Netflix's Wealth Password: Let users grow wildly until the world is destroyed

The outbreak of the new crown in the world, promoting the "home economy" of the strong development. Since the outbreak, more than 80 per cent of US and UK users have said they have consumed more content in the print media, radio and television, and on streaming platforms than ever before, according to a report by Global Web Index, a UK market research firm.

Recurly's research data further showed that during the outbreak, streaming service subscriptions grew by an average of more than 30 percent, with an extreme value of 87 percent (in May).

Since its inception in 1997, Netflix seems to have been on the fast-growing "Kangzhuang Avenue." As the key to the success of Netflix's business model, it is significant that subscribers can grow steadily.So what are the main features of Netflix's user growth strategy at all stages of its growth? How does Netflix continue to grow its subscriber population?This issue of All Media (ID:quanmeipai) is an indulging in user growth, approaching the fast-impacting Hollywood streaming giant as a new myth.

different stages, equally crazy growth

From its inception to today, Netflix's core business model has been stable, with cost-effective subscription fees to increase the number of subscribers, resulting in major revenue. So unlike advertising-focused platforms such as YouTube, netflix's number of users is not a "focus economy" that can be sold, but a real "real money". For Netflix, the user is the real "dad."

"User Growth" is its core KPI, and in order to achieve this goal, Netflix's user growth strategies vary at different stages of its growth.

1997-2007: Low-cost high-quality growth

In 1997, Read Hastings, the founder of Netflix, founded Netflix after complaining about the high and inconvenient rental service of traditional video rental company Persida, and launched online video rentals in 1998. At the time, Netflix's business was called a "three-none" service by users - no lease limits, no shipping costs, no handling fees.

In 1999, users could rent four DVDs for a minimum of $4.99 a month. From then until the dotcom bubble of 2000, There were still huge numbers of offline active users, and online, all kinds of free trial, delivery start-ups, also caused a block to the development of Netflix. By 2002, Netflix had only about 860,000 subscribers.

But then came the Internet era, the traditional movie rental model quickly collapsed, Netflix's online low-cost strategy, to meet the needs of users at that time, subscriptions in the next few years ushered in a rapid growth.In 2003, the number of subscribers exceeded 1.5 million, and in 2007 the number reached 7.5 million, with a compound annual growth rate of 55%.

2008-2013: Original content growth

Between 2008 and 2010, Netflix rooted its services in home TV terminals, PC terminals, and so on by reaching out to families and allowing users to access content on multiple ports through one account. These channels and in-portal strategies have helped Netflix achieve continued user growth, climbing from 7.5 million in 2007 to 20 million in 2010.

At this stage, of course, the key to Netflix's rapid subscriber growth is to penetrate the market as a reformer and take on a tough challenge to established service provider Persia through high-quality, low-cost, convenient services.

At the time, per five movies were rented for $9.99, with a five-day deadline, and Netflix had a monthly membership system that allowed users to choose from hundreds of thousands of movies online and order a new one immediately when they returned it, without paying an extension penalty.

With challenges and rewrites to established rules of the game, Netflix has seized on the growth passwords of the new era, with the influx of subscribers directly returning revenue. In 2007, Netflix generated $1.2 billion in revenue and $67 million in profits, and by 2013, Netflix's subscriber base was at a record high, with revenue of $1.1 billion in the single quarter, essentially the same as in the whole of 2007.

Netflix spun off its DVD rental business in 2010 and focused on online channels, anticipating that DVD rentals would be replaced in advance.It also allowed Netflix to make a natural transition from traditional disc rentals to online streaming services when the "crisis" came.

During this time, Netflix invested heavily in the purchase of film and television rights, adding to its content library and providing more reasons for users to subscribe to their own services.

With the cost of copyright increasing and more content producers building their own streaming platforms, Netflix has semi-voluntarily and semi-passively embarked on the path of home-made drama.In 2013, Netflix's home-made drama House of Cards came out in a stunning state. The play received nine nominations for Best Episode, Best Actor and Best Actress at the Emmys. The first two seasons cost as much as $4 million, far more than the average price of a traditional American production.

Since then, this familyStreaming platforms have opened up a transition from content service providers to content producers.

