Global Ultra Leisure Game Advertising Spending and Revenue Top 10 Advertising Network List and 4 Key Points - "Ultra Leisure Game Marketing Foundation Report 2020" Morketing Global interpretation

The following article is from Morketing Global Author Morketing Global

Read about globalization here! Global marketing business media Morketing's Matrix sub-account for the offshore industry. Track chinese companies' sea-going tracks to learn about major new developments in overseas markets.

Sylvia Ma

In fact, ultra-casual gaming is not a new concept, but it is obviously small, it has been difficult to cash through internal purchases, but with the development of Internet advertising technology to fill its commercial logic defects.Low trial and error and opportunity costs from low development costs have made it a fast-growing hot spot in the gaming industry in 2019, with some moderate and heavy gaming companies also experimenting with ultra-casual games, in addition to the new work room.

The word "ultra-casual game" first came from an article published by Johannes Heinze, managing director of AppLovin. He summarizes three characteristics of ultra-casual gaming:

1、“Snackable content, instantly available”即:Attract players to fast-food game content, the use of fragmented time can play, download fast, install fast, get started quickly.

2、“Simple but addictive gameplay presented in a minimalistic fashion”:The gameplay is simple, addictive, and the style (design) of the game is minimal.

3、“Cashcow”,引用剑桥词典对这个词的解释“a business, product, or service that makes a large profit, often used to make money to support other business activities”,Combined with the actual situation of ultra-casual games, it can be understood here that the revenue of ultra-leisure games is generally very good, and to a large extent rely on advertising traffic cashing out, but also for advertisers to provide a large amount of traffic.

As can be seen from the above features, the advertising and advertising revenue data of ultra-casual games have high reference value for both gamers and advertisers. In the opening year of 2020, Tenjin released the Ultra Leisure Game Marketing Benchmark Report 2020, which combs through the CPI data for the 2019 Ultra Leisure Games by Country and Advertising Network, which contains anonymous data on all ultra-leisure games collected by Tenjin from January 1 to December 31, 2019, CPI and the Advertising Network (the report is aggregated by the top 10 ad networks for advertising expenditure), The CPI report includes only countries and regions that spend more than $1 million on advertising.

By combing and interpreting the contents of the report, Morketing Global distills four key points of information on the cashing out and buying volume of ultra-casual games.

