How does the split of Google's parent company, Alphabet, affect share prices?

Alphabet, like most big technology companies, is under review by U.S. regulators for monopolies.

Alphabet onceSplit, may release YouTube,Google Cloudand the hidden value of businesses like Waymo.

We think alphabetIt's still the cheapest of the tech giants.

As the U.S. government prepares to spin off big technology companies, investors need to start preparing for that possibility. If America's big tech companies do split up, Alphabet(GOOG, GOOGL)Its business will unleash huge hidden value.

Currently,AlphabetThe stock is the cheapest in technology, and the value of the rest of its business has been overlooked by the market because of Google's long-standing strong position. We are still more bullish on the split stock, albeit for some timeAlphabetHigher legal fees may apply.

The U.S. Justice Department is considering forcing Google to abandon Chrome

According to a report released by the House Judiciary Committee, the four largest U.S. technology companies have a "monopoly power." In addition to Alphabet, Amazon(AMZN)apple.(AAPL)and Facebook(FB)are the targets of federal investigations, and Microsoft(MSFT)To date, no regulatory issues have been raised.

The U.S. Department of Justice and state regulators are about to file a lawsuit to force Alphabet to abandon its dominant Chrome browser.ChromeBrowsers are used to send traffic to Google, according to the federal government.Alphabet Take advantage ofChromeBrowser to comeIt accounts for nearly 90% of the U.S. search engine market and dominates and monopolizes the huge digital advertising market.

Despite the innity of search engine revenue, no one, including Microsoft and Yahoo, can challenge itChromedominance. If Chrome is owned by a company, then the data does not fully support that consumers will not continue to use Google Search.

Any antitrust case could take years, and it's uncertain whether the Justice Department will succeed in proving that Alphabet is using monopoly power to control the market. After all, the digital advertising market is highly competitive, with Facebook a strong competitor to Google, and Amazon quickly seizing the market, an online retailer that can push ads to users while offering product lists and related searches.

Even if Wall Street's forecast for Alphabet's 2021 earnings per share falls from $63 before the outbreak to just $56, the stock's forward price-to-earnings ratio is only 28 times. Technically, in accordance with these GAAP(GAAP)Data, Facebook is now cheaper.

Alphabet's problem is the extreme impact of equity pay. Our previous estimate was that the tech giant would earn $83 per share in 2021/22. The company's net cash is $117bn, or $170 per share, at a price-to-earnings ratio of just 17 times, which makes much more sense.

There are predictions that Jeff Bezos may even spin off AWS from Amazon in 2021. In fact, Alphabet could easily do the same for a division like Waymo, becauseWaymo's business is possibleIt can cause losses and drag down the overall value of large technology companies. In addition, youTube's spin-off may easeAlphabetConcerns about its own dominance of digital advertising, while allowing itYouTubeThe video streaming service platform is flourishing as an independent entity.

The potential that comes with a spin-off

Alphabet has become a diversified company that has actually gone far beyond Google Search. YouTube is a major player in digital advertising and streaming video subscriptions, while Google Cloud has received limited attention worldwide.