Thanks to the increase in home-made original content and the acquisition of copyrighted content, a large number of popular episodes such as Friends and Women's Prison have been included in the content library, driving Netflix's continued growth in user base. Netflix, for example, added 3 million subscribers in the current quarter after "House of Cards" launched in 2013.

2013-2020: Overseas layout for growth

The U.S. market completed the construction and popularization of streaming media earlier.As the dividend for domestic users weakens in the U.S., the vast overseas market is a new target for Netflix.

In fact, as early as September 2010, when old rival Persia declared bankruptcy, Netflix began to implement the important strategy of internationalization. It first launched a streaming service in Canada, then south America, then Europe, and finally Asia. In May 2014, Netflix announced the launch of an online video subscription service in six countries: France, Germany, Austria, Switzerland, Belgium and Luxembourg. Starting in 2015, Netflix has accelerated its global footprint.

In 2014, 2015 and 2016, Netflix had 57 million, 74 million and 93 million subscribers, respectively. By the end of 2017, Netflix had 190 countries and territories providing services, and in the third quarter of that year, its global subscriber size exceeded 100 million for the first time. By the end of 2018, that number had reached 139 million. In April, Netflix announced that it had 183 million paid users worldwide.

Providing international users with more international content and tailor-made, localized content are two of Netflix's main aggressive overseas expansions.

In 2014, Netflix acquired the BBC's costume drama The Blood Mafia.Peaky BlindersThree seasons of network rights; in 2015, Netflix introduced the TV series "Censorship" from China, which was re-edited and aired for 90 minutes per episode of the six-episode series; and in 2017, Netflix announced that it had bought the Indian film "The Inch of Love"Love Per Square FootCopyright and broadcast exclusively on your own platform...

Netflix also produces original content that is not in English, in response to market demands in different countries.For example, its first non-English-language original play, Lily Hammer (Lily hammerAll are filmed in Norwegian locally. In Japan, Netflix has also adopted a localization strategy, co-producing "Double-Decker Apartments" with Japan's Fuji TV (CX).Terrace Houseand "The White Collar in Underwear" ()AtelierAND other TV dramas.

Looking back, while the high cost of home-made content overseas and the reludes of localization have made Netflix's expansion path difficult, the returns from overseas markets have been strong in terms of user growth.

Especially considering that Netflix's growth in North America is already very weak, and it has to face intense competition from streaming media such as Disney plus and Apple TV plus.

Took Hollywood, but lost to Wall Street

Copyright and home-made content are core competencies for streaming media platforms.

Today, when people talk about Netflix's success, the first thing that comes to mind may be the company's huge investment and output in original content. But the early Days Of Netflix didn't really look original, or even followed in that regard.

In a typical case, in 2008, Netflix struck a four-year copyright agreement with Starz, the cable station, under which it could get 2,500 films from Starz for $30 million. In 2012, when the contract expires, Netflix subscribers grew rapidly, and Starz raised the renewal price to $300 million. The two sides failed to reach an agreement because of the high price, and as a result, the 2,500 films were taken off the Netflix platform overnight.

As a result of the incident, Netflix began to make efforts in the original content space, which led to "House of Cards," "Black Mirror," "Mamma Jack," "Strange Things," "Love, Death, and Robots"... Today, these classic episodes have become Netflix's signature.

During this outbreak, Netflix was able to stay ahead of many streaming platforms, thanks to its solid content reserves, and basically completed most of this year's programming before the outbreak.

Netflix's home-made multi-stream hit show has attracted a large number of new subscribers. According to statistics, at least 64 million people watched Netflix's new documentary "Tiger King" in the first half of the year.The Tiger KingIn addition, the reality show "Love Is Blind" ()Love Is BlindIt is also popular with users and attracts more than 30 million viewers.

But at the same time, Netflix is facing a "crackdown" from competitors who are playing the same way, and it's become common practice to invest heavily in original content production.

Netflix is losing the rights to "evergreen tree" classics such as "Friends" and "The Intern Grey" as more and more original content partners join the streaming wars, such as Warner Media's launch of streaming platform HBO Max and Disney's Disney Plus.