Even if the price is higher,

Advertisers are still willing to pay for iOS platform users

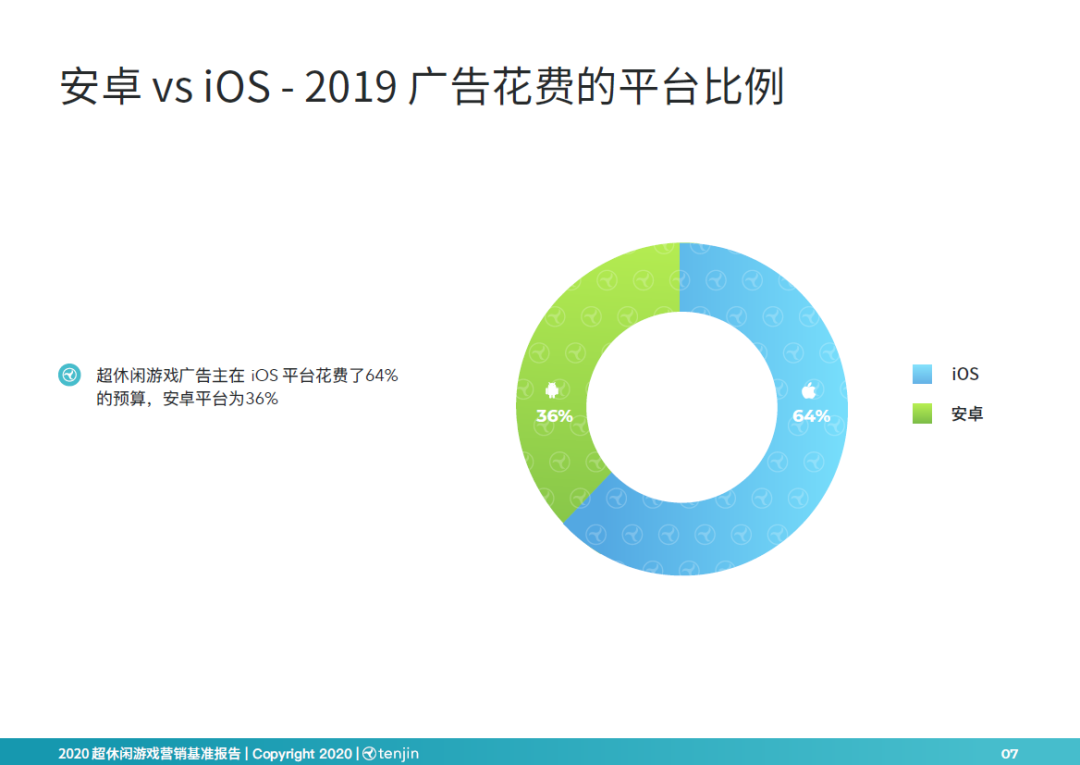

The median CPI for ultra-casual games on Android platforms in 2019 is $0.18, down from $0.34 for iOS. In 2019, ultra-casual game advertisers will spend four or six times on two platforms: 64% on iOS and 36% on Android. Although iOS has a much higher median CPI than Android, the former attracts more budgets from advertisers with better ROI.

Europe, The United States, Japan and South Korea and other mature markets high investment high returns,

