Source of the original text  The Economist-20200926期「Business」Microblogging:Weibo woesNo light at the end of the tunnel for China’s answer to Twitter

The Economist-20200926期「Business」Microblogging:Weibo woesNo light at the end of the tunnel for China’s answer to Twitter Micro-blogging: Weibo dilemma

The Chinese version of Twitter is struggling for the future

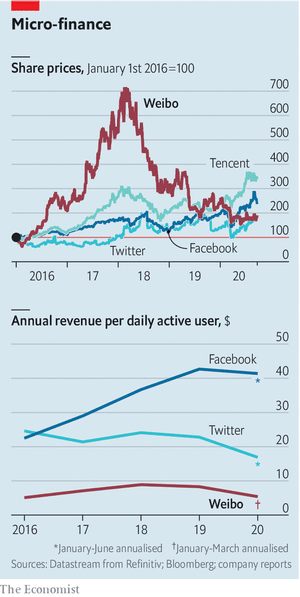

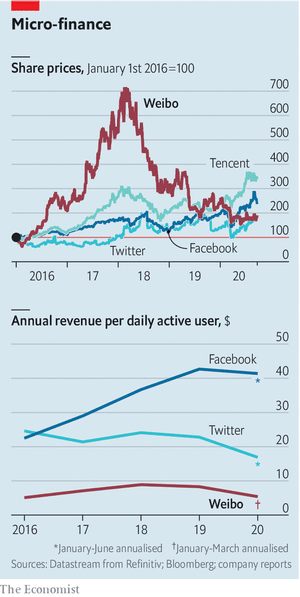

Three years after Twitter launched in 2006, Chinese techies created a similar microblogging service in China. Weibo (literally “microblog” in Chinese) boasted an average of 241m daily active users in March, more than Twitter. Like its American cousin, Weibo allows users to follow other users, tweet, retweet and browse a real-time list of trending topics. And like Twitter, it relies heavily on advertising revenue.Twitter was launched in 2006, and three years later, China's tech community was born with a service similar to micro-blogs. Sina Weibo," Chinese "micro-blog", surpassed Twitter in March with an average of 241 million daily active users. Sina Weibo is similar to its U.S. "cousin" Twitter feature: users can follow other users, post tweets, retweet microblogs, and browse real-time "hot searches." In addition, advertising revenue accounts for the majority of microblogging revenue, which is similar to Twitter.So as coronavirus-induced uncertainty led advertisers to slash budgets, Weibo saw advertising revenue, which accounts for nearly 90% of sales, plunge. In the first quarter it fell by a fifth year on year, to $275m. Operating profit plummeted by more than half, to $58m. Delayed second-quarter results, due on September 28th, may be less terrible. China was the first to be hit by covid-19 but began to recover just as the West went into lockdown.The outbreak of the new crown has caused a lot of uncertainty. Advertisers have clasmed their purses to cut advertising budgets, and advertising revenue has fallen sharply since then, accounting for 90 per cent of its total revenue. In the first quarter of 2020, Weibo's advertising revenue was $275 million, down 20% from a year earlier. Operating profit fell to $58 million, down from $58 million a year earlier. The second-quarter figures, which are expected to be released on September 28th, are expected to look slightly better. The West has just launched a city closure, and as the first country to be baptized by the outbreak, China's economy is beginning to recover.But Weibo also confronts a longer-term challenge. Yujun Shao of Westwin, a Shanghai-based digital-marketing firm, notes that for much of the past decade two firms—Weibo and Tencent (which owns WeChat, a messaging service)—sucked in the vast majority of advertising spending on Chinese social media. Today the “big two” are competing for ad yuan with another behemoth, ByteDance, which operates Douyin, an addictive short-video app (as well as TikTok, its global version). Other rising internet stars, such as Pinduoduo, which offers bargain shopping, are also muscling in on the advertising market.However, for Sina Weibo, there are also far-off worries. Nie Yujun of West Window Technologies, a Shanghai-list digital marketing company, points out that the vast majority of advertising revenue in the domestic social media industry has been pocketed by the two giants, Sina Weibo and Tencent, the parent company of the messaging app WeChat. And now, byteDance, another industry giant, is also a strong addition to the double-powered battle for a piece of the advertising business. Countless users are addicted to the short video app Jitter (and the international version of Jitter TikTok) which is a subsidiary of Byte Beats. In addition, other Internet up-and-down rookies, such as the main special shopping more than, also began to stare at the advertising market this big cake.Weibo already boasts more than half a billion registered users in China. But user growth has slowed. To keep advertisers on board, Weibo must therefore boost user engagement. The company understands this. It already sports a richer array of functions than Twitter, for example a popular question-and-answer service in the mould of Quora. It is constantly adding new ones. In 2018 it acquired Yizhibo, in which people live-stream stand-up comedy, moonwalks and other acts for tips. Last year it launched a photo-sharing service akin to Instagram called Oasis. Still, Weibo’s revenues per user have been declining since 2018, and its share price with them (see chart). That is one more feature it has in common with Twitter—but is the opposite of what you would expect from a platform with strong network effects, such as Facebook.■In China, Weibo has more than 500 million registered users. But user growth has slowed. To prevent ad losing, Weibo must increase user activity. Weibo clearly knows this. Weibo is more feature-rich than Twitter, which has launched a question-and-answer service similar to Quora, a foreign site, and is popular. Weibo continues to push new ideas. In 2018, Weibo acquired a live stream where users can earn a reward for a single-player comedy, space dance or other show; last year, Weibo launched an Instagram-like photo-sharing software, Oasis. Since 2008, however, the profitability of Weibo's unit users has been on a downward trend, and share prices have fallen. That's the same thing as Twitter. But with such a powerful web effect (like Facebook), you probably wouldn't expect it to go downhill.■

A team of Economists every dayPDF version of the file/full textNotes/vein combingGrammar parsing/writing accumulation/question-and-answer interaction

See The Economist's Reading Community

Sweep the code to learn more

Receive fresh bilingual newslettersTake you to discover the joys of Reading in English

The Economist-20200926期「Business」Microblogging:Weibo woes

The Economist-20200926期「Business」Microblogging:Weibo woes

Go to "Discovery" - "Take a look" browse "Friends are watching"