earnings and Valuations)

It is said that people who love to share have good luck

It is said that people who love to share have good luck

Go to "Discovery" - "Take a look" browse "Friends are watching"