Or because of the complexity of channels to prevent overseas games into China

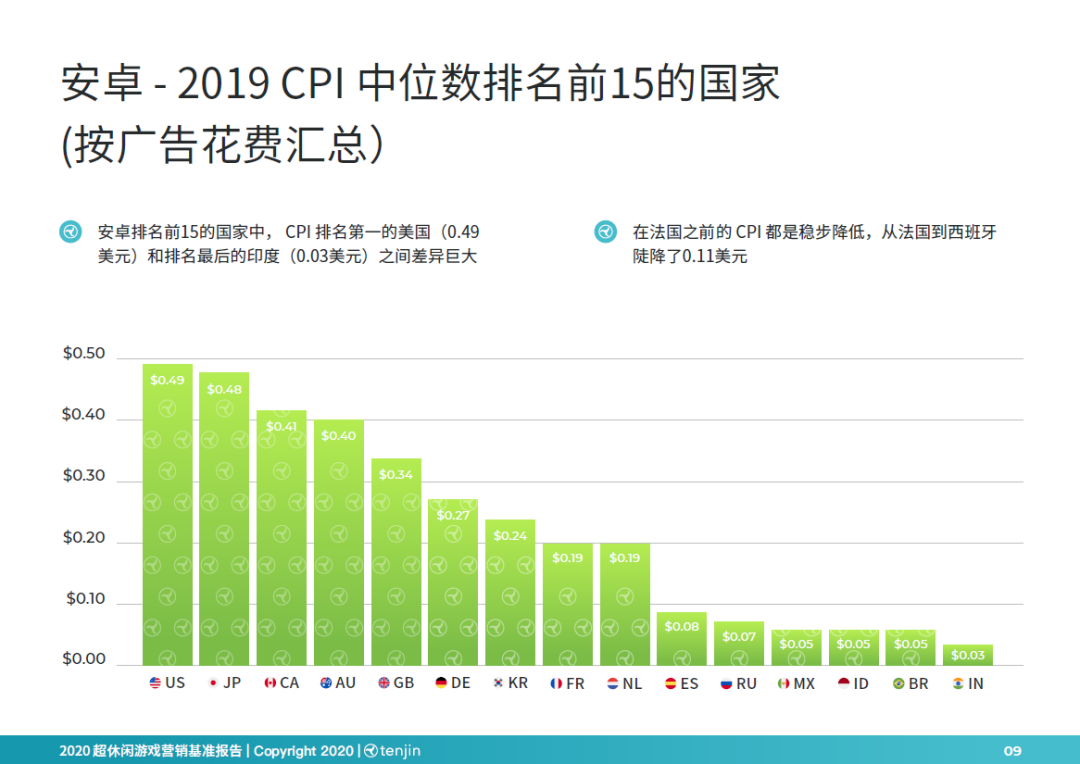

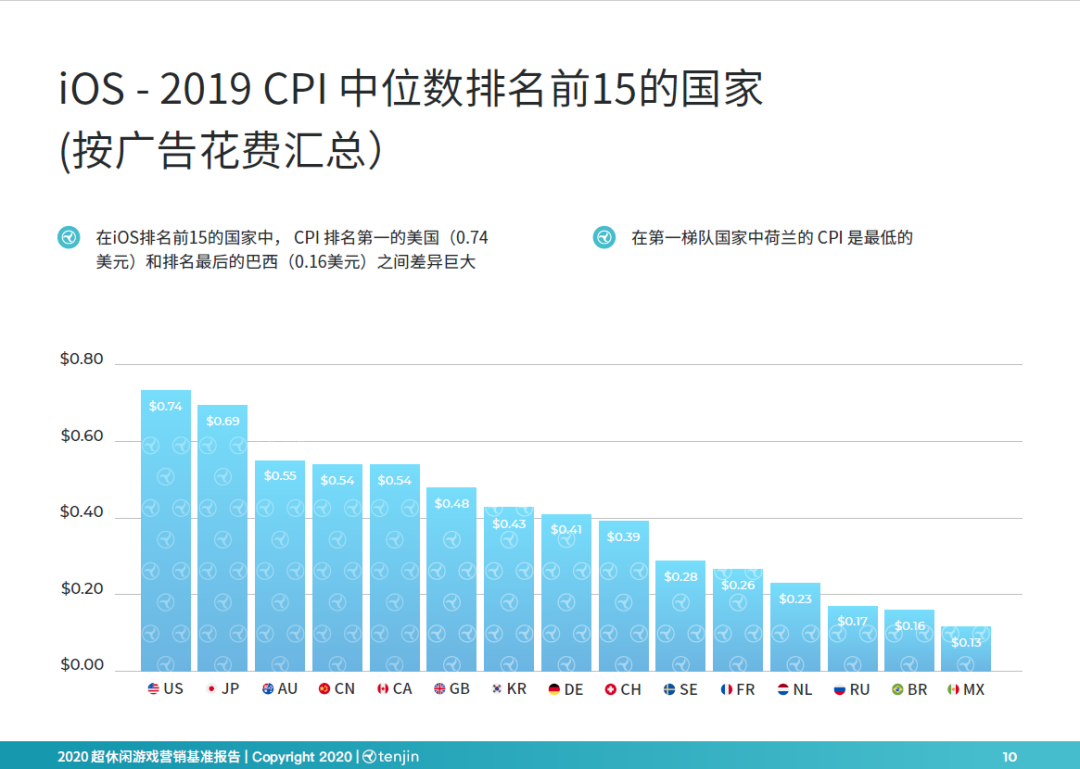

In terms of country rankings, whether it's Android or iOS, the U.S. ranks 1st in the median CPI, and it's very different from the 15th-ranked country.Tenjin notes that the report only includes countries and regions with more than $1 million in advertising spending, so while the median CPI looks low, the amount of advertising spending in the top 15 countries and regions is small.

The top 10 countries in the median CPI for dual platforms are the United States, Japan and South Korea, as well as Western Europe and other more mature gaming markets. China does not appear in the Android platform rankings, ranking fourth in the iOS platform rankings, perhaps as a result of the complexity of the domestic Android ecosystem that has led foreign manufacturers to abandon access to the Chinese market.

After talking about similarities, look at the differences between the two platforms.The first is the difference in the extreme difference (maximum-minimum).The difference between the median CPI in the top 15 countries of the Android platform is significantly higher than that of the iOS platformOn Android, the median CPI in the U.S. ($0.49) is 16.3 times higher than in India, and on the iOS platform it's only 5.69 times ($0.74 in the U.S. and $0.13 in Mexico).

Second, the top 15 countries in android's median CPI data show a clear fault lineFrance and the Netherlands, the bottom tier of the first tier, fell sharply, with Spain's median CPI at 42% of France and the Netherlands ($0.19). In contrast, the chart curves of the top 15 countries in the IOS platform's median CPI are smoother without significant fault lines.

The iOS platform's median CPI performance is more consistent and natural in terms of differential and echelon distribution.The huge difference and apparent fault in the top 15 of the Android platform CPI is a reflection of the immaturity of ultra-casual gaming in emerging markets and a reflection of the uneven type of Android platform users in some markets. At the same time, the very low CPI compared with the developed countries of the gaming industry also shows that ultra-casual games in Brazil, India, Indonesia and other emerging markets still have a large market space.

iOS and Android ads cost the top 10 ad networks

In terms of advertising network list, the top 10 advertising networks in dual-platform advertising spending are basically the same, only in the ranking difference,The aggregation platform represented by Applevin ranks high. Tapjoy appeared only on Android's list, ranking ninth. Apple Search Ads is the ninth-largest iOS platform. AppLovin takes the top job with dual-platform advertising. It's no surprise that Lion Studios, the game publisher owned by AppLovin, spends a lot of money on ads for ultra-casual games. The other five in the top six are: Facebook, IronSource, Google Ads, Unity Ads, Vungle.

