First digital euro report: Digital currency project launched in 2021

The European Central Bank (ECB) recently released its first digital euro report, laying the policy foundation for its upcoming digital currency project. The European Central Bank says it will start the project as soon as 2021.

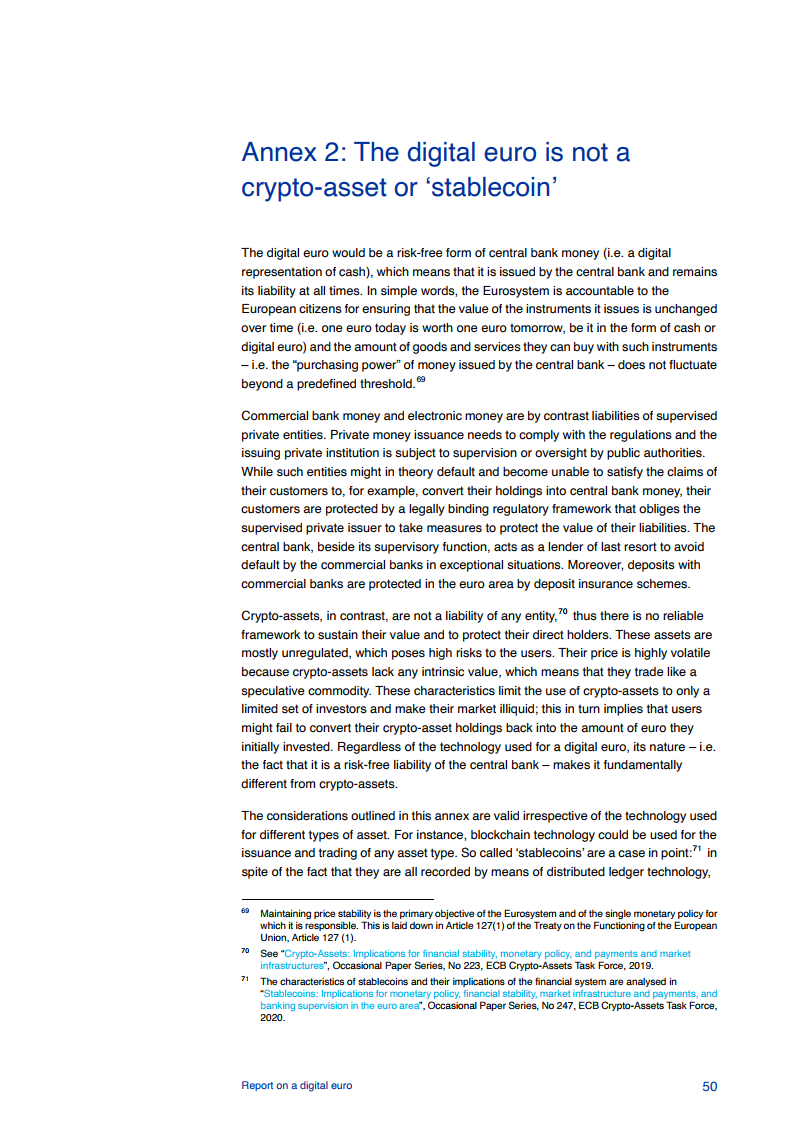

The ECB defines the digital euro as the central bank's digital currency that can be made available to all parties. The European Central Bank explained that the digital euro should first be an electronic version of legal tender, which can be offered directly to consumers or purchased through banks. Second, digital euros are based on blockchain technology designed to keep transactions secure.