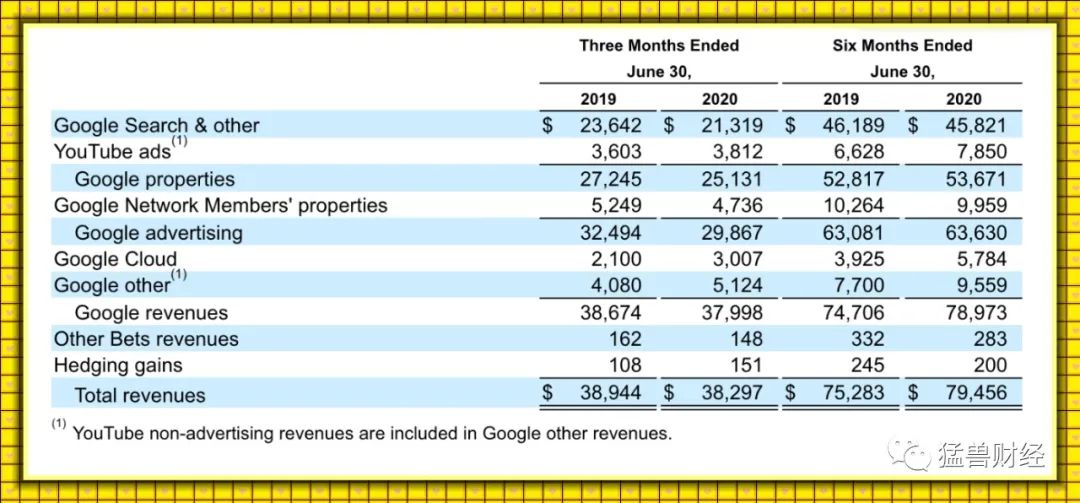

Alphabet The first half of 2020The reported quarterly revenue is as follows. Advertising revenue was hit in the second quarter and underperformed.

Source: Alphabet's earnings report

Needham'sAnalyst Laura Martin last year valued different parts of Alphabet as follows:

* Chrome- $600 billion

:: YouTube - $200 billion

:: Google Play - $100 billion

* Gmail

* Google map

* Waymo

:: DeepMind and other GsoogleBusiness.

Alphabet is currently valued at just $1 trillionNeedhamMore than a year ago, it set a valuation target of $900bn for the three major business units. At the time, some analysts valued Waymo at more than $100 billion.

The biggest problem with analyzing Alphabet is the lack of detailed revenue from services such as Gmail and Google Play. Much of the revenue is integrated into Google Search and other businesses.

Given the normalization of the advertising market, we think Needham is rightAlphabet'sValuations are actually very low, and we think they've reached $1.2 trillion. And after splitting up some business units,Alphabet'sThe potential for growth is greater.

For example, Netflix (NFLX)It has a market capitalisation of $238 billion, meaning YouTube will be worth far more than $200 billion as an independent company. Netflix is a money-burning machine with a target revenue of $25 billion in 2020, while Alphabet is a behemoth with $173 billion in revenue during the outbreak. YouTube alone generates $15 billion in ad-related revenue. In addition,YouTubeSubscription revenue mixed with Google's other revenues could make its stock more attractive to investors than Netflix.

Not yet in this valuation analysisGoogle Cloud, which will have revenues of more than $10 billion, is now valued at $100 billion. Google's other revenue includes products such as pixel phones and Nest Home, which earned $5 billion in the second quarter, which is not included in analysts' analysis.

It is more likely that the valuation will be lower than the following:

* Chrome- $700 billion

:: YouTube - $250 billion

* Google Play- $100 billion

* Google Cloud- $100 billion

:: Waymo - $50 billion

Currently, Google searches include Chrome, Google map and Gmail's advertising revenue. Based on these underlying valuations, the stock is valued at $1.2 trillion. With a better break in revenue in the division, Google Play and other departments can easily be given higher value.

Conclusion.

We believe it could take years for the federal antitrust case against Alphabet and other tech giants to be resolved.Alphabet as a familyTechnology giants can easily take the initiative to split their business units to increase the company's overall market capitalization and reduce pressure on U.S. regulators.

In any case, assuming alphabet does split, it's easy to appreciate because the share price is too cheap at the moment and several of its independent business entities could unleash huge hidden value.

These are investment exchanges only and do not represent investment advice

Mammoth Financial is committed to making every reluctant young person learn to invest in U.S. stocks and experience the joys and thrills of being a shareholder in the world's most mature and compliant market. Let every young person be free with dignity and equality through U.S. investments.

In addition, in the U.S. stock investment in this matter, mammoths are always alone, cattle and sheep are flocks. Like Mammoth, we focus on global U.S. stocks, A-shares, Hong Kong stocks and other stock markets and provide investors with professional financial information, various types of Hong Kong-U.S. stock research reports, Hong Kong-U.S. stock investment strategies, global macroeconomic research reports, financial circle social, knowledge question and answer, online and offline activities and other services.

Mammoth Finance as a cross-China, based on hong Kong stocks and the U.S. stock market professional financial media and investment and research platform, through our technology and professional investment research and analysis services, has been at home and abroad "Mammoth Financial Hong Kong and U.S. stock investment super member" friends have brought a very considerable return on investment.

To find out about the friends of Mammoth Financial Hong Kong And American Investment Super Member, please sweep the followingQR codeOr.Read the original textLearn more about it.

Sweep the code to learn about Mammoth Financial Super Members

Weibo.: smh.com.au

Snowballs: smh.com.au

Send to the author