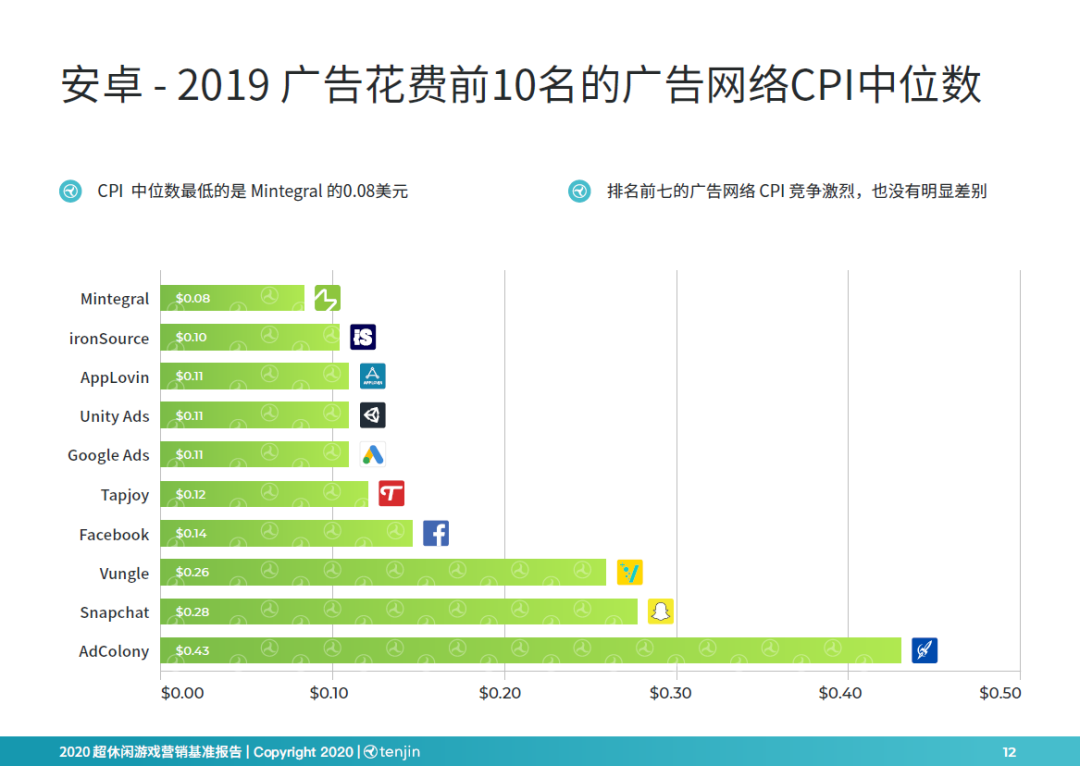

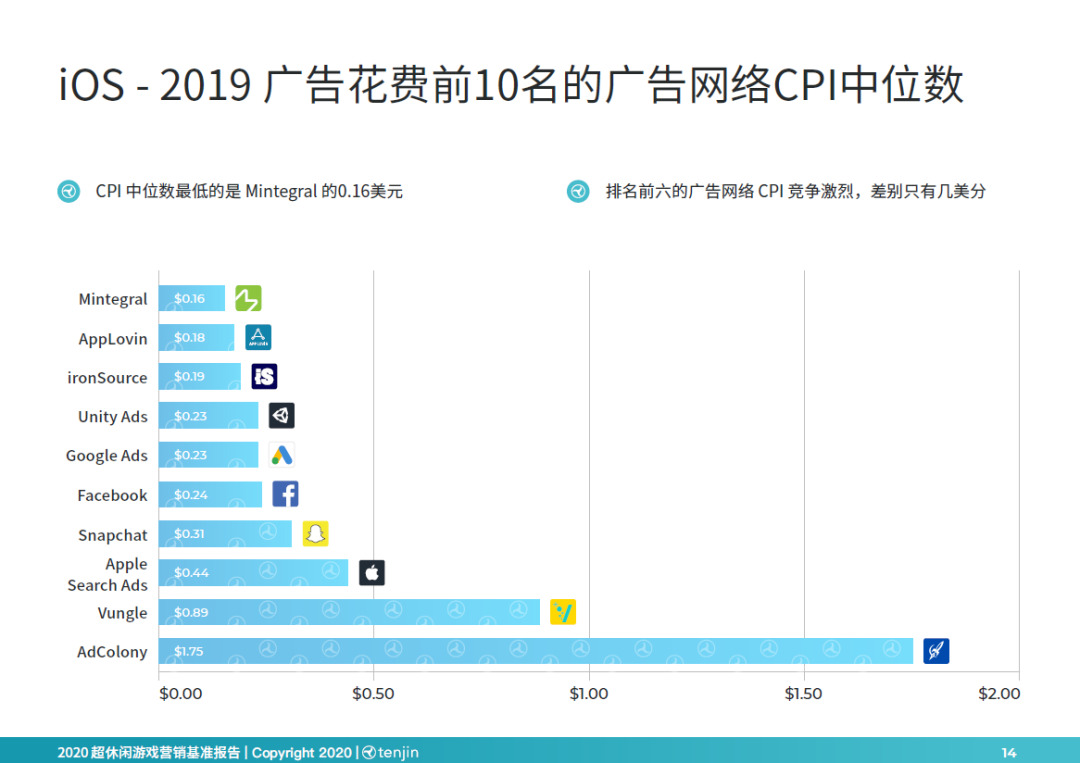

In terms of the median CPI ranking of the advertising network, the top seven android platforms and the top six iOS platforms are highly competitive, with the median CPI gap of only a few cents, while the median CPI of the last few is much higher than the previous few, with significant faults.

It's worth noting that Mintegral has done very well in 2019, with both platforms being the lowest-median advertising network in the CPI. According to Morketing, Mintegral has become the first Chinese platform to support In-app Bidding, and has been successfully aggregated by industry-leading aggregators such as AppLovin's Max platform and MoPub. AdColony is 10th in the median CPI for both platforms, about five times the median CPI on Android and about 10 times the median CPI on iOS.

In terms of the performance of individual ad networks, Snapchat failed to make the top six in the median CPI, which is related to western European countries with a higher median CPI for its main user base. Apple Search ads did not particularly well in ultra-casual gaming advertising, but it was a global leader in tool application advertising in the AdsFlyer Comprehensive Performance Report (10th edition) released in March.

AdColony's median CPI is significantly higher than other ad networks. According to its official website, AdColony is one of the first companies to develop applications on the iOS platform, they attach great importance to advertising creativity and quality, and have a deep understanding of user retention and transformation, while paying attention to the user to bring a good experience.

Top 10 Ad Revenue List,

The "two-headed monopoly" has eased on the iOS platform

In terms of ad realization, 63 per cent of the revenue from ultra-casual gaming publishers comes from iOS platforms and 37 per cent from Android platforms, a difference of only 1 per cent from advertising spending on both platforms.

In terms of advertising platform revenue rankings, Google and iOS, which have long touted Android as the top platforms, are at the top of the dual-platform rankings. In addition, it is worth noting that MoPub, ironSource and other aggregation platforms are also very bright performance. Google and Facebook's dominance on both platforms appears to be being challenged by other head companies.