Photo credit: Vision China

As external copyrights become increasingly difficult to obtain, Netflix is destined to add weight to content production if it is to continue to attract users。But commercially, it looks more like a dangerous game of "shaky".

One set of data is noteworthy: Netflix's content cost about $30 million a year from 2008 to 2010, and has grown to $12 billion to $13 billion by 2018. So the next time we see news like "Netflix borrows billions to invest in new shows," we don't need to be surprised.

High content creation costs, so that Netflix has long been in the "high growth" and "high debt" of the embarrassing situation, operating income and net profit upside down, is the industry's general view of Netflix.Some analysts have said that Netflix won Hollywood but lost to Wall Street.How long Netflix can last under this "burn money" for "growth" business model remains a question mark.

The core is content, but not just content

For streaming media, content king is the basic law. However, combined with the market law, no platform can rely on cost-effective content alone to achieve continuous expansion. In addition to its obsession with spending money on shows, Netflix's secret to keeping users growing can also be found in marketing.

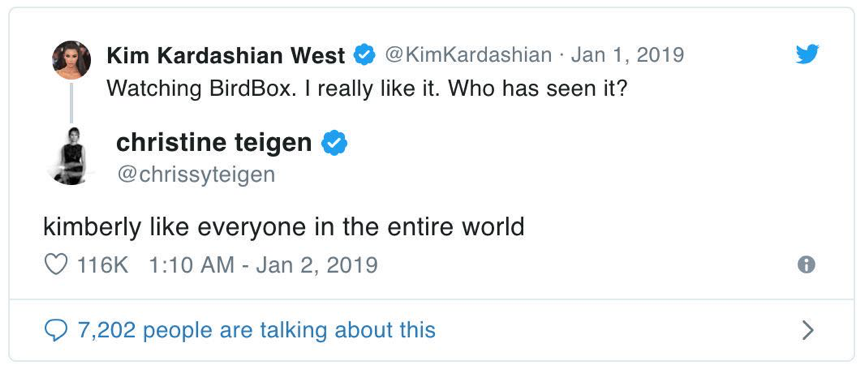

In 2019, Netflix launches the new thriller Bird Box, Blindfolded. Kim Kardashian, who has 60 million followers on Twitter, later posted a video-related message in the comments area, with another of her best friends, Chrissy Teigen, replying: "Oh my God, it feels like the whole world is watching this." "

This conveys the charm of a Netflix series: the ability to easily create a user perception that "the whole world is watching, and I don't watch it longer." Behind this is Netflix's sophisticated social media and branded content strategy.

In the traditional promotion model, the platform will be through the website recommendation, APP push and other ways to market users, but Netflix obviously has a more unique marketing means. "We found that the most effective way to drive viewing growth was chic user service," said Chris Jaffe, its vice president of product innovation. "

Netflix's social and branded content divisions serve as engines for subscriber growth, ensuring that Netflix's shows will always lead the popular culture's communication hotspots and be active in people's daily conversations.

On social media such as Twitter, Netflix has a large number of loyal episode fans. The secret to maintaining a relationship with a fan is to try to increase user engagement and interactivity. Netflix sometimes simply forwards material, and sometimes it's creative to work with creative companies to launch "viral" emoji packages and other material.

Netflix has a 15-person social media operations team in the U.S., bringing together a group of sci-fi and comedy fans (both of which are also the head content on Netflix), all with experience in marketing, news, public relations and entertainment.

With the richness of Netflix's original content, these accounts have grown from a single subject to a media matrix, focusing on different markets such as comedy, family drama and animation.Netflix also has independent social media teams in different countries and regions, and these accounts are uniquely localized while maintaining a degree of unity.

In 2018, Ted Sarandos, Netflix's chief content officer, described it this way, "Social media can effectively create a collective viewing experience." Not only do people like to watch movies, they also like to reminisc about it over and over again and discuss it on Ins or Facebook. Globally, it's an amazing shared experience. "

For Netflix, social media is not only the platform's "voice", but also for the brand voice, brand perception and image, brand people and fans to migrate the spread of important occasions. And all of this will eventually be fed back into the growth of paid users and the consumption of overall content.

Is there an end to growth?