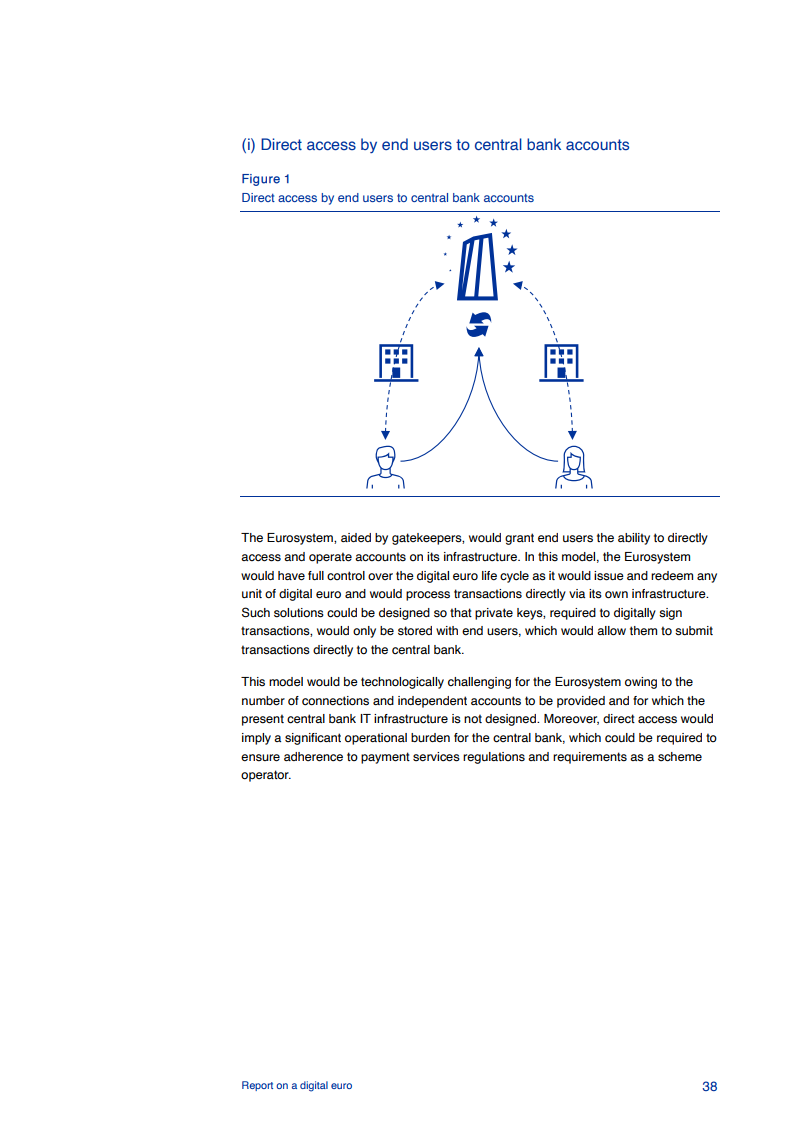

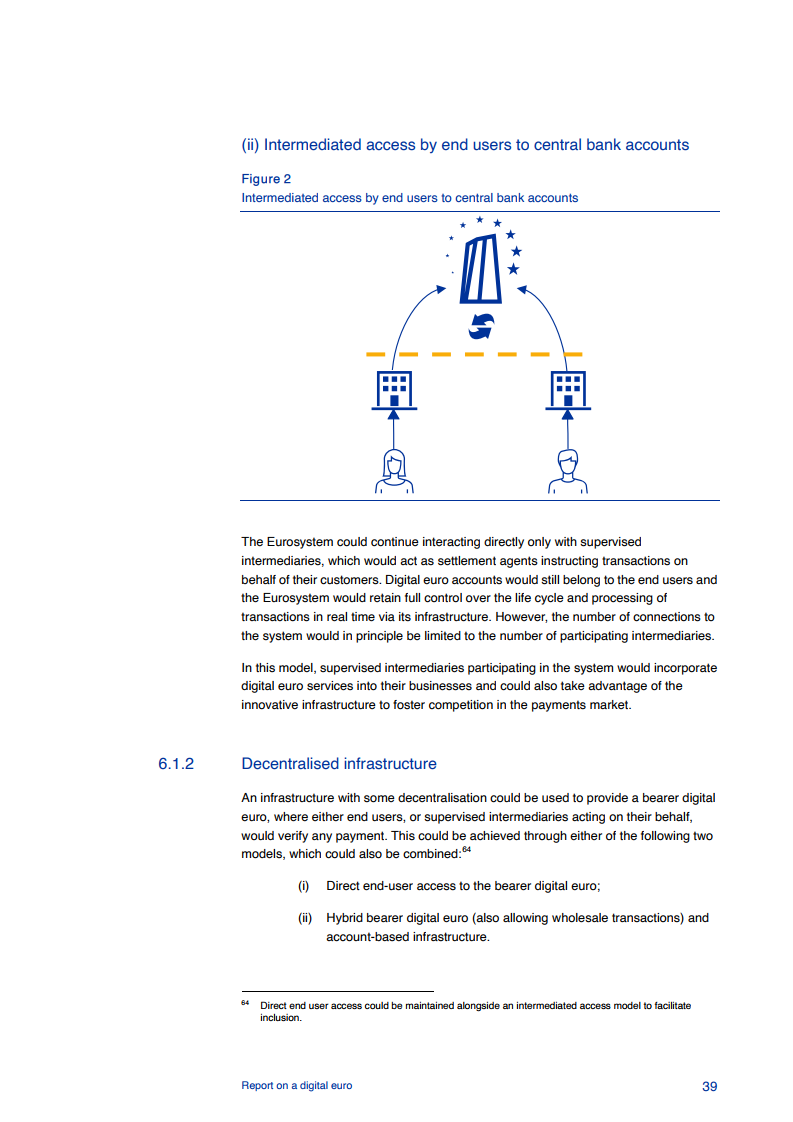

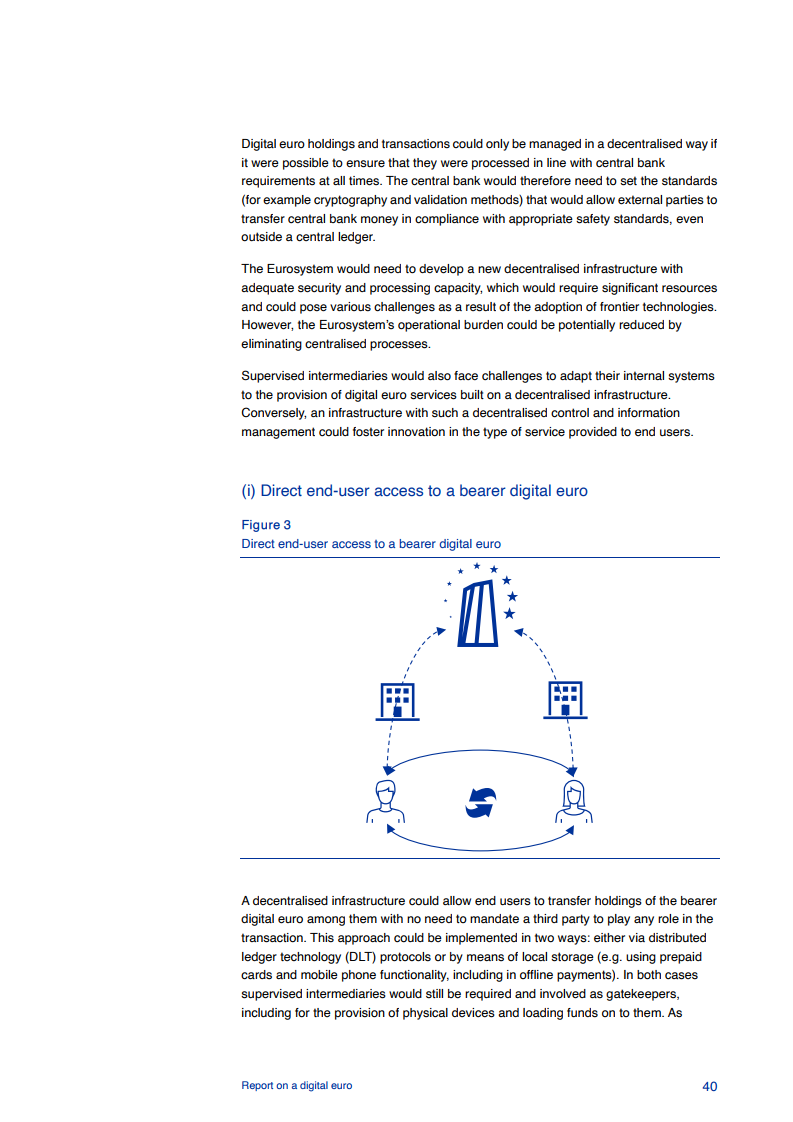

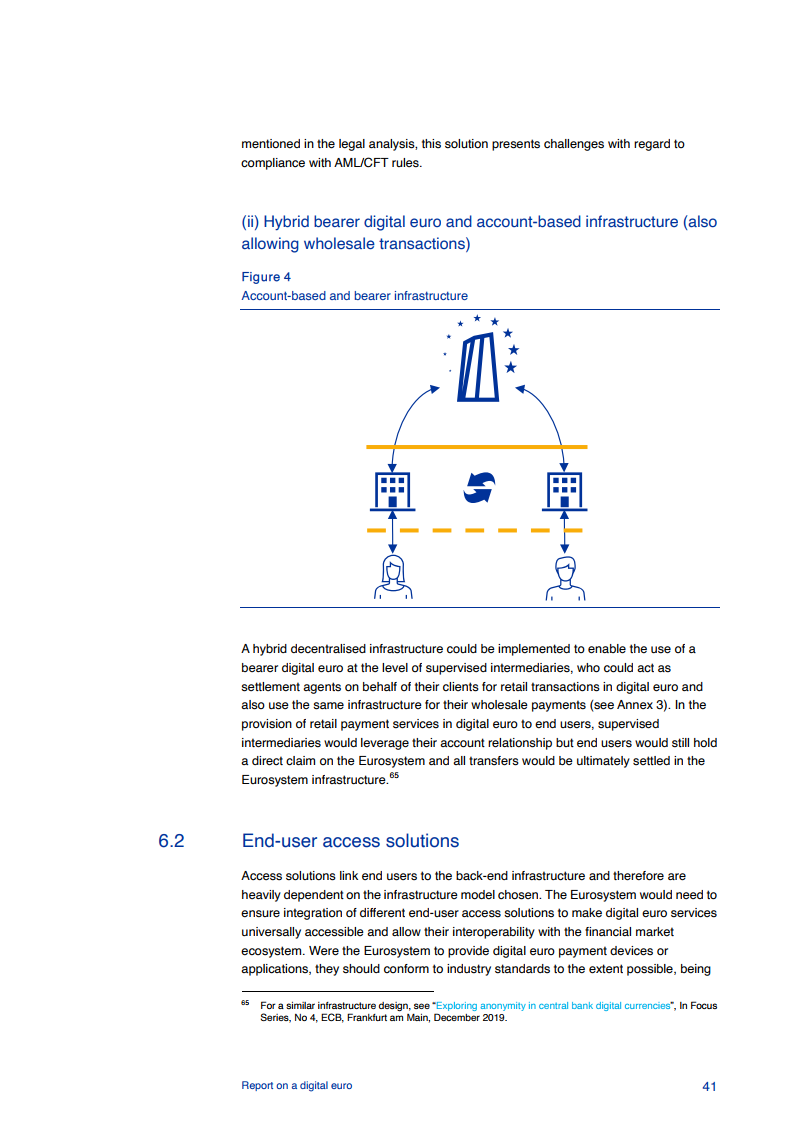

The European Central Bank is currently considering two design options. The first is centralized trading, in which the European Central Bank records all digital euro transactions in its ledger, and the second is to decentralize the above-mentioned authority to subordinate institutions, which are responsible for setting rules for settlement and recording transactions.

European Central Bank Governor Christine Lagarde said Europeans are increasingly digitizing their spending, saving and investment practices. The European Central Bank will ensure that people trust the euro and adapt it to the digital age.

"If necessary, we should be prepared to issue digital euros." She said.

Digital euros are no substitute for cash

In some countries and regions of the euro zone, cash as a means of payment has declined significantly, the report said. While young people still use large amounts of cash, the trend towards electronic payments is on the rise, and many consumers expect to strengthen infrastructure.

At the same time, central banks around the world are actively working on digital currency projects, and countries such as Sweden and Switzerland are leading the way in this regard, which, if further developed, could affect the ECB's ability to control the euro zone's money supply.

This has made the European Central Bank aware of the urfacing of a digital currency programme. Edindos, the European Central Bank's deputy governor, told a recent seminar that issuing a digital euro had become a task it had to carry out.

However, the issuance of digital currencies will not shake the position of cash in the euro system. In a statement, the European Central Bank also said it was explicitly opposed to the motion to abolish banknotes and coins, and said the digital euro would be used as a supplement to cash, not as a substitute for cash.