The ad networks in the top nine of dual-platform ad revenue are consistent, with only rankings: Google AdMob, Facebook Audience Network, ironSource, AppLovin compete for the top four, Unity Ads in fifth place, and Vungle, Mintegral, Tapjoy, and MobPub in sixth to 9th place. Android's 10th-place advertising revenue was AdColony' and iOS platform's 10th-place finisher was Ocean Engine.

In AppsFlyer's Comprehensive Performance Report for Advertising Platforms (10th edition), released in March, the top five in the Composite Performance Index were: (1) Google Ads, (2) Facebook, (3) IronSource, (4) AppLovin, and (5) Unity Ads, which is exactly in agreement with Tenjin's top five ad networks in its dual-platform advertising revenue. These companies have not only achieved world-leading advertising performance, but also in the ultra-casual gaming sector.

Tapjoy didn't make the top 10 ads spent on iOS platforms, but appeared in the top 10 in iOS platform ad revenue. Tapjoy was named ROI's top media resource on both iOS and Android platforms in the 2020 Singular ROI Index report released in February, while ROI on dual platforms in Europe and Asia Pacific continued to grow.

Also not in the top 10 of iOS platform ad spending but in the top 10 of ad revenue is OceanEngine (The Big Engine). Ocean Engine is the official marketing service brand for products such as headlines, shakes and watermelon videos. It also shows to some extent that the 400 million-day live holding based on jitter, and the jitter small program exempts the short link that can be downloaded and clicked. Byte beats are a big gain in the field of small programs in 2019.

Conclusion.

The Tenjin 2020 Ultra Leisure Game Marketing Benchmark Report shows us the basic picture of global ultra-casual game advertising and realization in 2019, starting with both national and advertising networks.Despite the slowdown in growth, with very low median CPI in countries such as Brazil and India, we can estimate that there is still more room for ultra-casual gaming in emerging markets. On the ad network side, head companies are highly competitive, and Ocean Engine's entry into the top 10 of advertising revenue on the iOS platform is impressive. Affected by the outbreak, in 2020 "home" economic development is rapid, ultra-leisure games in this year's performance is worth looking forward to.

To download the report, please click on the original text and fill out the form to obtain the original report

Go to "Discovery" - "Take a look" browse "Friends are watching"