From CCTV to Google: Talk about the mechanism design of bidding ads

The following article comes from Weixi chat ads Author Wei Xi

A read you will top the technology Internet public number, author Wei Xi, a weekly in-depth article to analyze the Internet, advertising, marketing-related underlying logic!

The puzzle is from Unsplash and is based on the CC0 protocol

Author: Wei Xi,Sina Weibo Advertising Product Manager

WeChat Public Number: Weixi Chat Ads (ID: Weixiads)

The full text is 4818 words 6 figures, read for more than 11 minutes

———— / BEGIN / ————

Many people have two extreme views about bidding ads:

The first point of view will think that bidding advertising is very simple, is not CCTV annual gold advertising space bidding, who bid high advertising space to whom;

The second extreme will think that bidding advertising is too complex, involving game theory, mechanism design, auction theory, CTR estimation and other ordinary people simply do not understand the theory, so many people are expected to stop ... ...

But is the truth the god horse? Which idea is right?

I'll tell you what.The truth is like the ending of "The Pony Crosses the River": the river is neither as shallow as the yellow cow says nor as deep as the squirrel says - the basic logic of the auction ad certainly involves a lot of complex theories, but after reading this article most people can easily understand its core principles.

First, from CCTV to Google's bidding advertising system

Regarding bidding ads, many people think that Baidu is the first company to launch bidding ads in China;

As early as 1994, CCTV began to auction advertising space in the form of bidding, the birth of Qinchi, Edo VCD and other well-known kings.

A typical auction scenario is this - the auctioneer first signs the ad space and indicates the floor price, and then starts waiting for the bidder to bid up, "1 million!" 1.2 million! 2 million! ""2 million once, 2 million twice, deal! "

Such scenes can't be more familiar to us in many film and television productions.

However, not all auctions are conducted in this way, and this is just one of many auction mechanisms that have been described as "British-style auctions".

Similar to British auctions, there are Dutch auctions.

Dutch auctions take the opposite form, with the auctioneer bidding a very high price and then continuing to test it until a bidder is willing to accept the price.

So the question is - traditional advertising can be auctioned in this way, so can online advertising be auctioned in the same way?

The answer is no.

The reason is that there are several important differences between online advertising auction and traditional advertising auction, which can have an important impact on the design of bidding mechanism.

First, whether it's a British or Dutch auction, everyone's bids are public, and many online advertisers may be reluctant to make their bids public, so public bidding becomes unsuitable.

Second, CCTV's auction is a single act, and online advertising is a repeated game many times, that is, this advertising space was robbed, advertisers can also grab the next advertising space, advertisers can constantly adjust their bids.

Third, online advertising has multiple objects (each ad request may be the object of multiple bids), the characteristics of a large amount of real-time calculations.

So, what kind of bidding mechanism should online advertising adopt?

In fact, there are many choices, let's look at one by one:

The first possible option is to seal the first price bid. This is actually a kind of bidding method that we are familiar with, and many project tenders take this approach.

Its mechanism is that each bidder does not publish his or her bid, seals it in an envelope and hands it over to the seller, who lets the highest bidder win the bid and pays the highest bidder.

Some people say that this approach looks perfect, in line with advertisers do not disclose the need for quotations, but also by many practice has proved.

However, this bidding method advertiser's bid strategy depends on how others come out, but has little to do with their true valuation, and this application to online advertising auctions will be a problem.