In Germany, the euro zone's largest economy, people still favour cash payments. "Many Germans still value cash because it protects privacy and doesn't have to rely on any technology infrastructure when paying, " says Deutsche Bank president David Weidmann. "

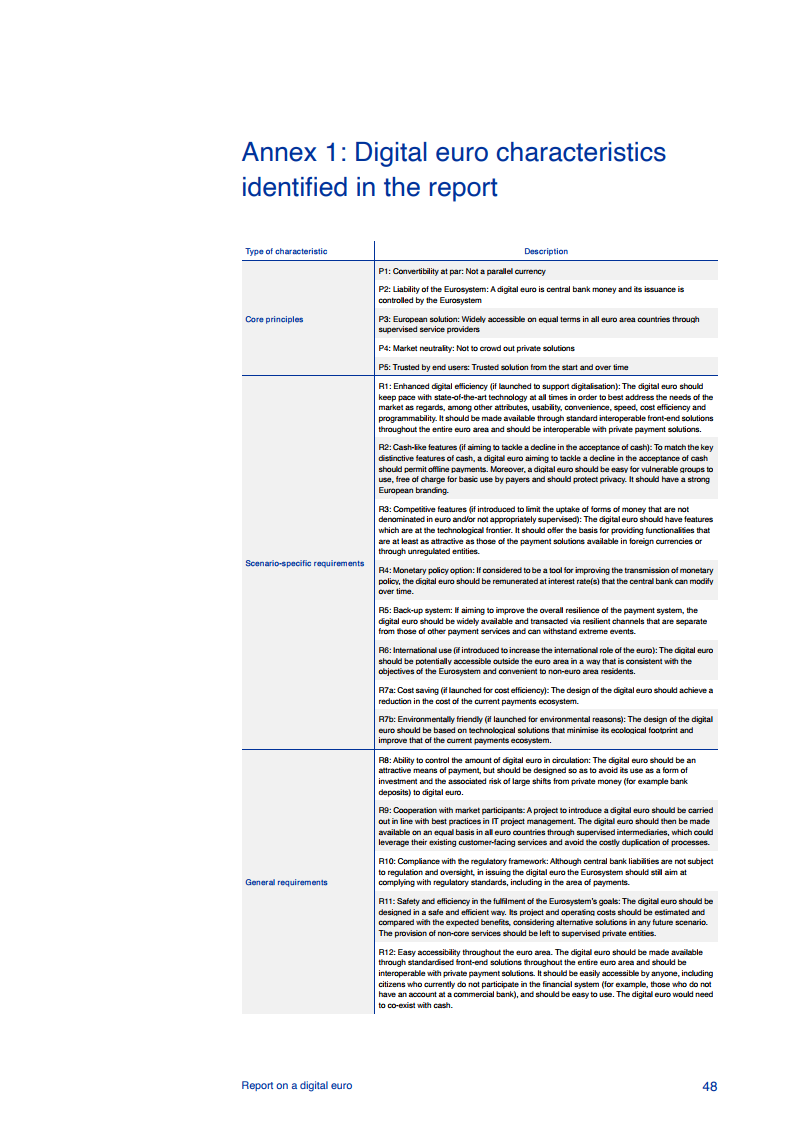

There is still debate between the euro zone's stakeholders over how to issue digital euros in the future. The European Central Bank said there were five principles for future issuance of digital euros.

First, the digital euro is only another way of supplying the euro, not a parallel currency, which should be convertible with other forms of euro; Nor should private solutions be limited in their attempts in this area;

The European Central Bank said the issuance of digital euros would support the digitization of the European economy and the eu's strategic independence, and could serve as a new channel for monetary policy transmission, reducing the risk of regular payment services, enhancing the euro's international standing and improving the total cost of the currency and payment system.

Risks posed by digital currencies should be avoided

In addition to the benefits, the report says, the potential adverse effects of issuing digital currencies need to be taken into account. In addition to common issues such as privacy and security, the European Central Bank said it needed to consider the three major issues that could lead to losses in the banking sector, the stability of monetary policy and the financial system in the euro zone, and the fact that the digital euro is another form of investment.

The ECB's first challenge is to ensure that the European commercial banking system does not suffer as a result of people transferring deposits to the central bank. The issuance of digital currencies will increase the cost of financing banks. It could lead depositors to convert commercial bank deposits into central bank debt, raising the cost of financing, which in turn increases bank lending rates and reduces the amount of credit banks lend to the economy.

Second, the European Central Bank said the issuance of digital currencies would increase demand for digital euros, which could have a negative impact on the stability of the financial system.

The European Central Bank said that if such demand increased the cost of financing banks, they might have to deleveraging and reduce the supply of credit, thereby preventing optimal levels of total investment and consumption. Economic activity could be hampered if the process meant higher costs for borrowers.

