U.S. stock warning: the market changes in that, when the highs and lows!

Video.

People with Wifi and Toho can see it first

Here's an introduction to the video, watch the video for details

Today is Monday, October 12. This video we first talk about the dynamics of a few stocks, and then in the second half, I would like to say to you that I think the market tomorrow may have the risk of short-term changes, and where to do the operation of reducing positions, this change is a change in the trend or an adjustment of the upward process.

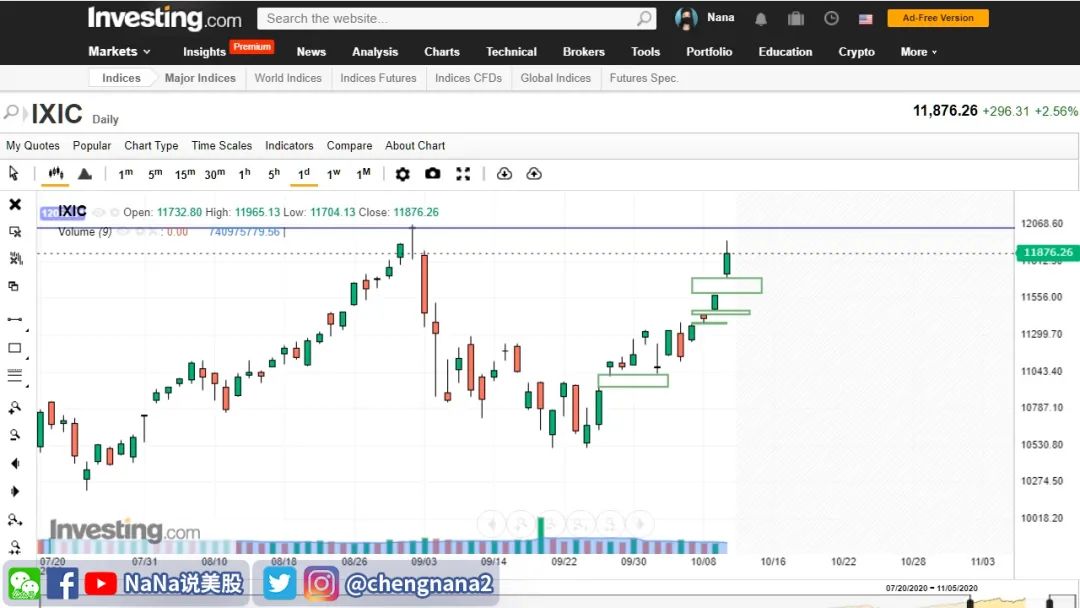

U.S. and European stocks closed higher on optimism about the U.S. stimulus package. The Dow closed up 0.88 percent today, while the Nasdaq closed up 2.56 percent, its biggest gain in a month, while the Standard and Poor's 500 index rose 1.64 percent. E-commerce stocks also rose, with Amazon up 4.75 percent and JD.com up 6.51 percent and Alibaba up 2.20 percent.

In last week's 3 video, I told everyone that Apple because to develop the cloth meeting, Amazon because there is PRIME DAY, so this wave of money-picking market, passing by do not necessarily miss. Here to congratulate you meat friends, you can use the money earned this time to buy Apple phones and amazon shopping. The next time I call everyone on the cover to come in and see it, we'll remember to pick up the money quickly. When it comes to e-commerce stocks, Google announced last week that it was turning YouTube into a shopping platform to compete with Amazon, allowing viewers to browse, click and buy directly by turning the vast number of videos on YouTube into a huge catalog.