In 2018, the streaming giant is expected to have 360 million users by 2030, according to an assessment agency. There are already more than 1 billion platforms in the content and communications APP market, but considering that Netflix users are mostly paid, 360 million is a staggering number.

We can't predict whether Netflix will continue to grow at this rate over the next decade, but if we're going to answer the question "Is there an end to its growth," maybe we can take a different dimension and see how the platform retains.

How did this near-miracle figure come about when Netflix's subscriber churn rate remained around 9%, according to the data?

As a subscription service provider, Netflix is at risk every month that users may choose to unsubscribe. Providing high-quality content that users are willing to pay to watch is, of course, the primary factor, while new notifications, consecutive monthly offers, etc. are commonly used by streaming platforms such as Netflix.

But beyond that, focusing on the user experience and keeping users "addicted" is also a reason to ignore, let's talk about it in detailNetflix is representativeThe user retention play.

First, in terms of functionality, Netflix has always been focused on listening to the needs of its users and improving the user experience based on their needs.

In 2019, for example, Netflix introduced multi-speed viewing on the Android operating system side, providing users with viewing options at different speeds, such as 0.5x, 0.75x, 1.0x, and 1.5x. On August 1st this year, Netflix will have this feature on all ends.

According to Netflix, the feature was born out of "a strong demand from users." At the same time, Netflix says the feature will benefit the hearing impaired. By slowing down playback, more hearing-impaired people will be able to enjoy video content better.

Double-speed playback is nothing new to Chinese audiences, and has caused some opposition in the U.S. industry because it undermines the integrity of film and television content and is seen as "an artistic injury to the work."。But in the context of Netflix's product system and marketing, this feature was eventually sublimation to the point where the user experience is at its core and social public services are delivered.

Second, Netflix has been raising prices in recent years because of rising costs. But in order to take care of and retain older users, Netflix's latest pricing is generally delayed for older users. This is a retention strategy that deserves careful observation.

How does it work? Take a price increase in 2019, when CNBC reported that Netflix decided to increase subscription prices in the U.S. by 13 to 18 percent, base service subscriptions from $8 to $9, and HD and 4K from $11 and $14 to $13 and $16, respectively, in order to better present video content.

Even if the new pricing was aimed only at the mature U.S. market, it still had a rapid impact on Netflix's user growth at the time, and the delay in the entry into force of older users took some pressure on it, creating a bottoming and cushioning effect.

ThirdAt Netflix, there's a dedicated team that studies users' browsing and viewing habits.In order to maximize the user's personalized needs.

What is the number of users for the entire episode, how long the user has been watching the gap between the last and new seasons, where the user pauses and fast-forwards, the user rates the video, and what the user's search term is... These user portraits are very mature.

For example, when pushing trailers for House of Cards, Netflix produced different versions for different genders and occupational groups of users.

Photo credit: Vision China

In addition to all of the above, Netflix is constantly testing and refining to prevent loss of subscribers.

In May, Netflix announced that it would ask users who had not used the platform in the past year if they would like to keep their subscriptions. If the user does not reply, Netflix will automatically cancel the subscription.

Eddy Wu, head of product innovation at Netflix, said: "For those who have subscribed to Netflix but haven't watched anything in the past year, we ask them to confirm whether they need to retain their membership. "

The move is unusual in a group of platforms that promote automatic renewal services, looks very public-spirited, and highlights Netflix's value proposition for its users. But from a retention perspective, this is essentially a wake-up call strategy. The ideal result is increased platform user activity.

By the first quarter of 2020, less than 0.5 percent of its 183 million global users will have inactive accounts, according to Netflix.

Netflix also showed polite restraint in pushing new content. Currently, users can turn off notification push by email or app settings. Netflix says users should be interrupted unless they don't resent the messages.

All in all, whether it's laxin or retained, Netflix's entire system around user growth has been playing a huge role over the past 23 years.

For Netflix, which has become a symbol of cultural consumption, sustaining growth is still important, but sustained growth is always a challenge. The ever-increasing competition in the streaming market has brought more variables to the 23-year-old giant. But in the final analysis, master the law of user crazy growth, also master the market's wealth password.

Go to "Discovery" - "Take a look" browse "Friends are watching"