Holland InternationalIn a recent report issued by the Group, the European Central Bank said that the current monetary policy transmission channels are mainly through commercial banks.If the issuance of digital currency, so that lending, investment and other acts around commercial banks, will not only change the commercial bank's business model, but also affect the European Central Bank's monetary policy role in macroeconomic ways.

The European Central Bank says it is not desirable for the digital euro to attract large inflows of investment. But it also needs to be carefully regulated, and if the value of the digital euro held by the public is too low, the digital euro will be less attractive as a means of payment.

At the macro level, Lagarde also said that increased global protectionism could pose another serious risk to the issuance of digital currencies. Many payment service providers in Europe come from abroad, and an increase in protectionist policies could lead to a break in the payment process.

All of these considerations will have a direct impact on the design of the digital euro, the report said. The European Central Bank will launch a public consultation on October 12th to hear from the public, academics, financial institutions and the public sector on the digital euro project to assess demand. Relevant internal tests will also be performed simultaneously.

At the end of September, the European Central Bank registered the digital euro as a trademark, a historic step towards issuing digital currencies, according to the European Intellectual Property Office's website.

Pdf version will be shared to 199IT high-end communication group, thank you for your support!

The achievements and challenges of artificial intelligence in five major industries

Q1-Q2 China TMT Industry Private Equity and Venture Capital Report 2020

United Nations Network of Economists: A Trend Report That Shapes Our Time

Progress report on food and agriculture-related SDR indicators for 2020

China's balance of payments report for the first half of 2020

Report: Rethinking Japan's Retail Strategy in the COVID-19 Era

Cross-border e-commerce white paper: China's cross-border e-commerce sold to the world

China Home Appliance Market Report for the First Half of 2020

Culture: The most important thing for new fashion and luxury consumers

2020 Asia Pacific Travel Industry Consumer Behavior and Attitudes Research Report

2020 China accommodation market network word-of-mouth report

Google Decoding Decision Report: Decision Awareness in Chaos

SaaS merger and acquisition report for the second quarter of 2020

Successful experience in optimizing the business environment in China

2020 Annual Report of the CMO Expenditure Survey, Chief Marketing Officer

"14th Five-Year" a new starting point: China's highway enterprises to break the road

Research on Electric Vehicle Travel in Rural Areas of China (Version 2.0)

Report: Experiences and lessons learned from online brands and traditional retailers

Report: Changing global marketing procurement concepts and contributions

ASEAN Agricultural Food Science and Technology Investment Report 2020

2020 China Fashion Cross-Border E-commerce Development Report

Why restricting trade with China would end America's leadership in the chip industry?

Advertising procedural purchase supply chain transparency survey report

Covid-19 Impact on Advertising Spending 2020 Report: The Transformation of Television

United Nations Environment Programme: Plastic Limit Report (118 pages)

2020 Communications, Public Relations and Public Affairs Survey Report

China K12 Online Education Market Research and User Consumption Behavior Report

The impact of coronavirus on the data and marketing industry in 2020

Building shelf awareness: Quantify the impact of broadcasting on the FMCG brand at the last minute

2019 China Enterprise Digital Procurement Development Report

2020 Customer Journey Management and Customer Experience Measurement Report

Report: Chief Marketing Officer's Challenges and Standards for Good Marketers

Generation Z Asia Pacific: Interconnecting, Interacting, and Growing in the Asia Pacific Region

Report: Can Electric Vehicles Overcome the Coronavirus Crisis?

Report: The potential impact of COVID-19 on schools and education

The adoption and innovation of fintech in Hong Kong's banking industry

The cosmetics industry before and after the new crown epidemic is observed and prospected

Ai AI Chip Controversy Report: China's Challenge in the Technology War (69 pages)

Asia Pacific Investment Report for the first quarter of 2020

Mobile Advertising Index Report for the First Quarter of 2020

Report on effective transformation of energy systems in 2020

The fourth edition of the new crown pneumonia outbreak and global employment monitoring report

COVID - 19 Related Travel Restrictions: Global Travel Overview Report

2019-2020 Micro-Enterprise Financing Status Report (97 pages)

| NOTICE |

WeChat's public platform is currently available for subscriptionsNumber top function

Click on our home page

Check the top public number

Capture great content in a timely manner

For business cooperation, please contact Microsyscope: dingli Public Number Contribution Email: T@199it.com

Go to "Discovery" - "Take a look" browse "Friends are watching"