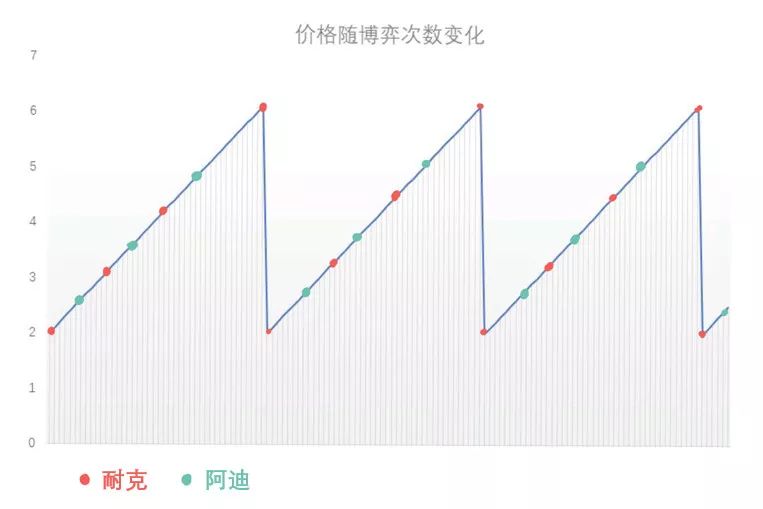

One characteristic of online advertising is the repetition of the game, what does the god horse mean? Offline project bidding, for example, is a one-off-the-go, and bidders are more inclined to be cautious about their bids - because he has only one chance, but online advertising is repeated, i.e. advertisers have multiple opportunities to constantly test other people's bids to achieve their best strategy.

Let me give you an example - Google's keyword "run" under the advertising space, Nike thinks a click is worth 10 yuan, Adi thinks it is worth 6 yuan, this time if they take the "sealed first price" auction, and Google's advertising system gives a floor price of 2 yuan, then Adi and Nike will try to bid.

Adi started at 2 blocks, Nike out 2.1, Adi out 2.2, Nike out 2.3, the two sides have a process of increasing prices, all the way up to 6 when Adi stopped bidding because it thought the ad was worth up to 6 bucks, and Adi pulled out.

At this time only Nike, Nike is not silly, since no one and I compete, then why do I have to make 6 pieces, so quickly transferred to 2 pieces;

Carefully you'll see that there's an obvious flaw in this approach - instability, the root of which is that there's no Nash equilibrium in this auction from a game theory perspective (as economists have mathematically proved), that there's always a state where you're chasing me because the auction method depends on the opponent's bid.

At the same time, on a deeper level, this mechanism has at least two flaws in the mechanism of repeating the game:

First, it doesn't match Pareto's best, that is, a good auction mechanism should be to sell the underlying item to the highest bidder for it, in this case Nike, but half the chances were taken away by Adi.

Second, it is not in the seller's interest to maximize, Nike Adi evaluation is far more than 2 pieces, but the bid started from 2 pieces.

From this can be seen: this bidding method used in online advertising auction is unreasonable, then there is wood has a better way of bidding.

The answer is yes!

Next we'll take a look:

2. A change in winning the Nobel Prize

The economist William Vickery tried to solve this problem by systematically discussing the auction of the "second seal price" in his 1961 book Anti-Speculation, Auctions and Competitive Sealed Bids.

William Vickery, left

It made a small change to the "first sealed price" specifically - the bidder still sealed the bid, still the highest bidder to win the auction, but the winner only needs to pay the second bid, that is, if Nike bid 10, Aldi bid 6, is still Nike to win, but Nike only need to pay the second Adi bid - 6.

It's a little counterintuitive change - the first one only has to pay the second bid, but don't look down on it, it's because it's systematically discussed that William Vickery won the 1996 Nobel Prize in economics, and the Sealed Second Price auction is also known in economics as the "Vickery Auction".

So, is this magical little change hiding the secret of the god horse?

The answer is that it systematically addresses the major flaws in the "first seal price".

Some people will immediately ask: Why can this change to overcome this defect?

Simply put, in the "sealed second price" bidding mechanism, everyone has a fixed optimal strategy - bid equal to their own valuation, or above the price strategy, Nike valuation of 10 yuan, Adi's bid how much do not know, this time Nike's best strategy is god horse?

The answer is 10 bucks.

Why?

We consider two scenarios:

First, if Adi bids more than 10 bucks, then Nike can't win anyway, because Nike can't bid higher than its own valuation, higher than its own loss.