YouTube is already testing further integration with Shopify and may be able to sell through YouTube in the future. I'm telling you the truth, it's kind of hard to imagine what YOUTUBE will look like. Is it a big success or a big failure? Because Google has tried to over-e-commerce this piece before, is the introduction of google shopping. I don't know if you've ever used it, I personally feel it's very unsothyst. The page is not optimized. It doesn't feel any different from a search engine, and you don't buy it in the end. It's all bought directly on Amazon. Can friends who have used GOOGLE SHOPPING leave a message in the comments area about the shopping experience using GOOGLE SHOPPING? Maybe I can give it a try if I'm all right. In short, for YOUTUBE to open up the shopping platform business in the future, we will wait and see, if done well, perhaps really can become Google's next billions of dollars of new business. That could also see more room for growth in Google's share price.

Back to some of the news in today's market. Deutsche Bank today raised its rating and target price for Twitter, Facebook and Google, and is optimistic about future revenue growth in its digital advertising business. Twitter, Facebook and Google also rose more than 4 percent today. Normally, before the election, both parties needed to build momentum through social media stocks, and the buzz of news about the election was good for traffic on those platforms. We mentioned it again and again two months ago. Friends who have been watching my videos will certainly remember that when the advertisers boycotted the campaign, I said I had no to worry, I was bullish on FACEBOOK twitter before the election, and I talked about it many times. Because of the stock this thing, observe for a long time, we will be more or less to touch some doorways. For example, before the major e-commerce festival, ambush e-commerce stocks in advance, in AMD, NVIDIA, TESLA, APPLE and other companies in advance of the major launch of the stock, can eat meat. It's hard to say whether the outcome of the launch will disappoint, but the probability of a share price rally before the launch is very, very high. So stock speculation on the same as love, since ancient times can not stay deeply affectionate, only set the way to popular ah. I'm a guest emotional blogger again. Friends watch more of my videos, in addition to knowing where to go to pick up money, but also to learn the skills of love. The gold content of the video is simply glittering and blind.

U.S. stocks next week to pick up money market, walk by don't miss!

Speaking of which, the carrot is the U.S. stimulus package, which Pelosi and U.S. Treasury Secretary Steven Mnuchin plan to continue this week, but according to media reports, don't expect much from this week's pass, as several Senate Democrats oppose Trump's $1.8 trillion plan on Friday. It's 2.2 trillion. In fact, the program does not pass what does it matter, today's U.S. stocks are not a collective climax? This and carrots can not be eaten by donkeys, but also have to continue to hang it.

Today, there is also a financial news to attract the attention of many friends, is the tiger tooth fish announced the merger of this news. Tiger Tooth will acquire all of Doodle's issued shares, including common stock represented by American Deposit receipts (ADS), through a share-for-share merger. The combined company will have a co-CEO, led by current TIGER CEO Dong Rongjie and doodle current CEO Chen Shaojie, and is expected to complete the merger in the first half of next year. After the merger, Tencent will have 67.5 per cent of the voting rights of the new company, becoming the controlling shareholder of the new company, while Doo Fish will be de-listed. So far, as the country's two main head game live platform, Tiger Tooth and Doodle are finally going from competitors to a family, and behind the merger of the two is the two co-shareholders of Tencent. Tencent has reduced the internal consumption of its live gaming platforms by merging Tiger Tooth, Fish and Penguin. Today, the fish is up 12%, while tiger teeth are down more than 11%. Some friends find it strange, why the de-listed fish share price rose sharply, while the purchaser's tiger teeth share price fell sharply? Actually, it's normal. Because the basic acquirer needs to come up with cash to buy, but also face a variety of problems after the merger and acquisition restructuring. And the acquirer just need to wait to collect the money, the general price of the merger will have a premium, so this explains why today's fish share price fell sharply, tiger tooth share price rose. A friend asked me today if I could buy fish. My view is that you can buy it. This is a big opportunity to copy the bottom tiger teeth, after the live broadcast industry's carrying a brother is it, and Tencent itself has a large number of game business, can completely put the house men a net. Domestic live video platform can also be with the war, only beep miles and bytes beat its jitter and watermelon video. But the beep is already Tencent investment, and tiger teeth should not fight up, and watermelon video direct competition is beep miles, want to go to want to go should be left to shake the sound belt live this aspect and tiger teeth have a part of the rematch, but shake tone does not focus on the game copyright these, so the future of tiger teeth temporarily invincible.

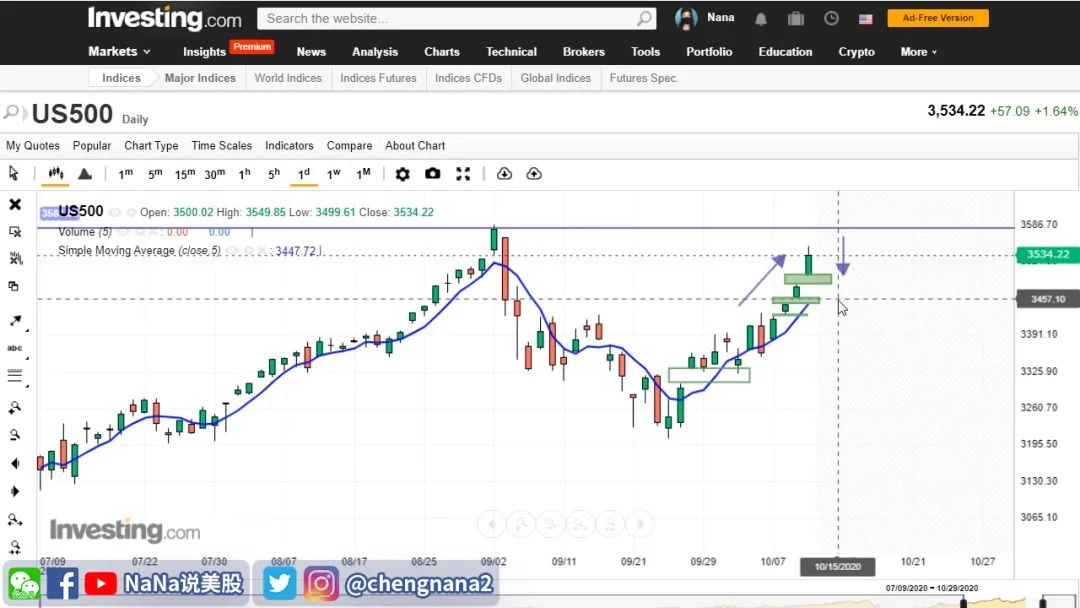

Now that we've finished talking about the dynamics of these stocks, we're going to go into the big market. Everyone knows that this multi-party gap, which jumped high here on September 28th, is a breakthrough. After the index hit a new low in the previous stage, began to stabilize, and then one day suddenly appeared a sharp jump high open trend, once this signal, indicating that the bulls have launched a round of offensive, the next index will change the previous weak trend, into a strong bull market. So I've been on this chart before, with buying at a low price above the gap and selling at a high price below, because above the gap is the market controlled by the long head and below the gap is the market controlled by the short. As the index strengthens, the constant buying also blocked the fall in the index space, into a forced short rise, the center of gravity continues to move up, continuous pull up. The subsequent round also fully validates the long-term strategy that we have been emphasizing for the last week to be low above the gap.

And the most recent 3 trading days, there is a continuous jump three yang line, that is, the index in the process of rising, there are three consecutive up jump high open yang line, 1 2 3, so left 3 gaps. In the technical form, the emergence of such a continuous short jump sanyang line often foreshadows that the stock price will soon change from up to down, is a signal of stagflation, after the market is bearish. Why is this interpreted in this way? Because in the process of rising, multi-party gas, continuous jump high open, pulled 3 yang line. But as the saying goes, a drum, and then decay, three and exhausted, this round of the surge so that many parties at this time almost exhausted the last strength. If the empty side takes the opportunity to organize a counter-offensive, many parties may not be able to resist. Therefore, we see this K-line pattern, we can reduce positions, when found that the next trading day if the index in the market from up to down, closed out the big Yin line and other peak K-line pattern or fell below the 5-day average in time to stop the loss. Even if it is only because the short-term index rose too sharply, the rise in the relay, the short-term index adjustment is also a high probability event. That's one of the reasons why I said on Friday and Sunday that I was short-term worried that this rally in the broader market might not last this week.