Second, if Adi is below 10 bucks, then Nike should pay the maximum price it can get to increase its chances of winning, and that maximum value is 10 bucks, i.e. Nike has no incentive to lower its bid because it has no control over the final price.

What does a god horse mean?

If Nike makes eight, then if Adi makes six, Nike wins the auction and only pays six, no different from the 10 it makes, but if Adi makes nine it loses the bid, so Nike has no incentive to adjust the bid to eight, which could lead to a failed bid, the only best strategy is to bid 10.

In the words of game theory, "sealing the second price" has a unique Nash equilibrium, that is, everyone has their own real valuation of the goods is the best strategy, so the mechanism is a mechanism to encourage bidders to tell the truth, and has considerable stability, that is, advertisers do not frequently adjust their bid motivation.

Under this mechanism, advertisers with the highest ratings always win, while ensuring the platform's revenue, and no advertiser bids lower than their own.

In fact, Google, Baidu, Sina Weibo and other advertising platforms are taking this way of bidding.

Well, would anyone say that this way of bidding is the perfect way to bid? In fact, not necessarily, "sealing the second bid" mechanism has at least one defect, that is, its anti-cheating characteristics are not strong, if there is collusion between the accomplices, in this bidding mechanism, complicity is easier to achieve.

What does a god horse mean?

Still take Nike Adi to analogy: Nike's psychological bid is 10 yuan, Adi is 6 yuan, this time they collude, Adi out of 1 piece, Nike out of 10 yuan, eventually Nike only need to spend 1 yuan to buy this advertising space, injured is the advertising platform.

Smart people will immediately say - isn't that what happens with the "first seal price"? For example, Nike and Adi to discuss good, Nike out of 1 piece, Adi out of 0.5 yuan, or Nike at the price of 1 yuan to buy this advertising space ah!

Haha, that's right, but the "first seal price" is more likely to betray the accomplices: although nike out of 1 piece, Adi out of 0.5 hair, but Adi is motivated to violate the accomplices, as long as Adi out of 2 pieces, it can win the auction, this time Nike is silly eyes.

But in the case of the "second sealed price", Nike out of 10, Adi out of 1, this alliance is very powerful, because Adi in any case betrayal, it is impossible to win the auction (its bid can not exceed 6 pieces), so it has no incentive to betray, so the accomplice is easier to achieve, the probability of cheating will be greater.

Well, since there is this defect, then now online advertising Google, Baidu why use it?

An important reason is: unlike a single offline auction, online advertising is a large-scale repeat game, large-scale means that the number of advertisers involved in bidding, objectively increased the difficulty of colluding to cheat, in a sense to cover up the shortcomings of this mechanism.

VCG, a multi-advertising auction mechanism

Above we discussed the basic principle of bidding mechanism, all examples are ad space situation, and in the real advertising system, a request for advertising is often multiple, such as search engines have more than one ad space, how should we set up the bidding mechanism?

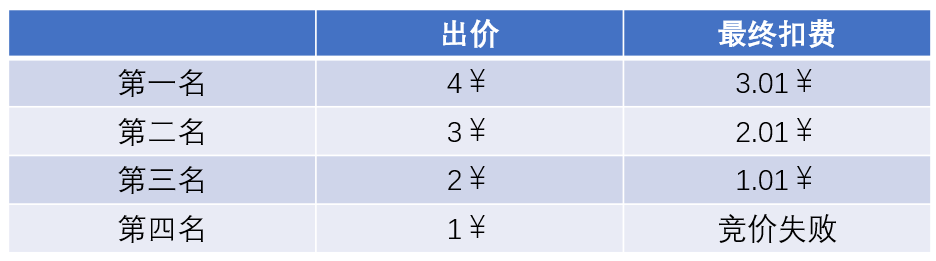

Google and Baidu have expanded the "sealed second price" auction, i.e. if there are multiple advertising spaces, the first place is charged by the second place plus a minimum bid unit charge (e.g. 0.01 yuan), the second is charged by the third place, the third is charged by the fourth place, and so on, the bidding method is called the "Generalized Second Price Auction", referred to as GSP.