By Friday, though, there had not been a gap in today's high jump. But there are already 2 gaps, so today's high jump open strong upward trend has added to my worries. Look at the finger, there is exactly the same trend, jump three lianyang, so I also in today's market to remind members to keep profits, ambushed in advance those stocks have a profit can sell a part or set a take profit stop loss. Here, I also remind you, be sure to do a good job of wind control, such as now to their positions set take profit stop loss. In the event of a change of stock, it will not be caught off guard and lead to a sharp return in profits. But people don't panic, tomorrow's Apple launch and Amazon PRIME DAY, unless there is a sudden black swan incident, or Trump suddenly pushed the plate, otherwise the probability of jumping low open is relatively low.

Tomorrow, if the market can appear high open low go, or the situation of stagflation, we can do the operation of reducing positions or leave the market first. At present, I cannot predict whether a correction in the index will be a reversal of the trend or a short-term upward relay adjustment. You can only continue to observe step by step. As the index runs to its current position, the market is struggling to maintain the current high valuation level of U.S. stocks, and while there is a premium in the overall U.S. stock market caused by the Federal Reserve's water release, companies will also have to prove to investors in the third quarter that the current overvaluation level is justified.

JPMorgan Chase will report third-quarter results before the market starts tomorrow. Analysts had expected earnings of $2.05 per share and sales of $27.72 billion. If financial stocks get off to a good start, it will help boost confidence in the U.S. economic recovery as banks' trading and underwriting businesses continue to boom. Overall, for the third quarter earnings season, U.S. corporate earnings, I am still optimistic, at least in the short term, if these data can surprise investors, it is expected to continue to provide U.S. stocks with the fourth quarter of the rally support, after all, according to historical data, the fourth quarter is usually the best performance of the U.S. stocks in a year, the S.P. 500 in the quarter's historical average increase of 3.9%, a cumulative gain of 79%. Over the past decade, as long as U.S. stocks have grown sharply in the third quarter, they will continue to rise for most of the fourth quarter. There is now a general perception among investors that if the economy is bad, the U.S. government and the Federal Reserve will take further fiscal stimulus to boost the market and U.S. stocks will rise. If the economy is good, there will be no action, and U.S. stocks will rise. "So everyone thinks the fourth quarter dollar is something to worry about. I have to admit to you that I was convinced by this logic. After all, in an environment of low interest rates for years to come, where can money go except for the stock market? So on the whole, don't worry too much. In the short term, however, the broader market is about to see a correction.

Read about it

Trump tweeted, "Hey, the market is good!" These plates are about to explode!?

Broker recommendation

Paid articles

If you're already a member of Youtube, go to Youtube to watch the paid video content on WeChat Public and the same as the membership video on Youtube, but there's more video text.

Members - 10 minutes to understand K-line analysis and patterns!

For more paid videos, please point directly to The Member on the main interface of the Public Number - Member Video,

Or reply to keywords:Member.

You can see the description. 。

Disclaimer

NaNa's videos and articles are for personal experience sharing and spitting, not investment advice!

Any view that appears in the video and the analysis of individual stocks only represents my personal point of view, not necessarily guaranteed to be completely correct! It is not recommended to blindly adopt the app! The stock market is changing rapidly, risk is everywhere, investment needs to be cautious!

I am only responsible for my own investment profits and losses, and I am not responsible for the investment actions of any individual or institution! Any of my views are not investment advice for any individual or institution!

Subscribe to ours

They're all rich!

ID:nanashuomeigu

Press and hold the sweep code to follow us

RememberShare,"Like"And."Looking at it."Oh! ~

Send to the author