GSP broad second price auction

This approach maximizes the advantage of "sealing the second price", i.e. it creates a stable equilibrium.

But it also has one drawback: it's not a way to maximize the benefits of all bidders.

So three economists, Vickrey, Clarke and Groves, proposed a multi-item auction mechanism, referred to as "VCG Auction", in three papers.

This complex bidding mechanism from the overall interests of the entire bidder, it is still the high price, but the deduction is the calculation of the high price participants to other bidders to bring the total loss, that is, first calculate the total benefit of the participants without the high price, and then calculate the total benefits of others after the participation of the high price, the difference between the benefits is the loss of other participants.

In short: if you participate in a bid, you lose money to other bidders, and you pay for the overall benefit of the system to be reduced to maximize the overall benefit.

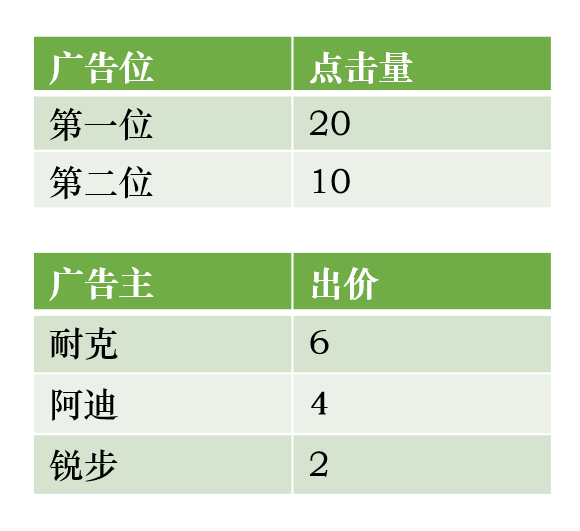

This bidding method is relatively complex to calculate, and I'll illustrate it with a simple example - if there are now two advertising spaces, the first and second place in the search for the keyword "run", the first can bring 20 clicks, the second can bring 10 clicks.

There are three advertisers bidding, Nike 6 per click, Adi 4 and Reebok 2. According to the principle of high price, Nike won the first ad space, Adi won the second ad space, and Reebok failed to bid.

Here's the question: How much should Nike be charged?

Follow the VCG bidding rules:

First calculate the revenue of Adi and Reebok when No Nike participates in the bidding, i.e. Adi wins the first ad space, Reebok wins the second ad position, the revenue is: 4 x 20 x 10 x 2 x 100

Then calculate the nike participation in the bidding of Adi and Reebok revenue, that is, Adi won a second advertising position, Reebok out, the proceeds are: 4 x 10 x 2 x 0 x 40.

The difference between the benefits of the two is: 100-40 x 60

Then Nike should pay 60/20 x 3 yuan for each click.

Facebook's advertising system takes this bidding approach, which maximizes the benefits of bidding participants.

But we can see that the auctioneer's interests are not maximized, and in the case above Nike charged three less than the four charged under the GSP bidding rules.

It can be said that Facebook is at the expense of short-term interests, from a longer-term perspective, because bidding advertising is not a short-term behavior, Facebook believes that the overall interests of advertisers in the long-term interests.

So why didn't Google do the same VCG bidding?

On the one hand, because although VCG can maximize the welfare of bidders, but it is very difficult to explain to advertisers, will face great educational costs;

On the other hand, economists have shown that VCG's income is no higher than GSP's because of the risk of falling revenues from moving directly from GSPs to VCG.

This article mainly introduces the context of the design of bidding mechanism, in fact, the selection of bidding mechanism is only a small aspect of bidding advertising.

———— / END / ————

Click "Read the original" to download the APP

Send to the author